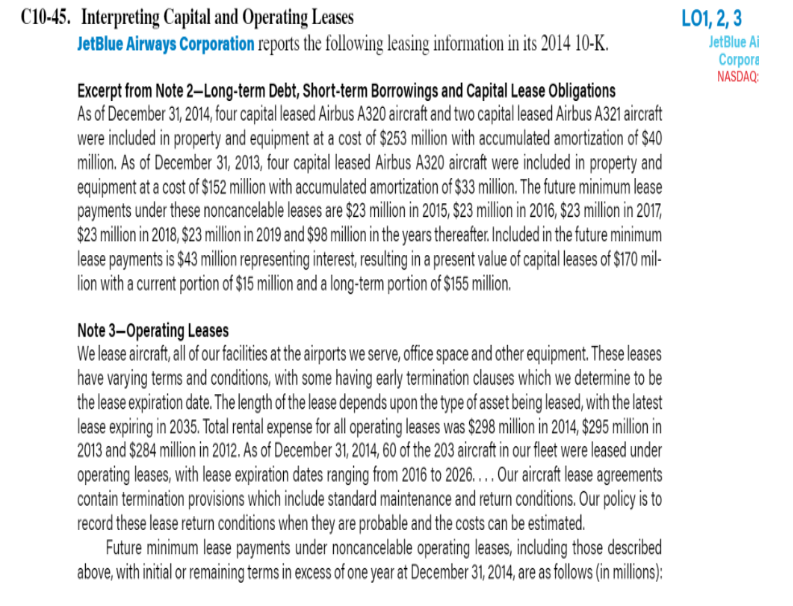

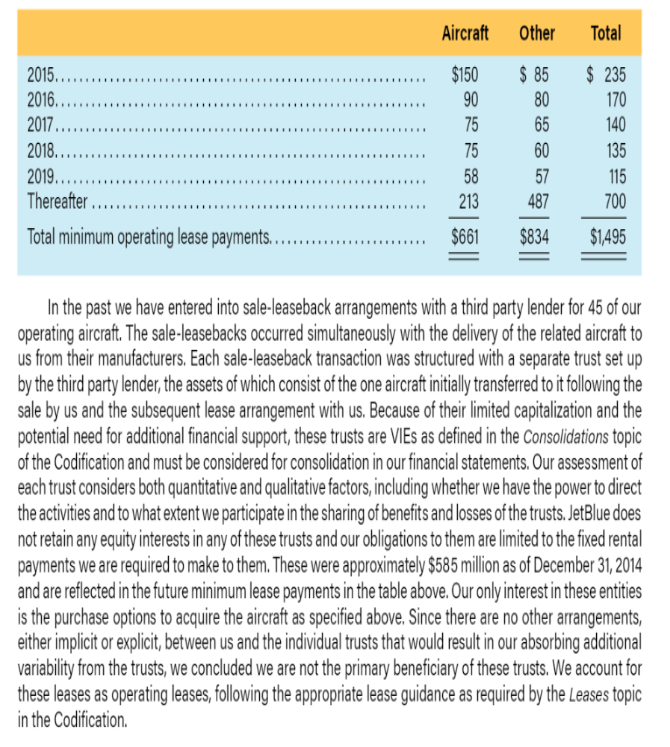

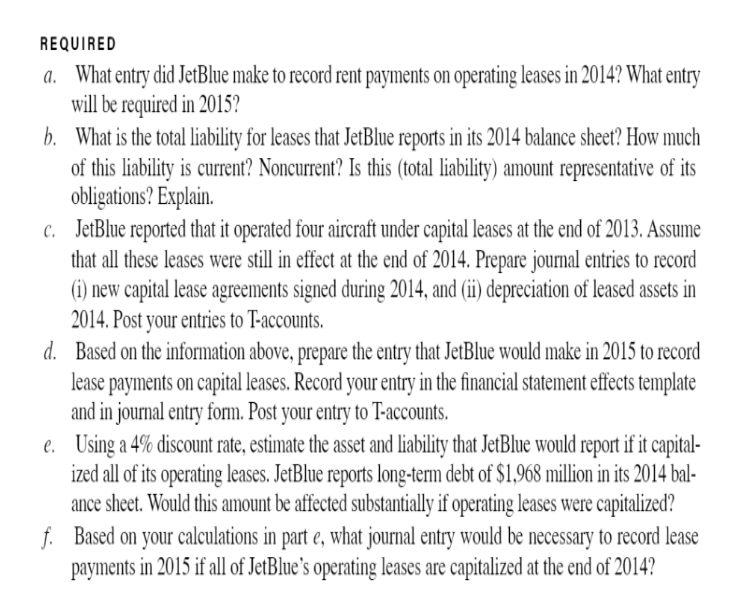

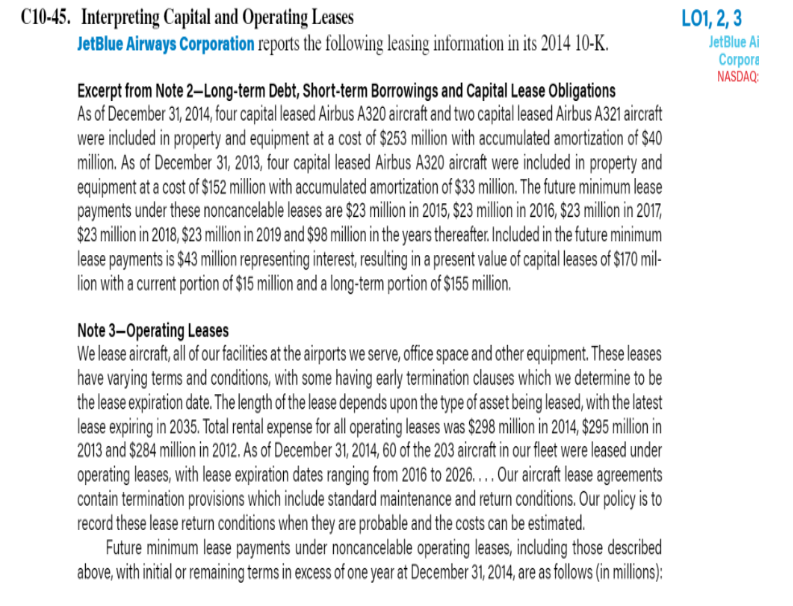

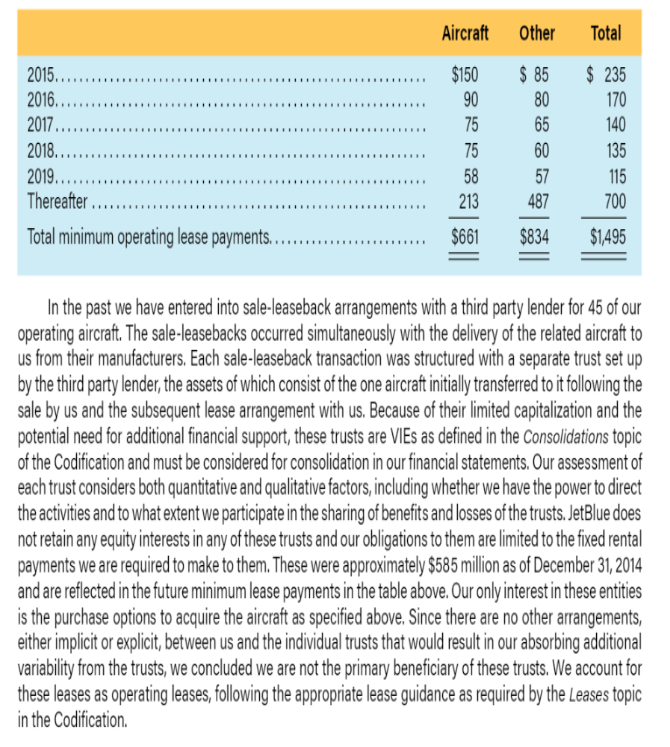

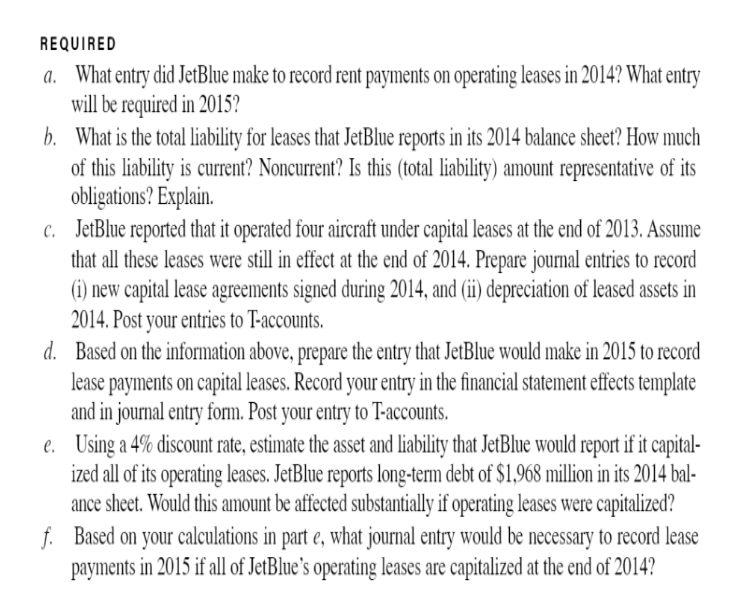

C10-45. Interpreting Capital and Operating Leases L01,2,3 JetBlue Airways Corporation reports the following leasing information in its 2014 10-K. JetBlue Ai Corpore NASDAQ Excerpt from Note 2-Long-term Debt, Short-term Borrowings and Capital Lease Obligations Asof December 31,2014, four capital leased Airbus A320 aircraftand two capital leased Airbus A321 aircraft were included in property and equipment at a cost of $253 million with accumulated amortization of $40 million.As of December 31, 2013, four capital leased Airbus A320 aircraft were included in property and equipment at a cost of $152 millin with accumulated amortization of $33 million. The future minimum lease payments under these noncancelable leases are $23 million in 2015,$23 million in 2016, $23 million in 2017, $23 million in 2018, $23 million in 2019 and $98 million in the years thereafter.Included in the future minimum lease payments is $43 million representing interest, resulting in a present value of capital leases of $170 mil ion with a current portion of $15 million and a long-term portion of $155 milion Note 3-0perating Leases We lease aircraft, all of our facilities at the airports we serve, office space and other equipment. These leases have varying terms and conditions, with some having early termination clauses which we determine to be the lease expiration date. The length of the lease depends upon the type ofasset being leased, with the latest lease expiring in 2035. Total rental expense for all operating leases was $298 milion in 2014, $295 million in 2013 and $284 million in 2012.As of December 31,2014,60 of the 203 aircraft in our fleet were leased under operating leases, with lease expiration dates ranging from 2016 to 2026... Our aircraft lease agreements contain termination provisions which include standard maintenance and return conditions.Our policy is