Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C-248 CASE 19 ZF Friedrichshafen's Acquisition of TRW Automotive: Making the Deal Introduction by market consolidation and a focus on innovation, with The case study

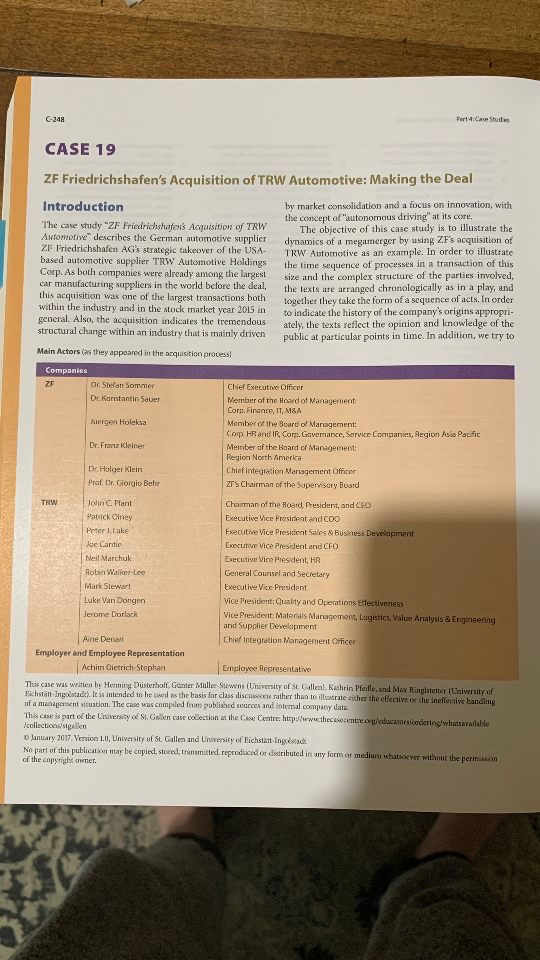

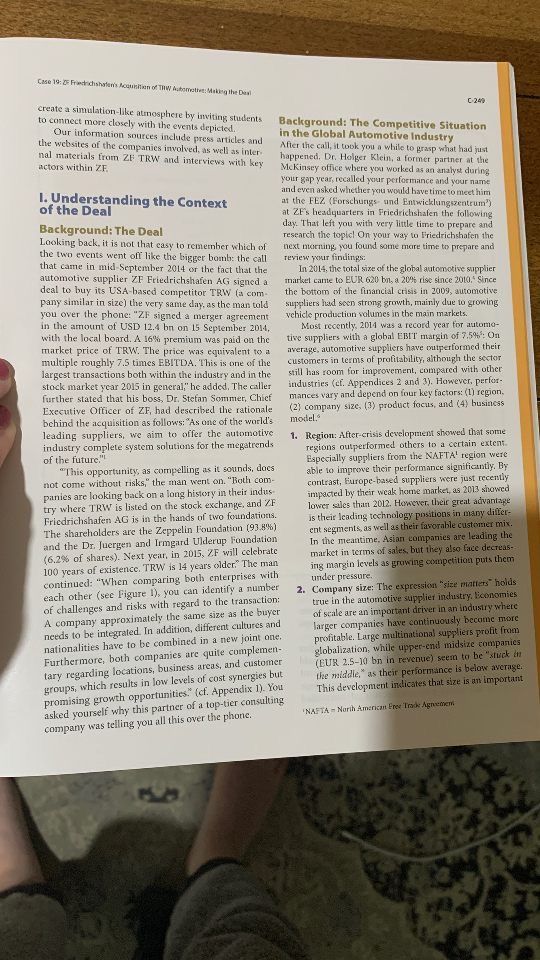

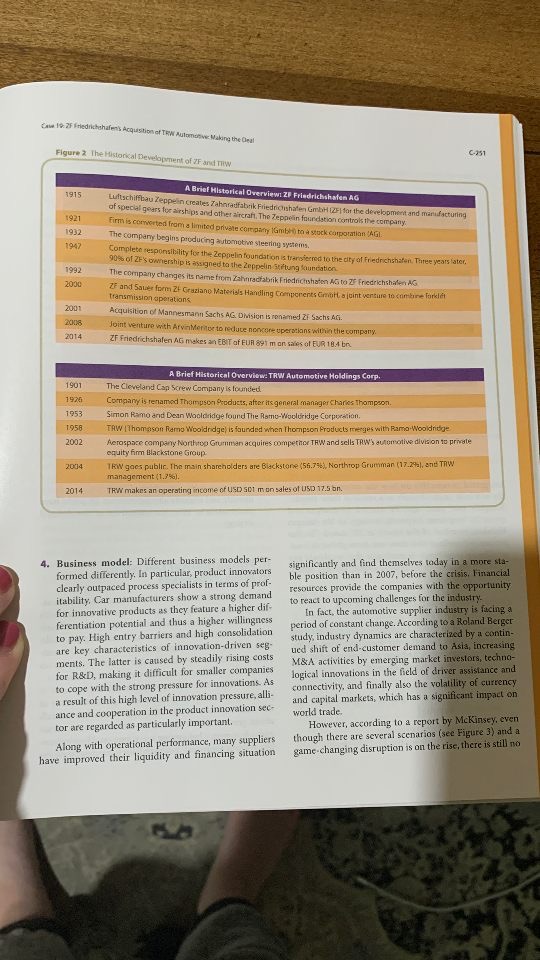

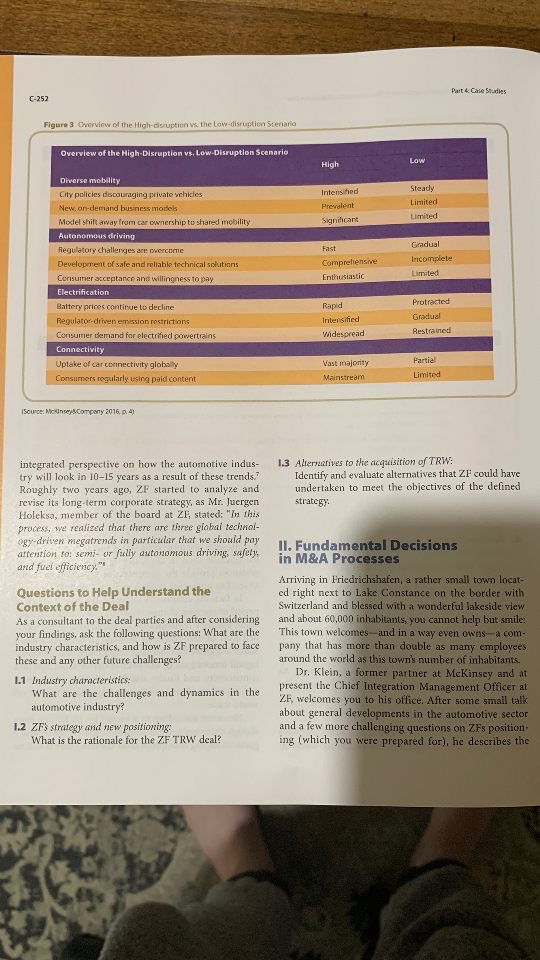

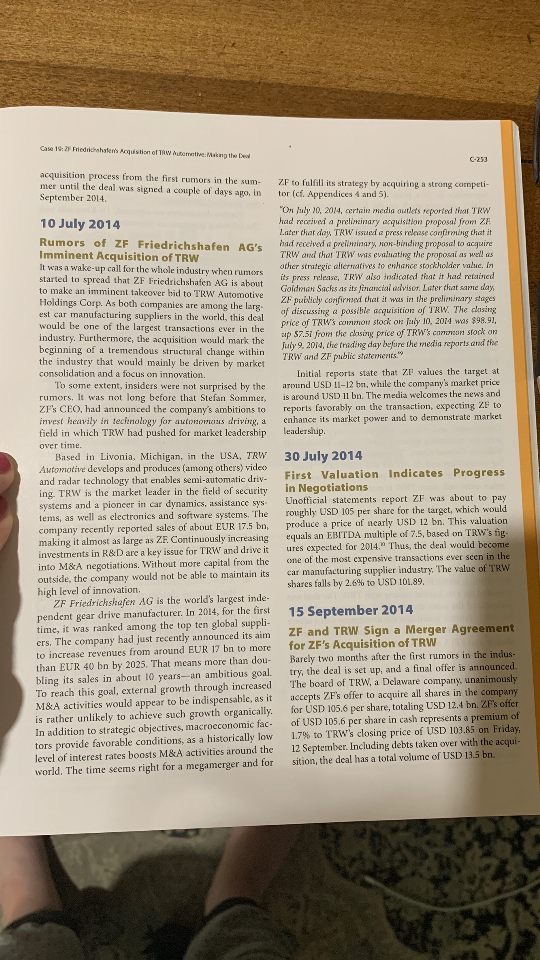

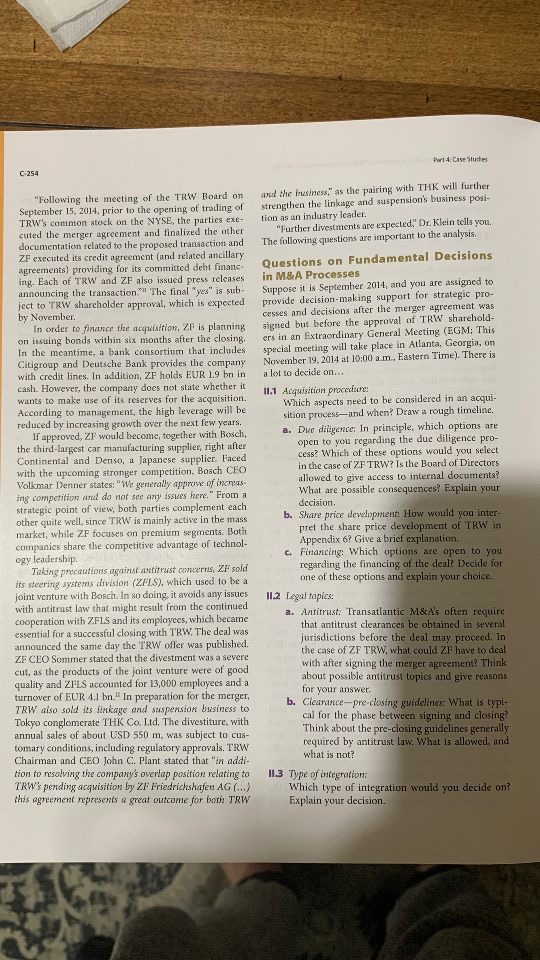

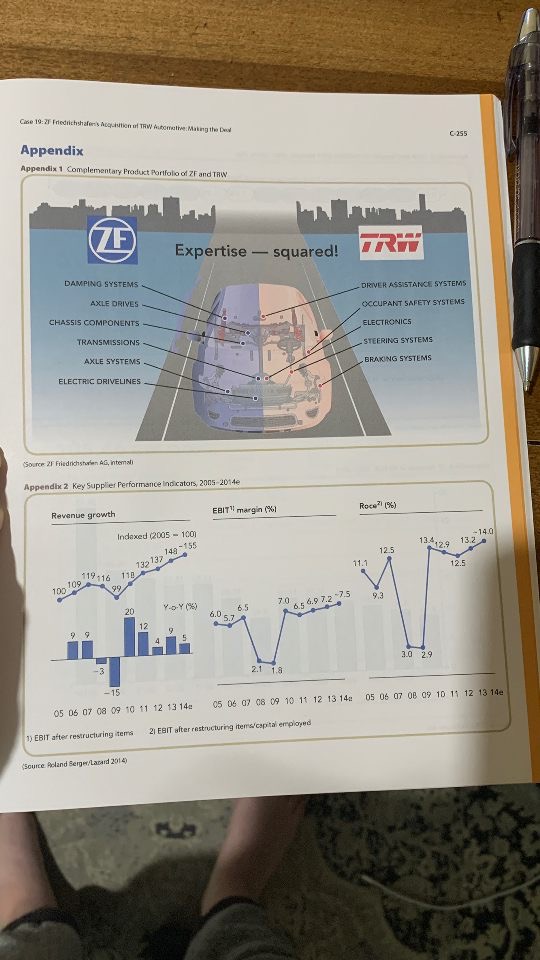

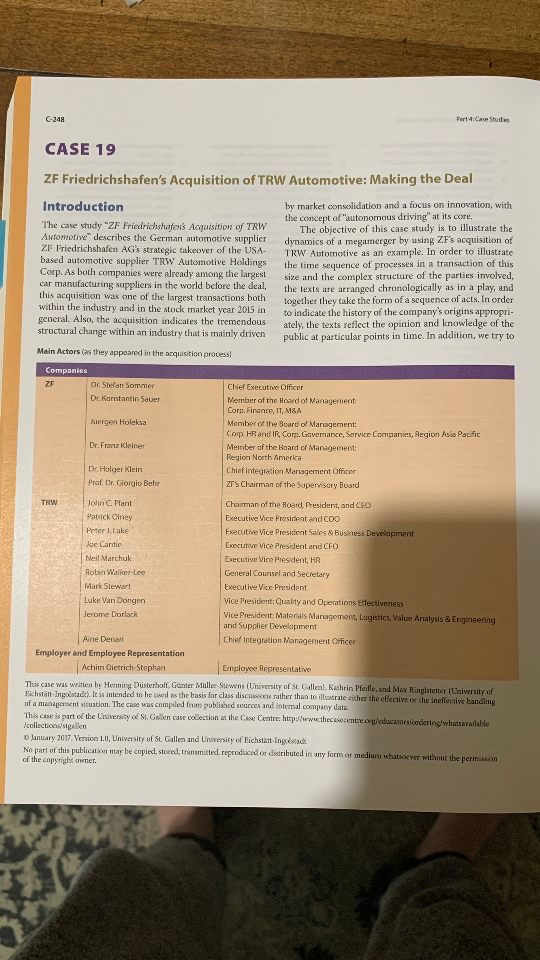

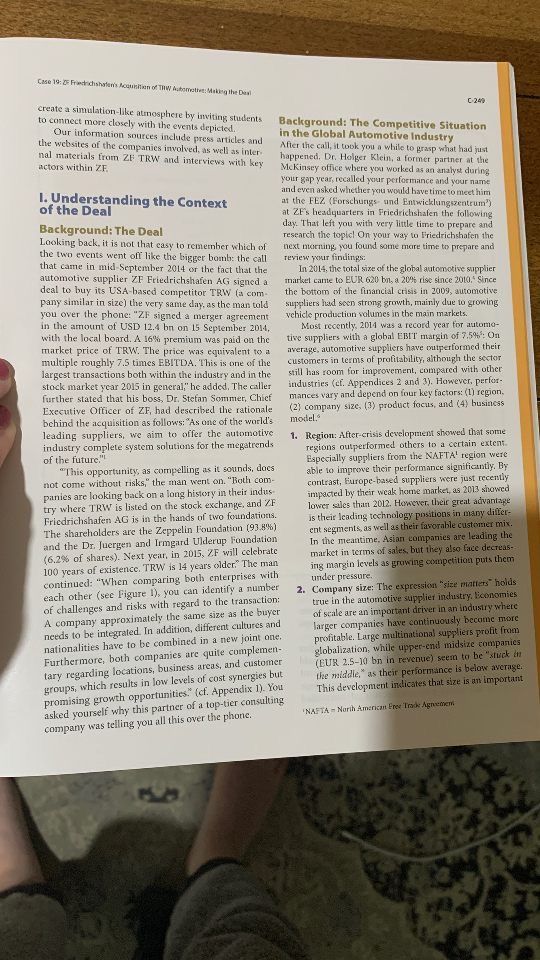

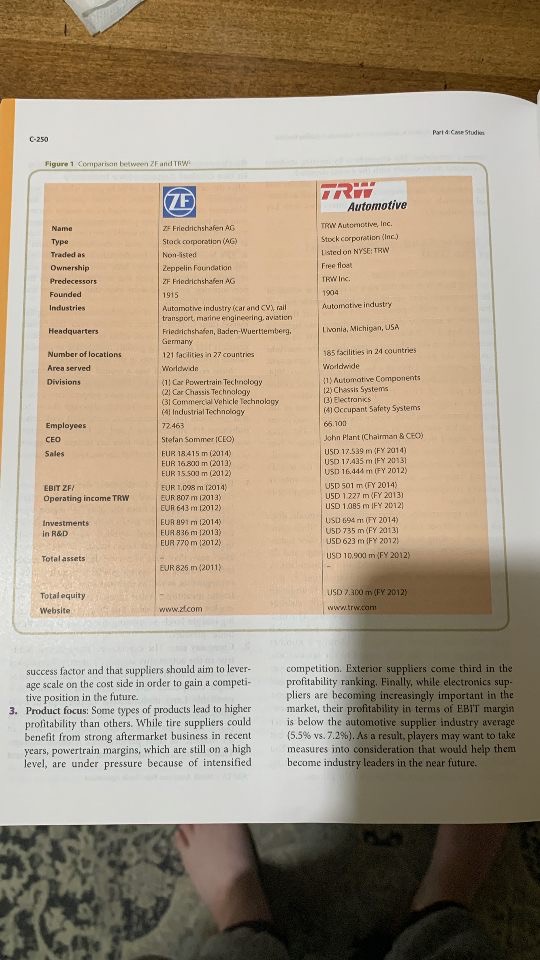

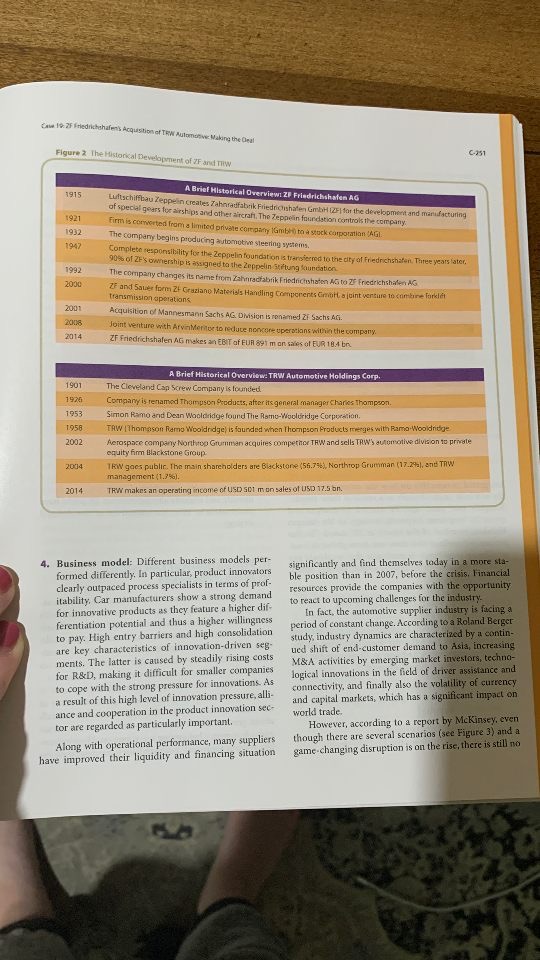

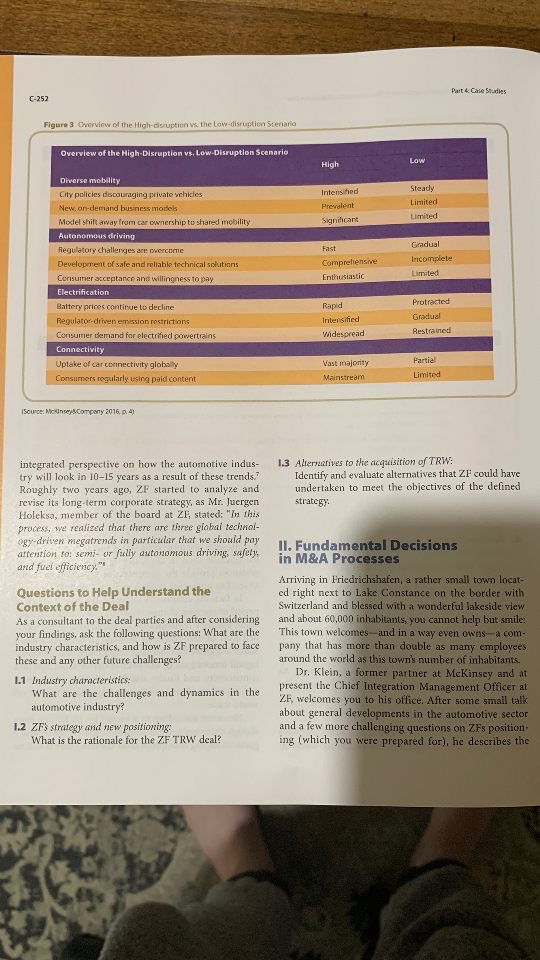

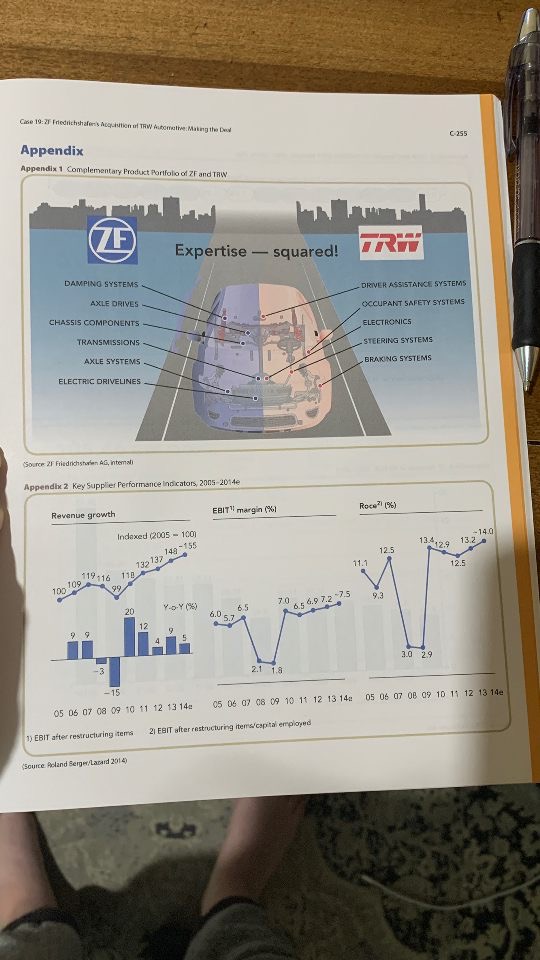

C-248 CASE 19 ZF Friedrichshafen's Acquisition of TRW Automotive: Making the Deal Introduction by market consolidation and a focus on innovation, with The case study "ZF Friedrichshefen's Acquisition of TRW the concept of "autonomous driving" at its core. Automotive" describes the German automotive supplies The objective of this case study is to illustrate the ZF Friedrichshafen AG's strategic takeover of the USA- dynamics of a megamerger by using ZF's acquisition of based automotive supplier TRW Automotive Holdings TRW Automotive as an example. In order to illustrate Corp. As both companies were already among the largest the time sequence of processes in a transaction of this car manufacturing suppliers in the world before the deal, size and the complex structure of the parties involved, this acquisition was one of the largest transactions both the texts are arranged chronologically as in a play, and within the industry and in the stock market year 2015 in together they take the form of a sequence of acts. In order general. Also, the acquisition indicates the tremendous to indicate the history of the company's origins appropri- structural change within an industry that is mainly driven ately, the texts reflect the opinion and knowledge of the public at particular points in time. In addition, we try to Main Actors (as they appeared in the acquisition process) companies Or, Stefan Sommer Chief Executive Officer Dr. Konstantin Saver Member of the Hoard of Management Corp. Firanne, IT, M&A Juergen Holeksa Member of the Board of Management: Corp. HR and IR, Corp. Governance, Server Companies, Region Asia Pacific Dr. Franz Kleiner Member of the Board of Management: Region North Amerka Dr. Holger Klein Chief Integration Management Officer Prof. Or Giorgio Behr 2F'S Chairman of the Supervisory Board TRW John C Planit Chairman of the Board President, and CEO Patrick ney Executive Vice President and COO Potor I.take Executive Vice President Sales & Business Development Joe Cantic Executive Vice President and CFO Neil Marchuk Executive Vice Pres dent, HR Robin Walker-Lee General Counsel and Secretary Mark Stewart Executive Vice President Luke Van Dongen vice President: Quality and Operations Effectiveness Jerome Dorlack Vice President Materials Management, Logistics, Value Analysis & Engineering and Supplier Development Aine Denlani Chief Integration Managermerit Officer Employer and Employee Representation Achim Dietrich Stephan Employee Representative This case was written by Henning Dusterhoff, Gunter Muller-Stewens (University of & Calleak, Kathrin Pfeifle, and Max Ringlistener [University of Eichstall-Ingo sada. It is intended to be used as the basis for class discussion