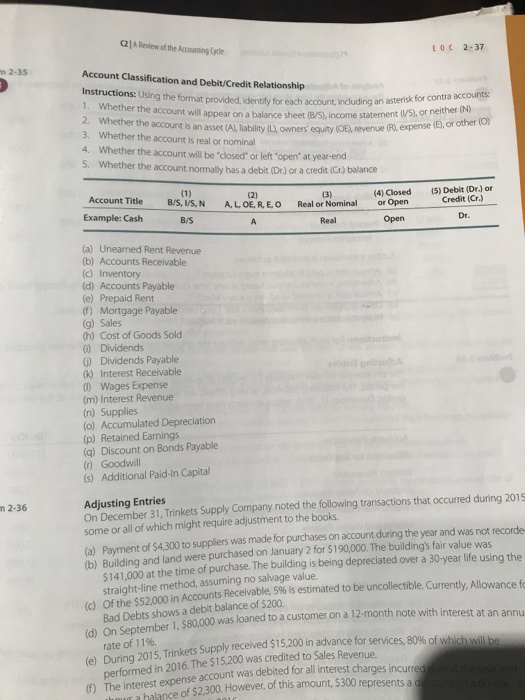

C2] A Review of the Accounting Cyde EOC2-37 m 2-35 Account Classification and Debit/Credit Relationship Instructions: Using the format provided, identify for each account,including an 1. Whether the account will appear on a balance sheet (B/S), income stat 2. Whether the 3. Whether the account is real or nominal 4. Whether the account will be 'closed" or left "open" at year-end asterisk for contra accounts ent (WS), or neither (N) account is an asset (A), liability ILJ,owners' equity (OE, evenue (RI expense Whether the account normally has a debit (Dr) or a credit (Cn) balance Account Title B/S, U/S, N A, L OE, R, E,O Real or Nominal oropen Example: Cash (4) Closed 5) Debit (Dr.) or Credit (Cr.) Dr. B/S Real Open (a) Unearned Rent Revenue (b) Accounts Receivable (c) Inventory (d) Accounts Payable (e) Prepaid Rent (f) Mortgage Payable (g) Sales (h) Cost of Goods Sold Dividends ) Dividends Payable (k) Interest Receivable (1) Wages Expense (m) Interest Revenue (n) Supplies (o) Accumulated Depreciation (p) Retained Earnings () Discount on Bonds Payable (r) Goodwill (s) Additional Paid-In Capital Adjusting Entries On December 31, Trinkets Supply Company noted the following transactions that occurred during 2015 m 2-36 some or all of which might require adjustment to the books. (a) Payment of $4.300 to suppliers was made for purchases on account during the year and was not recorde (b) Building and land were purchased on January 2 for $190,000. The building's fair value was $141,000 at the time of purchase. The building is being depreciated over a 30-year life using the d) Of the $52.000 in Accounts Receivable, 596 is estimated to be uncollectible. Currently, Allowance fo (d) On Sept (e) During 2015, Trinkets Supply received $1 (f) The interest expense account was debited for all interest straight-line method, assuming no salvage value. Bad Debts shows a debit balance of $200 rate of 1 1%. performed in 2016. The $15,200 was credited to Sales Revenue ember 1,$80,000 was loaned to a customer on a 12-month note with interest at an annu 5200 in advance for services, 80% of which will be balance of $2,300. However, of this amount, $300 represents a d