to record these lease return conditions when they are probable and the costs can be estimated. Future minimum lease payments under noncancelable operating leases, including those described above, with initial or remaining terms in excess of one year at December 31,2014,are as follows(in millions) ur to pe e ic of 50055 et gd t ed to nid re I tus on ag at it he 5050 57 87-34 le eee re on re in ird ive w tr lim ed tat er ss m mil ur ere sul of as 583- I de all ei al et d th 85 hno5 ed'a c in IC 5 aSwnu srs cu eabe eune sae ro e la st m ou a in ie des an pa ae.n sn ed cl si n se ar sea al i e a o enn ak n.r as Ea ass nt fin be ant ent mqwee CS e le er th aean udd nsdn aas rnet s ti ast cre par nd ed ica on a n we le ha ici fro es fin aed et er re pu in lit ea 56789r aoe 00000h 22222T T op us by sal pol oft ead the nol pay att van the . REQUIRED a. What entry did JetBlue make to record rent payments on operating leases in 2014? What entry b. will be required in 2015? What is the total liability for leases that JetBlue reports in its 2014 balance sheet? How much of this liability is current? Noncurrent? Is this (total liability) amount representative of its obligations? Explain. JetBlue reported that it operated four aircraft under capital leases at the end of 2013. Assume that all these leases were still in effect at the end of 2014. Prepare journal entries to record (i new capital lease agreements signed during 2014, and (i) depreciation of leased assets in 2014. Post your entries to T-accounts. Based on the information above, prepare the entry that JetBlue would make in 2015 to record lease payments on capital leases. Record your entry in the financial statement effects template and in jounal entry fom. Post your entry to l-accounts Using a 4% discount rate, estimate the asset and liability that JetBlue would report if it capital. ized all of its operating leases. JetBlue reports long-term debt of S1,968 million in its 2014 bal ance sheet. Would this amount be affected substantially if operating leases were capitalized? c. d. e. f. Based on your calculations in part e, what journal entry