is rather than to illustrate tithes the elecclive or the ineffective handling of a managersent situation. The case was compiled from published sources and internal company data /collections'sip Sen This case is part of the University of St, Galen case collection at the Case Centre. http:/www.thecasecentre cep/educators/ordering whoisavailable January 2017, Version 1.U, University of St Gallen and University of Eichstart Inpoland. of the copyright owner. No part of this publican on may be copied, stored, transmitted, reproduced or distributed in any form or medium whatsoever without the perm skinCase 19: 2 Fried chahaten's Accunition of THW Automatres: Making the Daal create a simulation-like atmosphere by inviting students C 240 to connect more closely with the events depicted. Our information sources include press articles and Background: The Competitive Situation the websites of the companies involved, as well as inter in the Global Automotive Industry nal materials from ZF TRW and interviews with key After the call, it took you a while to grasp what had just actors within ZF. happened. Dr. Holger Klein, a former partner at the Mckinsey office where you worked as an analyst during your gap year, recalled your performance and your name I. Understanding the Context and even asked whether you would have time to meet him of the Deal at the FEZ (Forschungs and Entwicklungszentrum") at ZF's headquarters in Friedrichshafen the following Background: The Deal day. That left you with very little time to prepare and Looking back. it is not that casy to remember which of research the topic On your way to Friedrichshafen the the two events went off like the bigger bomb: the call next morning you found some more time to prepare and that came in mid September 2014 or the fact that the review your findings: automotive supplier ZF Friedrichshafen AG signed a In 2014, the total size of the global automotive supplier deal to buy its USA-based competitor TRW (a com- market came to BUR 620 ba, a 209% rise since 2010,' Since pany similar in size) the very same day, as the man told the bottom of the financial crisis in 2009, automotive you over the phone: "ZF signed a merger agreement suppliers had seen strong growth, mainly due to growing in the amount of USD 12.4 be on 15 September 2014, vehicle production volumes in the main markets. with the local board. A 16% premium was paid on the Most recently, 2014 was a record year for automo- market price of TRW. The price was equivalent to a tive suppliers with a global EBIT margin of 7,59% ; On multiple roughly 7.5 times EBITDA. This is one of the average, automotive suppliers have putperformed their largest transactions both within the industry and in the customers in terms of profitability, although the sector still has room for improvement, compared with other stock market year 2015 in general," he added, The caller industries (cf. Appendices 2 and 3). However, perfor- further stated that his boss, Dr. Stefan Sommer, Chief mances vary and depend on four key factors: (1) region. Executive Officer of ZE, had described the rationale (2) company size. (3) product focus, and (4) business behind the acquisition as follows: "As one of the world's models leading suppliers, we aim to offer the automotive industry complete system solutions for the megatrends 1. Region: After-crisis development showed that some of the future." regions outperformed others to a certain extent "This opportunity, as