Answered step by step

Verified Expert Solution

Question

1 Approved Answer

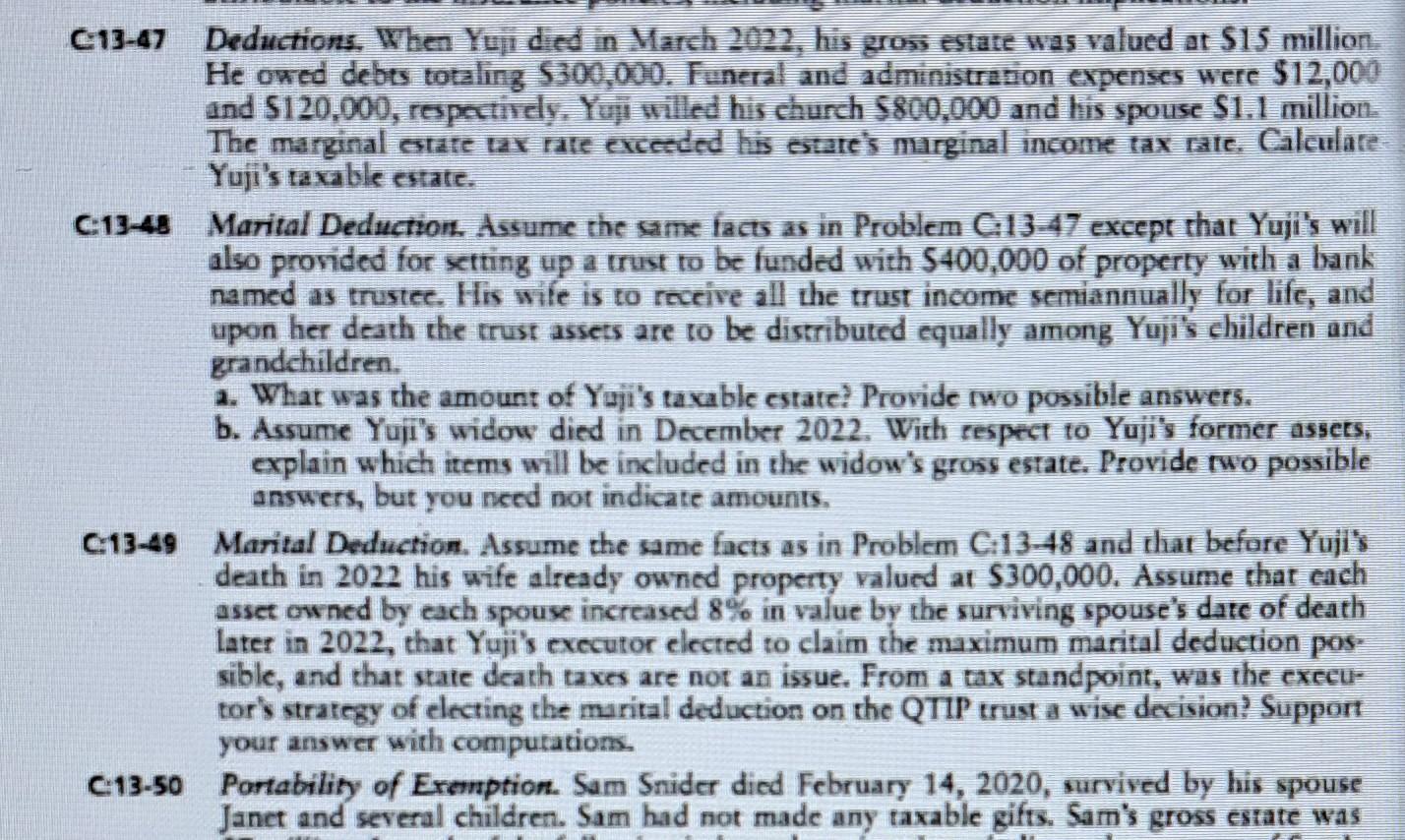

C13-47 Deductions. When Yuil died in March 2022, his gross estate was valued at S15 million. He owed debts totaling $300,000. Funeral and administration expenses

C13-47 Deductions. When Yuil died in March 2022, his gross estate was valued at S15 million. He owed debts totaling $300,000. Funeral and administration expenses were $12,000 and $120,000, respectircly. Y willed his church $800,000 and his spouse $1.1 million The marginal ertate tax rate exceeded his estare's marginal income tax rate. Calculare Yuji's taxable estate. C:13-48 Marital Deduction. Assume the same facts as in Problem Ci13-47 except that Yuji's will also provided for setting up a trust to be funded with $400,000 of property with a bank named as trustee. His wife is to receive all the trust income semiannually for life, and upon her death the trust assets are to be distributed equally among Yuil's children and grandchildren. a. What was the amount of Yuji's taxable estate? Provide two possible answers. b. Assume Yuij's widow died in December 2022. With respect to Yuji's former assets, explain which items will be included in the widow's gross estate. Provide rwo possible answers, but you need not indicate amounts. C13-49 Marital Deduction. Assume the same facts as in Problem C:13-48 and that before Yuji's death in 2022 his wife already owned property valued at $300,000. Assume that each asset owned by each spouse increased 8% in value by the surviving spouse's date of death later in 2022, that Yuli's executor elected to claim the maximum marital deduction possible, and that state death taxes are not an issue. From a tax standpoint, was the executor's strategy of electing the marital deduction on the QTIP trust a wise decision? Support your answer with computation. C:13-50 Portability of Exemption. Sam Snider died February 14, 2020, survived by his spouse Janct and several children. Sam had not made any taxable gifts. Sam's gross estate was

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started