would be necessary to record lease payments in 2015 if all of JetBlue's operating leases are capitalized at the end of 2014? C10-45. Interpreting Capital and Operating Leases L01,2,3 JetBlue Airways Corporation reports the following leasing information in its 2014 10-K. JetBlue Ai Corpore NASDAQ Excerpt from Note 2-Long-term Debt, Short-term Borrowings and Capital Lease Obligations Asof December 31,2014, four capital leased Airbus A320 aircraftand two capital leased Airbus A321 aircraft were included in property and equipment at a cost of $253 million with accumulated amortization of $40 million.As of December 31, 2013, four capital leased Airbus A320 aircraft were included in property and equipment at a cost of $152 millin with accumulated amortization of $33 million. The future minimum lease payments under these noncancelable leases are $23 million in 2015,$23 million in 2016, $23 million in 2017, $23 million in 2018, $23 million in 2019 and $98 million in the years thereafter.Included in the future minimum lease payments is $43 million representing interest, resulting in a present value of capital leases of $170 mil ion with a current portion of $15 million and a long-term portion of $155 milion Note 3-0perating Leases We lease aircraft, all of our facilities at the airports we serve, office space and other equipment. These leases have varying terms and conditions, with some having early termination clauses which we determine to be the lease expiration date. The length of the lease depends upon the type ofasset being leased, with the latest lease expiring in 2035. Total rental expense for all operating leases was $298 milion in 2014, $295 million in 2013 and $284 million in 2012.As of December 31,2014,60 of the 203 aircraft in our fleet were leased under operating leases, with lease expiration dates ranging from 2016 to 2026... Our aircraft lease agreements contain termination provisions which include standard maintenance and return conditions.Our policy is to record these lease return conditions when they are probable and the costs can be estimated. Future minimum lease payments