Answered step by step

Verified Expert Solution

Question

1 Approved Answer

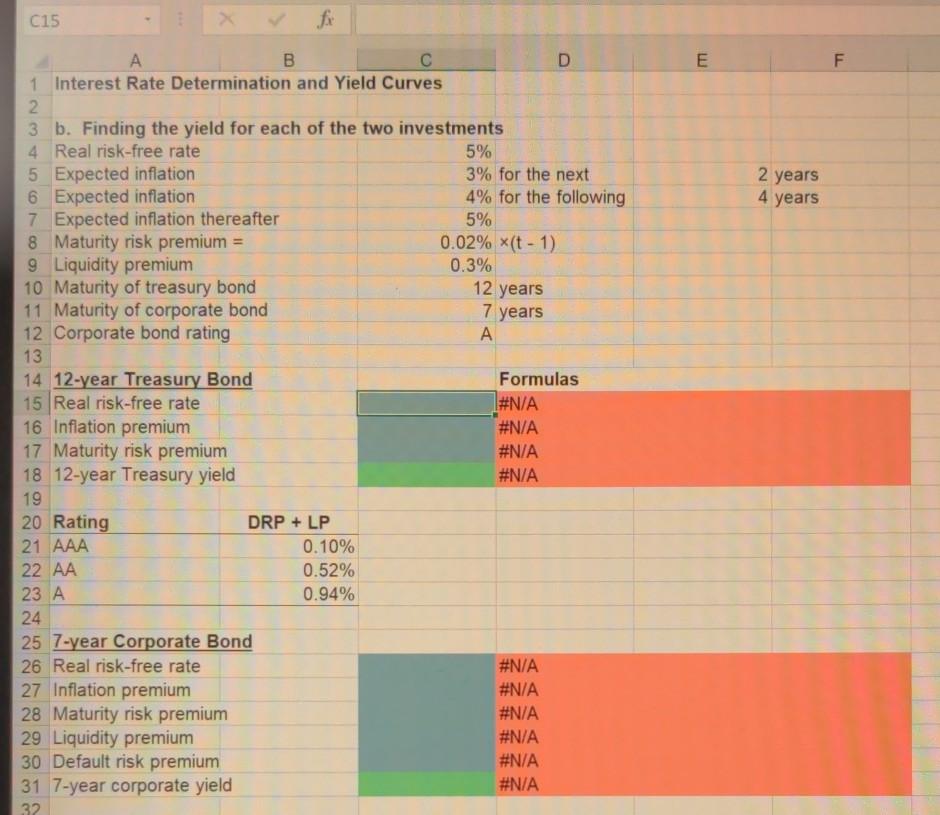

C15 fi E F F 2 years 4 years 12 years B D 1 Interest Rate Determination and Yield Curves 2. 3 b. Finding the