compelling as it sounds, does Especially suppliers from the NAFTA' region were not come without risks,"the man went on. "Both com- able to improve their performance significantly. By panies are looking back on a long history in their indus contrast, Europe-based suppliers were just recently try where TRW is listed on the stock exchange, and ZF impacted by their weak horne market, as 2013 showed Friedrichshafen AG is in the hands of two foundations. lower sales than 2012. However, their great advantage The shareholders are the Zeppelin Foundation (93.#%) is their leading technology positions in many differ- ent segments, as well as their favorable customer mix. and the Dr, Juergen and Irmgard Ulderup Foundation In the meantime. Asian companies are leading the (6.2%% of shares). Next year, in 2015, ZF will celebrate market in terms of sales, but they also face decreas 100 years of existence. TRW is 14 years older," The man ing margin levels as growing competition puts them continued: "When comparing both enterprises with under pressure. each other (see Figure D), you can identify a number 2. Company size: The expression "size matters" holds of challenges and risks with regard to the transaction: true in the automotive supplier industry. Economies A company approximately the same size as the buyer of scale are an important driver in an industry where needs to be integrated In addition, different cultures and larger companies have continuously become more nationalities have to be combined in a new joint one, profitable. Large multinational suppliers profit from Furthermore, both companies are quite complement globalization, while upper-end midsize companies tary regarding locations, business areas, and customer (EUR 2.5-10 bn in revenue) seem to be "stuck th groups, which results in low levels of cost synergies but the middle,* as their performance is below average. promising growth opportunities." (cf. Appendix 1). You This development indicates that size is an Important asked yourself why this partner of a top-tier consulting NAFTA - North American Fres Track Agnemen. company was telling you all this over the phone.C-250 Part 4: Che Stud in Figure 1 Comparison Between 2Fand TRW 7F Automotive Name XF Friedrichshafen AG TRWY' Automotive, Inc. Type Stack corporation (AGG) Stock corporation (Inc ) Traded as Non-isred Listed on NYSE: TRW Ownership Zeppelin Foundation Free float Predecessors 2F Friedrichshafen AG Founded 1915 1904 Industries Automotive industry (car and CV), rail Automotive industry transport marine engineering. aviation Headquarters Friedrichshaden, Baden-Wuerthemberg, Livonia, Michigan, USA Germany Number of locations 121 facilities in 27 countries 185 facilities in 24 countries Area served Worldwide Divisions (1) Car Powertrain Technology (1) Automotive Components (21 Car Chassis Technology 12) Chassis Systems $31 Commercial Vehicle Technology ()Electronics Cil Industrial Technology 141 Occupant Safety Systems Employees 72463 65.101 CEO Stefan Sommer [CEO) John Plant (Chairman & CEO) Sales FUR 18415 m (201.1) USD 17.539 m (FY 2014) FUR 16.800 m (2013) USD 17.435 m IFY 20131 FIJR 15 303 m (2012) USD 16.444 m IFY 2012 EBIT ZF/ FUR 1,028 m 12014) USD 501 m.