under noncancelable operating leases, including those described above, with initial or remaining terms in excess of one year at December 31,2014,are as follows(in millions) ur to pe e ic of 50055 et gd t ed to nid re I tus on ag at it he 5050 57 87-34 le eee re on re in ird ive w tr lim ed tat er ss m mil ur ere sul of as 583- I de all ei al et d th 85 hno5 ed'a c in IC 5 aSwnu srs cu eabe eune sae ro e la st m ou a in ie des an pa ae.n sn ed cl si n se ar sea al i e a o enn ak n.r as Ea ass nt fin be ant ent mqwee CS e le er th aean udd nsdn aas rnet s ti ast cre par nd ed ica on a n we le ha ici fro es fin aed et er re pu in lit ea 56789r aoe 00000h 22222T T op us by sal pol oft ead the nol pay att van the . REQUIRED a. What entry did JetBlue make to record rent payments on operating leases in 2014? What entry b. will be required in 2015? What is the total liability for leases that JetBlue reports in its 2014 balance sheet? How much of this liability is current? Noncurrent? Is this (total liability) amount representative of its obligations? Explain. JetBlue reported that it operated four aircraft under capital leases at the end of 2013. Assume that all these leases were still in effect at the end of 2014. Prepare journal entries to record (i new capital lease agreements signed during 2014, and (i) depreciation of leased assets in 2014. Post your entries to T-accounts. Based on the information above, prepare the entry that JetBlue would make in 2015 to record lease payments on capital leases. Record your entry in the financial statement effects template and in jounal entry fom. Post your entry to l-accounts Using a 4% discount rate, estimate the asset and liability that JetBlue would report if it capital. ized all of its operating leases. JetBlue reports long-term debt of S1,968 million in its 2014 bal ance sheet. Would this amount be affected substantially if operating leases were capitalized? c. d. e. f. Based on your calculations in part e, what journal entry would be necessary to record lease payments in 2015 if all of JetBlue's operating leases are capitalized at the end of 2014