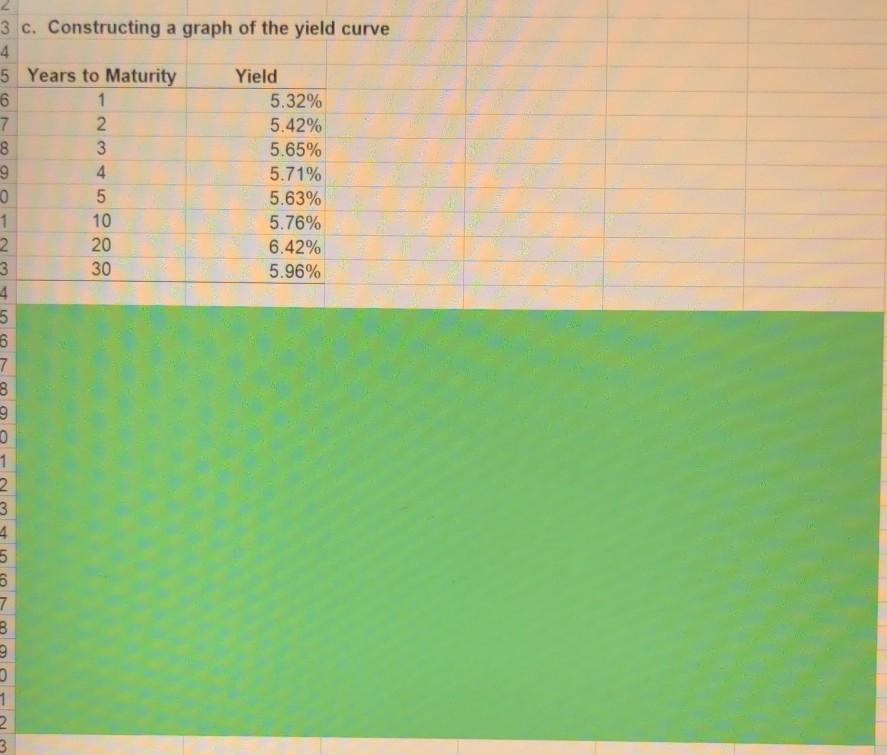

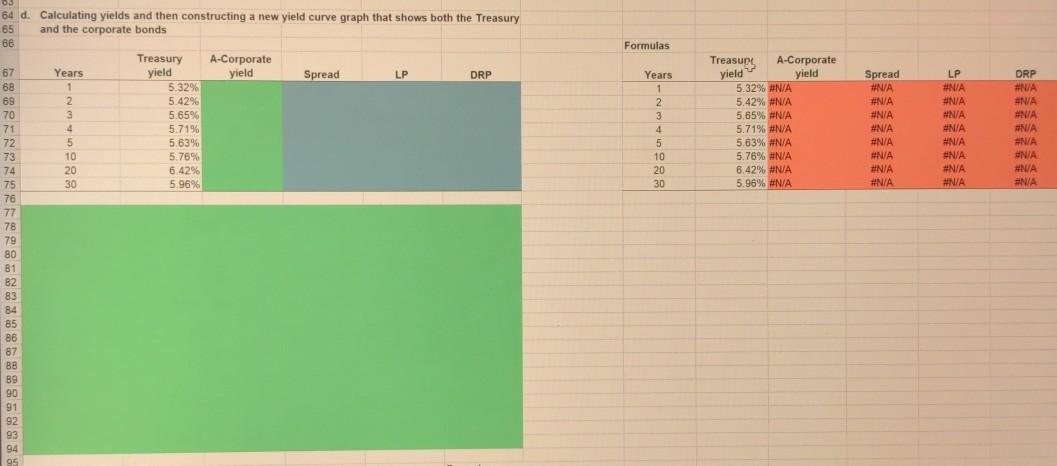

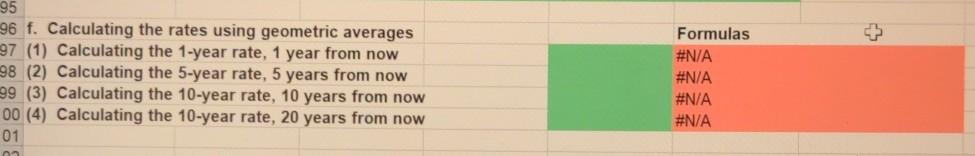

C15 fi E F F 2 years 4 years 12 years B D 1 Interest Rate Determination and Yield Curves 2. 3 b. Finding the yield for each of the two investments 4 Real risk-free rate 5% 5 Expected inflation 3% for the next 6 Expected inflation 4% for the following 7 Expected inflation thereafter 5% 8 Maturity risk premium = 0.02% *(t-1) 9 Liquidity premium 0.3% 10 Maturity of treasury bond 11 Maturity of corporate bond 7 years 12 Corporate bond rating A 13 14 12-year Treasury Bond Formulas 15 Real risk-free rate #N/A 16 Inflation premium #N/A 17 Maturity risk premium #N/A 18 12-year Treasury yield #N/A 19 20 Rating DRP + LP 21 AAA 0.10% 22 AA 0.52% 23 A 0.94% 24 25 7-year Corporate Bond 26 Real risk-free rate #N/A 27 Inflation premium #N/A 28 Maturity risk premium #N/A 29 Liquidity premium #N/A 30 Default risk premium #N/A 31 7-year corporate yield #N/A 32. 3 c. Constructing a graph of the yield curve 4 5 Years to Maturity Yield 6 1 5.32% 7 2 5.42% 8 3 5.65% 19 4 5.71% 0 5 5.63% 1 10 5.76% 2 20 6.42% 3 30 5.96% 4 5 6 7 8 9 1 2 3 4 5 5 7 B 9 0 2 3 Formulas Years 1 2 3 4 4 5 10 20 30 Treasup, A-Corporate yield yield 5.32% #N/A 5.42% #N/A 5.65% #N/A 5.71% #N/A 5.63% #N/A 5.76% #N/A 6.42% #N/A 5.96% #N/A Spread #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A LP #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A DRP #NUA ANA #UA #NA HVA #N/A WA #N/A 03 64 d. Calculating yields and then constructing a new yield curve graph that shows both the Treasury 85 and the corporate bonds 66 Treasury A-Corporate 67 Years yield yield Spread LP DRP 68 1 5.32% 69 2 5.4296 70 3 5.65% 71 4 4 5.71% 72 5 5.63% 73 10 5.76% 74 20 6.42% 75 30 5.96% 76 77 78 79 80 B1 82 83 84 85 86 87 89 90 91 92 93 94 95 + V 95 96 f. Calculating the rates using geometric averages 97 (1) Calculating the 1-year rate, 1 year from now 98 (2) Calculating the 5-year rate, 5 years from now 99 (3) Calculating the 10-year rate, 10 years from now 00 (4) Calculating the 10-year rate, 20 years from now 01 Formulas #N/A #N/A #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started