(FY 2014) Operating income TRW EUR 807 m 17013) USD 1 227 m (FY 20131 EUR 613 m-12012) USD 1.085 m IFY 20121 Investments EUR 097 m (2014) 130 694 m (FY 2014) in RED FUR 836 m 12013) USD 735 m (FY 20131 EUR 770 m (2012) USD 623 m IFY 2012) Total assets USD 10500 m (FY 2012) EUR 825 m (2011) Total equity USD 2.300 m (FY 2012) Website www.atcom www.try.cam success factor and that suppliers should aim to lever- competition. Exterior suppliers come third in the age scale on the cost side in order to gain a competi- profitability ranking. Finally, while electronics sup- tive position in the future. pliers are becoming increasingly important in the 3. Product focus: Some types of products lead to higher market, their profitability in terms of EBIT margin profitability than others. While tire suppliers could is below the automotive supplier industry average benefit from strong aftermarket business in recent (5.5%% vs. 7.296). As a result, players may want to lake years, powertrain margins, which are still on a high level, are under pressure because of intensified measures into consideration that would help them become industry leaders in the near future.One 19: 2F fredikelahafen's Acquisition of TRW Automotive Making the Deal Figure 2 The Hisdorkal Development of 2F and TRWY C-251 1915 A Brief Historical Overview: ZF Friedrichshafen AG 1921 Luftschiffbau Zeppelin creates Zahnradfabrik Friedrichshafen Umbel IF| for the development and manufacturing of special gears for airships and otheraircraft, The Zeppelin foundation controls the company 1932 Firm is converted from a limited private company IGmbto to a stuck computation Al. 1947 The company begins producing automotion steering systems. Complete responsibility for the Zeppelin foundation is transferred to the city of Friedrichsharon, Three years later. 1992 jose of ZF's ownership is assigned to the Zeppelin stiftung foundation 2000 The company changes its name from Zahmracfabrik Friednchishaton 46 to 28 Friedrichshafer AG ZF and Sauer form 24 Graziano Materials Handling Components Grantt a joint venture In combine farklet transmission operations Acquisition of Mannesmann Sachs AG. Division is renamed ZF Sachs AG. 2014 Joint venture with ArvinMentor to reduce noncore operations within the company. IF Friedrichshalen Ali makes an EBIT of FUR 891 mon sales of EUR 184 br. 1901 A Brief Historical Overview: TRW Automotive Holdings Corp. The Cleveland Cap Screw Company is founded 1920 Company is renamed Thompson Products, after its general manager Charles Thompson. 1953 Simon Ramo and Dean Wooldridge found The Ramo-Wooldridge Corporation, 1956 TAW |Thomason Ramo Wooldridge, is founded when Thompson Products merges with Ramo Wooldridge 2002 Aerospace company Northrop Grumman acquires compernor TRW and sells TRW's automotive division to private equity firm Blackstone Group 2004 1RW goes public. The main shareholders are Blackstone (56.7%), Northrop Grumman (17.212), and TRY! management (1.756]. 2014 TRW makes an operating moore of USD 501 mon sales of USD 17.5 an. 4. Business model: Different business models per- formed differently. In particular, product innovators significantly and find themselves today in a more sta- clearly outpaced process specialists in terms of prof- ble position than in 2007, before the crisis, Financial itability, Car manufacturers show a strong demand resources provide the companies with the opportunity for innovative products as they feature a higher dif- to react to upcoming challenges for the industry- ferentiation potential and thus a higher willingness In fact, the automotive supplier industry is facing a to pay. High entry barriers and high consolidation period of constant change. According