Question

c) You have been tasked to find the value for Towel Co using a residual earnings valuation model. To help Colm understand the process better,

c) You have been tasked to find the value for Towel Co using a residual earnings valuation model. To help Colm understand the process better, you have decided to write him a short memo outlining the following:

i) What is meant by residual earnings ii) The additional information you would require to undertake the residual earnings valuation iii) The steps that you would need to take to carry out this valuation. This should include a worked example of the calculation, using numbers that you have assumed yourself based on your answer in part c(ii).

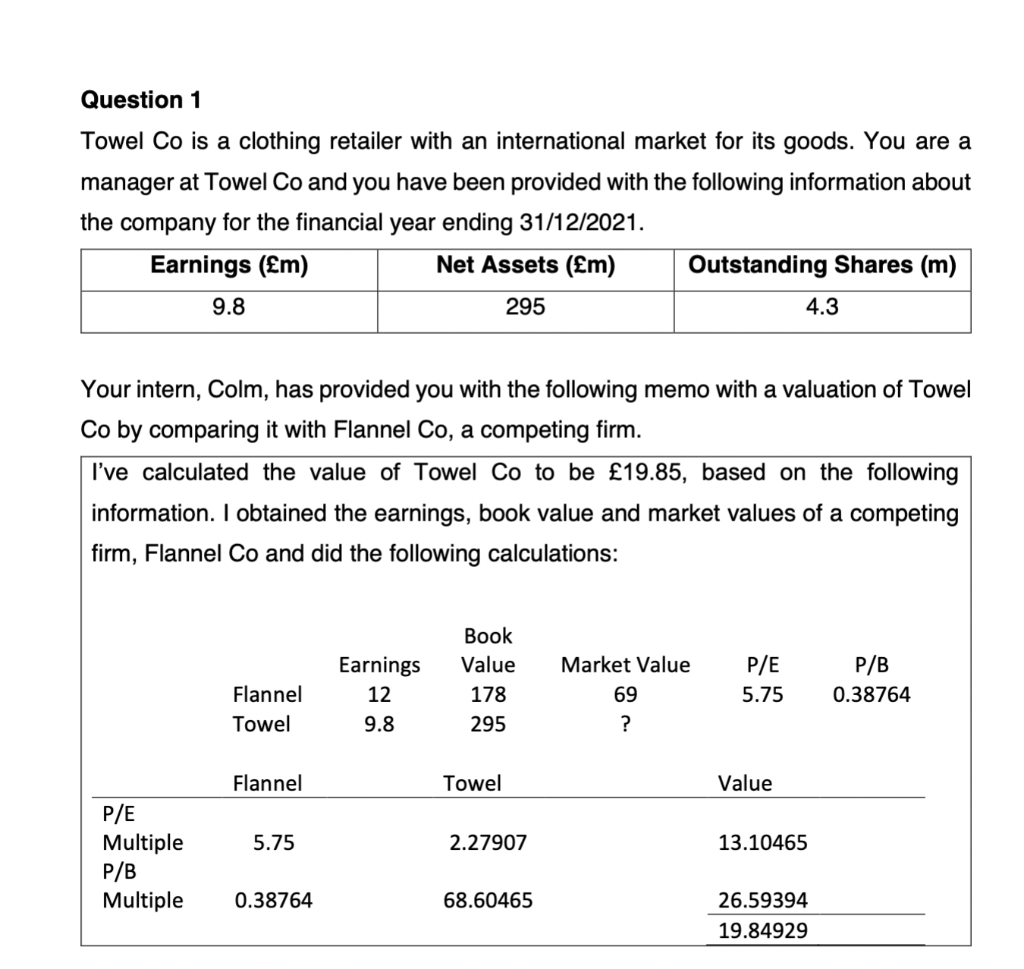

Question 1 Towel Co is a clothing retailer with an international market for its goods. You are a manager at Towel Co and you have been provided with the following information about the company for the financial year ending 31/12/2021. Earnings (m) Net Assets (m) 295 9.8 P/E Multiple P/B Multiple Your intern, Colm, has provided you with the following memo with a valuation of Towel Co by comparing it with Flannel Co, a competing firm. I've calculated the value of Towel Co to be 19.85, based on the following information. I obtained the earnings, book value and market values of a competing firm, Flannel Co and did the following calculations: Flannel Towel Flannel 5.75 0.38764 Earnings 12 9.8 Book Value 178 295 Towel 2.27907 Outstanding Shares (m) 68.60465 Market Value 69 ? P/E 5.75 4.3 Value 13.10465 26.59394 19.84929 P/B 0.38764Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started