Answered step by step

Verified Expert Solution

Question

1 Approved Answer

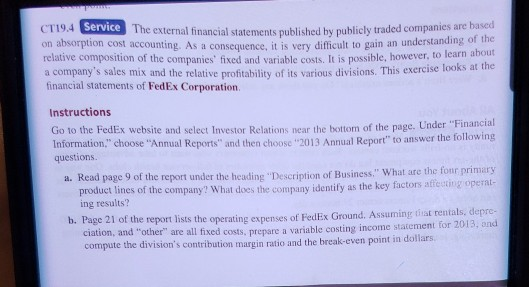

C119.4 Service The external financial statement oublished by publicly traded companies are based on absorption cost accounting As consequence is very difficult to gain an

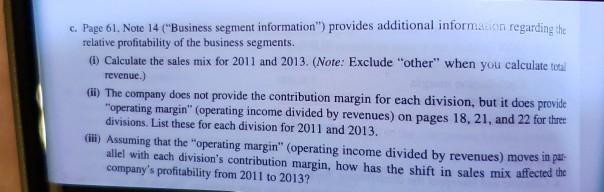

C119.4 Service The external financial statement oublished by publicly traded companies are based on absorption cost accounting As consequence is very difficult to gain an understanding of the relative composition of the companies fixed and variable is nossible, however, to learn about a company sales mix and the relative profitability of its various divisions. This exercise looks at the financial statements of FedEx Corporation Instructions Go to the FedEx website and select Investor Relations near the bottom of the page. Under "Financial Information," choose "Annual Reports and then choose 2013 Annual Report to answer the following questions. a. Read page 9 of the report under the heading "Description of Business." What are the four primary product lines of the company? What does the company identify as the key factors affecting operat- ing results? b. Page 21 of the report lists the operating expenses of FedEx Ground, Assuming that rentals, depre- ciation, and other" are all fixed costs, prepare a variable costing income statement for 2013, and compute the division's contribution margin ratio and the break-even point in dollars c. Page 61. Note 14 ("Business segment information") provides additional informacion regarding the relative profitability of the business segments. (1) Calculate the sales mix for 2011 and 2013. (Note: Exclude "other" when you calculate total revenue.) (ii) The company does not provide the contribution margin for each division, but it does provide "operating margin" (operating income divided by revenues) on pages 18, 21, and 22 for three divisions. List these for each division for 2011 and 2013. (iii) Assuming that the operating margin" (operating income divided by revenues) moves in pa allel with cach division's contribution margin, how has the shift in sales mix affected the company's profitability from 2011 to 2013? C119.4 Service The external financial statement oublished by publicly traded companies are based on absorption cost accounting As consequence is very difficult to gain an understanding of the relative composition of the companies fixed and variable is nossible, however, to learn about a company sales mix and the relative profitability of its various divisions. This exercise looks at the financial statements of FedEx Corporation Instructions Go to the FedEx website and select Investor Relations near the bottom of the page. Under "Financial Information," choose "Annual Reports and then choose 2013 Annual Report to answer the following questions. a. Read page 9 of the report under the heading "Description of Business." What are the four primary product lines of the company? What does the company identify as the key factors affecting operat- ing results? b. Page 21 of the report lists the operating expenses of FedEx Ground, Assuming that rentals, depre- ciation, and other" are all fixed costs, prepare a variable costing income statement for 2013, and compute the division's contribution margin ratio and the break-even point in dollars c. Page 61. Note 14 ("Business segment information") provides additional informacion regarding the relative profitability of the business segments. (1) Calculate the sales mix for 2011 and 2013. (Note: Exclude "other" when you calculate total revenue.) (ii) The company does not provide the contribution margin for each division, but it does provide "operating margin" (operating income divided by revenues) on pages 18, 21, and 22 for three divisions. List these for each division for 2011 and 2013. (iii) Assuming that the operating margin" (operating income divided by revenues) moves in pa allel with cach division's contribution margin, how has the shift in sales mix affected the company's profitability from 2011 to 2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started