to a Roland Berger are key characteristics of innovation-driven seg- study, industry dynamics are characterized by a contin- ments. The latter is caused by steadily rising costs ued shift of end-customer demand to Asia, increasing for R&D, making it difficult for smaller companies M&A activities by emerging market investors, techno- to cope with the strong pressure for innovations As logical innovations in the held of driver assistance and a result of this high level of innovation pressure, alli- connectivity, and finally also the volatility of currency and capital markets, which has a significant impact on ance and cooperation in the product innovation see- tor are regarded as particularly important. world trade. However, according to a report by Mckinsey, even Along with operational performance, many suppliers though there are several scenarios (see Figure 3) and a have improved their liquidity and financing situation game-changing disruption is on the rise, there is still noC-252 Part 4: Case Studies Figure 3 Carrview of the High-disruption is the Low-disruption Scenario Overview of the High-Disruption vs, Low-Disruption Scenario High Low Diverse mobility City policies decouniging private wehides Intens fied Steady New. on-demand business models Prevalent Limited Model shift away from car ownership to shared mobility Significant Limited Autonomous driving Regulatory challenges are overcome Fast Gradual Development of safe and reliable technical solutions Comprehensive Incomplete Consumer acceptance and willingness to pay Enthusiastic Limited Electrification Battery prices continue to decline Rapid Protracted Regulator-driven emission restrictions Intensified Gradual Consumer demand for electrified powertrains Widespread Restrained Connectivity Uptake of car connectivity globally Vast majority Partial Consumers regularly using paid content Mainstream Limited iSource: Mckinsey \\Company 2016, D. 4) integrated perspective on how the automotive indus- 13 Alternatives to the acquisition of TRW: try will look in 10-15 years as a result of these trends." Identify and evaluate alternatives that ZI could have Roughly two years ago, ZF started to analyze and undertaken to meet the objectives of the defined revise its long-term corporate strategy, as Mr. Juergen strategy. Holeksa, member of the board at ZF, stated: "In this process, we realized that there are three global technol- ogy-driven megatrends in particular that we should pay attention for semi- or fully autonomous driving, safety Il. Fundamental Decisions and fuel efficiency" in M&A Processes Questions to Help Understand the Arriving in Friedrichshafen, a rather small town locat- ed right next to Lake Constance on the border with Context of the Deal Switzerland and blessed with a wonderful lakeside view As a consultant to the deal parties and after considering and about 60,060 inhabitants, you cannot help but smile: your findings, ask the following questions: What are the This town welcomes and in a way even owns-a com- industry characteristics, and how is ZF prepared to face these and any other future challenges? pany that has more than double as many employees around the world as this town's number of inhabitants, 1.1 Industry characteristics: Dr. Klein, a former partner at Mckinsey and at What are the challenges and dynamics in the present the Chief Integration Management Officer at automotive industry? ZE, welcomes you to his office. After some small talk 