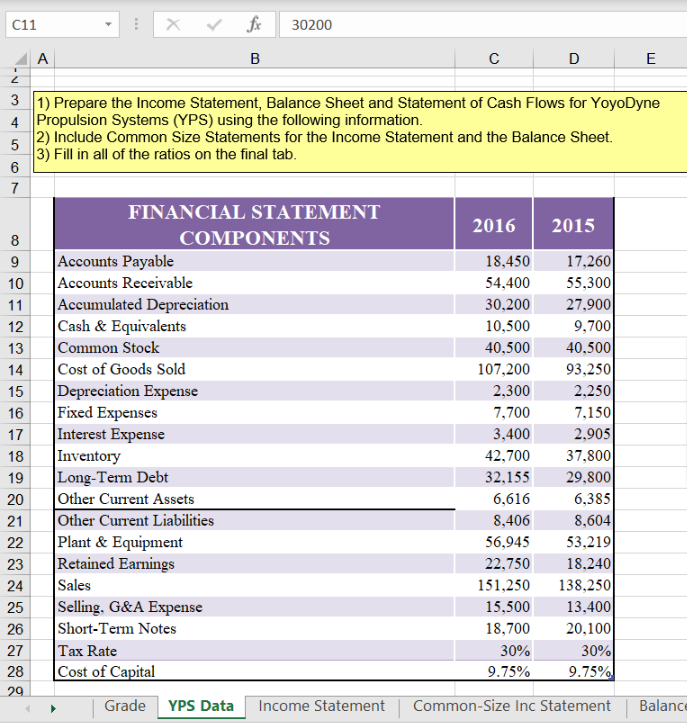

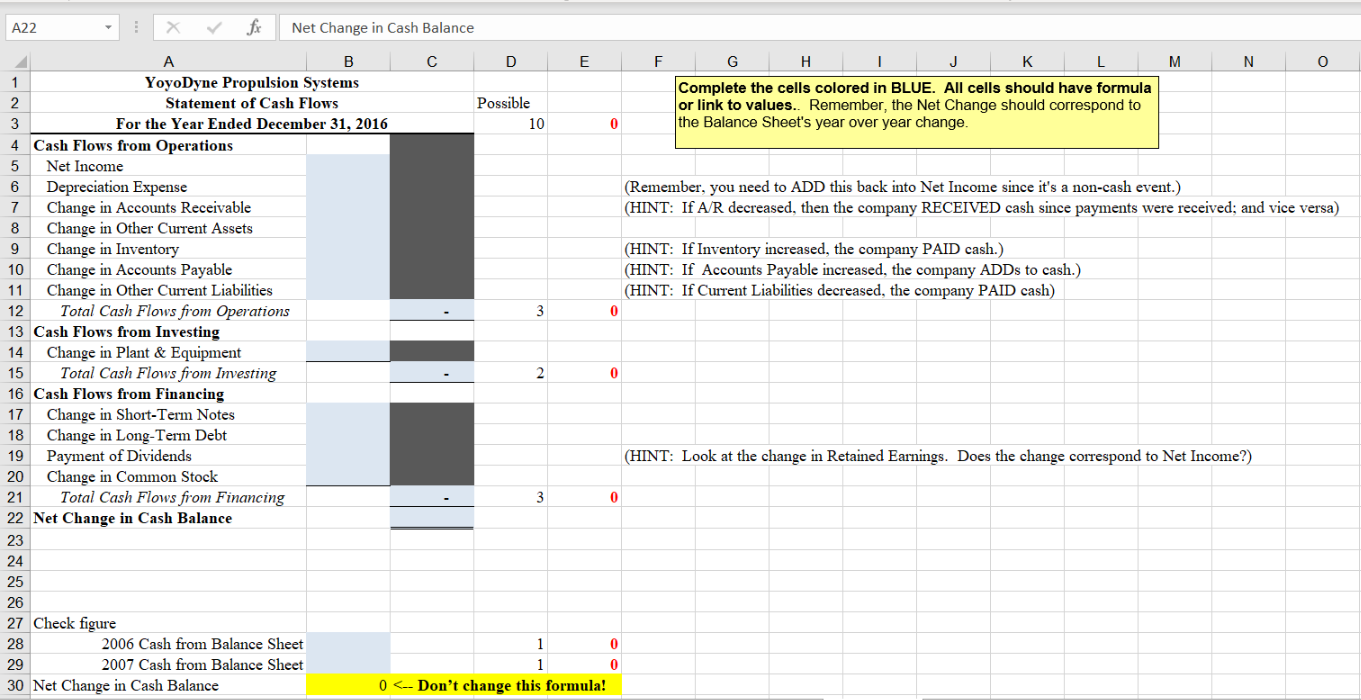

C11 30200 A B D E N- 3 1) Prepare the Income Statement, Balance Sheet and Statement of Cash Flows for YoyoDyne 4. Propulsion Systems (YPS) using the following information. 2) Include Common Size Statements for the Income Statement and the Balance Sheet. 5 3) Fill in all of the ratios on the final tab. 6 7 2016 2015 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 FINANCIAL STATEMENT COMPONENTS Accounts Payable Accounts Receivable Accumulated Depreciation Cash & Equivalents Common Stock Cost of Goods Sold Depreciation Expense Fixed Expenses Interest Expense Inventory Long-Term Debt Other Current Assets Other Current Liabilities Plant & Equipment Retained Earnings Sales Selling. G&A Expense Short-Term Notes Tax Rate Cost of Capital 18,450 54,400 30,200 10,500 40,500 107,200 2,300 7,700 3,400 42,700 32,155 6,616 8,406 56,945 22,750 151,250 15,500 18,700 30% 9.75% 17,2601 55,3001 27,900 9,700 40,500 93,250 2,250 7,1501 2,9051 37,800 29,800 6,385 8,604 53,219 18,240 138,250 13,400 20,100 30% 9.75% 23 24 25 26 27 28 29 Grade YPS Data Income Statement Common-Size Inc Statement Balance A22 X fx Net Change in Cash Balance 1 3 B D E F G M N O YoyoDyne Propulsion Systems Complete the cells colored in BLUE. All cells should have formula 2 Statement of Cash Flows Possible or link to values. Remember, the Net Change should correspond to For the Year Ended December 31, 2016 10 0 the Balance Sheet's year over year change. 4 Cash Flows from Operations 5 Net Income 6 Depreciation Expense (Remember, you need to ADD this back into Net Income since it's a non-cash event.) 7 Change in Accounts Receivable (HINT: If A/R decreased, then the company RECEIVED cash since payments were received; and vice versa) 8 Change in Other Current Assets 9 Change in Inventory (HINT: If Inventory increased, the company PAID cash.) 10 Change in Accounts Payable (HINT: If Accounts Payable increased, the company ADDs to cash.) 11 Change in Other Current Liabilities (HINT: If Current Liabilities decreased, the company PAID cash) 12 Total Cash Flows from Operations 3 0 13 Cash Flows from Investing 14 Change in Plant & Equipment 15 Total Cash Flows from Investing 2 0 16 Cash Flows from Financing 17 Change in Short-Term Notes 18 Change in Long-Term Debt 19 Payment of Dividends (HINT: Look at the change in Retained Earnings. Does the change correspond to Net Income?) 20 Change in Common Stock 21 Total Cash Flows from Financing 3 0 22 Net Change in Cash Balance 23 24 25 26 27 Check figure 28 2006 Cash from Balance Sheet 0 29 2007 Cash from Balance Sheet 1 0 30 Net Change in Cash Balance 0