1.2 ZF's strategy and new positioning: about general developments in the automotive sector What is the rationale for the ZF TRW deal? and a few more challenging questions on ZFs position. ing ( which you were prepared for), he describes theCase 14:7 Friedrichahaten's Acquisition of TOW Automathe: Making the Dead C-253 acquisition process from the first rumors in the sum- mer until the deal was signed a couple of days ago, in September 2014. ZF to fulfill its strategy by acquiring a strong competi- tor (cf. Appendices 4 and 5). 10 July 2014 On july 10, 2014, certain media outlets reported that TRW had received a preliminary acquisition proposal from 2.H. Rumors of ZF Friedrichshafen AG's Later that day TRW issued a press release confirming that it Imminent Acquisition of TRW had received a preliminary, non-binding proposal to acquire TRW and that TRW was evaluating the proposal as well as It was a wake-up call for the whole industry when rumors other strategic alternatives to enhance storkholder value. In started to spread that ZF Friedrichshafen AG is about its press release, TRW also dedicated that it had retained to make an imminent takeover bid to TRW Automotive Goldman Sacks as its financial advisor. Later that same day Holdings Corp. As both companies are among the large OF publicly confirmed that it was in the preliminary slopes est car manufacturing suppliers in the world, this deal of discussing a possible acquisition of TRW. The closing would be one of the largest transactions ever in the price of TRW's common stock on july 10. 2014 was $98.91, industry. Furthermore, the acquisition would mark the ap $7.5i from the clasing price of TRW's common stock an beginning of a tremendous structural change within July 9. 2014, the trading day before the media reports and the the industry that would mainly be driven by market TRW and ZF public statements" consolidation and a focus on innovation. To some extent, insiders were not surprised by the Initial reports state that ZI values the target at rumors, It was not long before that Stefan Sommer, around USD 11-12 ba, while the company's market price ZF's CEO, had announced the company's ambitions to is around USD 11 bn. The media welcomes the news and invest heavily in technology for autonomous driving, a reports favorably on the transaction, expecting ZF to field in which TRW had pushed for market leadership enhance its market power and to demonstrate market leadership. over time. Based in Livonia, Michigan, in the USA, TRW Automotive develops and produces (among others) video 30 July 2014 and radar technology that enables semi-automatic driv- First Valuation Indicates Progress ing TRW is the market leader in the field of security in Negotiations systems and a pioneer in car dynamics, assistance sys- Unofficial statements report ZF was about to pay tems, as well as electronics and software systems, The roughly USD 195 per share for the target, which would company recently reported sales of about EUR 17.5 ba, produce a price of nearly USD 12 bn. This valuation making it almost as large as ZF. Continuously increasing equals an EBITDA multiple of 7.5, based on TRW's fig- investments in R&D are a key issue for TRW and drive it ures expected for 2014." Thus, the deal would become into M&A negotiations. Without more capital from the one of the most expensive transactions ever seen in the outside. the company would not be able to maintain its car manufacturing supplier industry, The value of TRW high level of innovation, shares falls by 2.6% to USD 101.89. ZF Friedrichshafen AG is the world's largest inde- pendent gear drive manufacturer. In 2014, for the first time, it was ranked among the top ten global suppli- 15 September 2014 ers, The company had just recently announced its aim ZF and TRW Sign a Merger Agreement to increase revenues from around EUR 17 ba to more for ZF's Acquisition of TRW than EUR 40 bo by 2025. That means more than dou- Barely two months after the first rumors in the indus- bling its sales in about 10 years-an ambitious goal. try, the deal is set up, and a final offer is announced, To reach this goal, external growth through increased The board of TRW, a Delaware company, unanimously M&A activities would appear to be indispensable, as it accepts ZF's offer to acquire all shares in the company is rather unlikely to achieve such growth organically. for USD 105.6 per share, totaling USD 12.4 bn. ZF's offer In addition to strategic objectives, macroeconomic fac- of USD 105.6 per share in cash represents a premium of tors provide favorable conditions, as a historically low 1.79 to TRW's closing price of USD 103.85 on Friday, level of interest rates boosts M&A activities around the 12 September. Including debts taken over with the acqui- world, The time seems right for a megamerger and for sition, the deal has a total volume of USD 135 bn.C-254 Part 4. Case Studies "Following the meeting of the TRW Board on "and the business," as the pairing with THE will further September 15, 2014, prior to the opening of trading of strengthen the linkage and suspension's business posi- TRW's common stock on the NYSE, the parties exe- tion as an industry leader. cuted the merger agreement and finalized the other "Further divestments are expected,"Di Klein tells you. documentation related to the proposed transaction and The following questions are important to the analysis. ZF executed its credit agreement (and related ancillary agreemental providing for its committed debt finance Questions on Fundamental Decisions ing. Each of TRW and ZF also issued press releases in M&A Processes announcing the transaction."" The final "yes" is sub- Suppose it is September 2014, and you are assigned to ject to TRW shareholder approval, which is expected provide decision-making support for strategic pro- by November. cesses and decisions after the merger agreement was In order to finance the acquisition, ZF is planning signed but before the approval of TRW sharehold- on issuing bonds within six months after the closing. ers in an Extraordinary General Meeting (EGM; This In the meantime, a bank consortium that includes special meeting will take place in Atlanta, Georgia, on Citigroup and Deutsche Bank provides the company November 19, 2014 at 10:00 a.m, Eastern Time). There is with credit lines, In addition, ZF holds EUR 1.9 bn in a lot to decide on... cash. However, the company does not state whether it wants to make use of its reserves for the acquisition. 11.1 Acquisition procedure According to management, the high leverage will be Which aspects need to be considered in an acqui- reduced by increasing growth over the next few years. sition process-and when? Draw a rough timeline. If approved, ZF would become, together with Bosch, a. Due diligence: In principle, which options are the third-largest car manufacturing supplier, right after open to you regarding the due diligence pro- Continental and Denso, a Japanese supplier Faced cess? Which of these options would you select with the upcoming stronger competition, Bosch CBO in the case of ZF TRW? Is the Board of Directors Volkmar Denner states: " We generally approve of increase allowed to give access to internal documents? ing competition and do not see any issues here." From a What are possible consequences? Explain your strategic point of view, both parties complement each decision, other quite well, since TRW is mainly active in the mass b. Share price development. How would you inter- market, while ZF focuses on premium segments. Both prel the share price development of TRW in companies share the competitive advantage of technol- Appendix 6? Give a brief explanation. ogy leadership. c. Financing: Which options are open to you Taking precautions against antitrust concerns, ZF sold regarding the financing of the deal? Decide for its steering systems division (ZFIS), which used to be a one of these options and explain your choice. joint venture with Bosch. In so doing, it avoids any issues with antitrust law that might result from the continued 11.2 Legal topics: cooperation with ZFLS and its employees, which became a. Antitrust. Transatlantic M&A's often require essential for a successful closing with TRW. The deal was that antitrust clearances be obtained in several announced the same day the TRW offer was published. jurisdictions before the deal may proceed. In ZF CEO Sommer stated that the divestment was a severe the case of ZF TRW, what could ZF have to deal cut, as the products of the joint venture were of good with after signing the merger agreement? Think quality and ZFLS accounted for 13,000 employees and a about possible antitrust topics and give reasons turnover of EUR 4.1 bn." In preparation for the merger, for your answer. TRW also sold its linkage and suspension business to b. Clearance-pre-closing guidelines. What is typi- Tokyo conglomerate THK Co. Lid. The divestiture, with cal for the phase between signing and closing? annual sales of about USD 550 m. was subject to cus- Think about the pre-closing guidelines generally tomary conditions, including regulatory approvals. TRW required by antitrust law, What is allowed, and Chairman and CEO John C. Plant stated that "in addi- what is not? tion to resolving the company's overlap position relating to TRW's pending acquisition by ZF Friedrichshafen AG (...) 11.3 Type of integration: this agreement represents a great outcome for both TRW Which type of integration would you decide on? Explain your decision.Gie 19:21 Friedrichshafer's Acquisition of TRW Anomalies Making the Dead Appendix 1 255 Appendix 1 Complementary Product Portfolio of ZF and TRW ZE Expertise - squared! DAMPING SYSTEMS AXLE DRIVES DRIVER ASSISTANCE SYSTEMS CHASSIS COMPONENTS OCCUPANT SAFETY SYSTEMS ELECTRONICS TRANSMISSIONS STEERING SYSTEMS AXLE SYSTEMS BRAKING SYSTEMS ELECTRIC DRIVELINES "Source / Friedrichsnevan AG, intemali Appendi 2 Key Supplier Performance Indicators, 2005 2014e Revenue growth EBIT" margin (%] Indexed (2005 - 1001 149 -155 124. . $140 195137 4 12.9 13.2 0 12.5 10 109 7:16 178 11 1 12.5 99 65 70 65 4.9 7.2 75 12 5.7 20 29 2.1 1.8 -15 05 06 07 03 09 10 11 12 13 142 05 04 07 08 09 10 11 12 13 14: 05 04 07 08 09 10 19 12 13 142 1) EBIT after restructuring terra. 21 EBIT after restructuring iten's'capital employs "Source Roland Berger/Larand 201 4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started