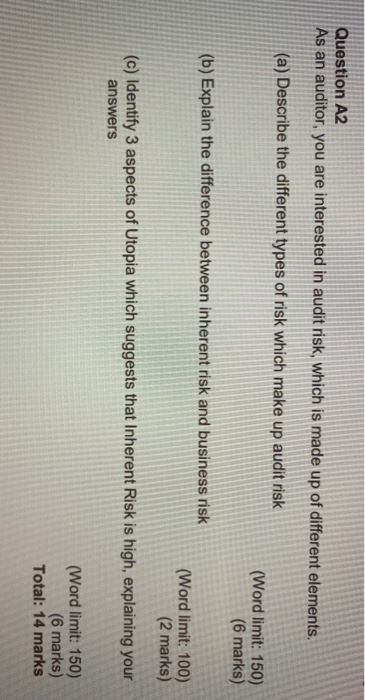

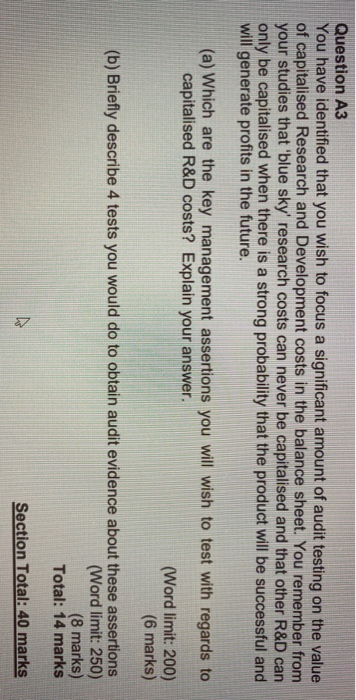

C39AU SECTION A (40 marks) Case study - Answer ALL questions in this section. You are an audit senior at an accountancy firm called Climax Audit. Your manager has asked you to prepare the audit plan for one of Climax Audit's biggest clients, Utopia Ltd. Utopia Ltd is a pharmaceuticals company which undertakes research and development activities with a view to developing new medicinal drugs. The founder of the company, Paul Simpson, is the Chairman and Chief Executive and owns 60% of the share capital. He is hoping to float the company on the London Stock Exchange within the next few years to raise money to invest in building new research laboratories. Utopia has been trading for 15 years and for the year ended 31 October 2019 had a turnover of 15mn. Turnover is predominantly made up of sales revenues from the drugs it has successfully developed and launched on the market place. Sales are mostly in the UK and Europe but the company hopes to increase the number of its products that have been approved for sale in the US to increase its market there. The main assets on the balance sheet are the intangible assets representing the drugs which have been successfully launched as well as those which are in various stages of development. The company employs around 50 people in the UK; half of these are research scientists, the others are administration and sales staff. Utopia usually has around 120 different research projects (for pharmaceutical products) underway at any one time, ranging from those just starting to those where a product is awaiting final approval before it can be launched on the market place. Each project is given a different code and that code is used to collect costs relating to the project. Research and laboratory staff complete weekly time sheets and allocate all their time to project codes or to admin. Purchase invoices are assigned to the relevant project codes. If a fixed asset is used on one project only, its depreciation expense is charged to that project. Other research related depreciation costs are spread across the research projects according to a formula developed by Paul Simpson. All projects are also allocated a share of general overhead costs, again using a formula developed by Paul Every quarter, the lead researcher for each project prepares a report for Paul summarising the progress of the project and the estimated time remaining before the product is ready for clinical trials. Around one in ten projects are abandoned before they reach the stage of clinical trials. This can be for a range of reasons but usually because either the product is not expected to pass the trials or because it will be too expensive to manufacture commercially. As soon as a project manager identifies that a product will not be viable, he immediately reports the situation to Paul. Paul then appoints a different researcher to confirm the information in the report, then all the project costs are immediately written off. Full forecasts and budgets are produced for each project once it has reached the stage of clinical trials. These forecasts include estimated costs to completion, projection mar acturing costs and expected sales revenue over the next 10 years. About 80% of the products which reach the stage of clinical trials are successfully launched on the market. Continued on next page L.. C39AU Required: Question A1 Paul has asked your firm what changes he needs to make if he wants to float the company In particular, he has heard about Corporate Governance and wants some more information about it. (a) Explain what is meant by Corporate Governance, briefly explaining some of its key elements and why it is important for a UK listed company (Word limit: 150) (4 marks) (b) Describe and explain the Corporate Governance Code guidance on the roles of Chairman and Chief Executive and suggest what changes Paul should make in this area (Word limit: 150) (4 marks) (c) Under the latest changes to the Corporate Governance Code, directors are required to confirm that they have carried out a robust assessment of the principal risks facing the company, including those that would threaten its business model, future performance, solvency or liquidity. Explain what is meant by business risk and give two examples of business risks facing Utopia, explaining why they are risks. (Word limit: 150) (4 marks) Total: 12 marks Question A2 As an auditor, you are interested in audit risk, which is made up of different elements. (a) Describe the different types of risk which make up audit risk (Word limit: 150) (6 marks) (b) Explain the difference between inherent risk and business risk (Word limit: 100) (2 marks) (c) Identity 3 aspects of Utopla which suggests that inherent Risk is high, explaining your answers (Word limit: 150) (6 marks) Total: 14 marks Continued on next page L.. Question A3 You have identified that you wish to focus a significant amount of audit testing on the value of capitalised Research and Development costs in the balance sheet. You remember from your studies that 'blue sky' research costs can never be capitalised and that other R&D can only be capitalised when there is a strong probability that the product will be successful and will generate profits in the future. (a) Which are the key management assertions you will wish to test with regards to capitalised R&D costs? Explain your answer. (Word limit: 200) (6 marks) (b) Briefly describe 4 tests you would do to obtain audit pvidence about these assertions (Word limit: 250) (8 marks) Total: 14 marks Section Total: 40 marks C39AU Required: Question A1 Paul has asked your firm what changes he needs to make if he wants to float the company. In particular, he has heard about Corporate Governance and wants some more information about it. (a) Explain what is meant by Corporate Governance, briefly explaining some of its key elements and why it is important for a UK listed company (Word limit: 150) (4 marks) (b) Describe and explain the Corporate Governance Code guidance on the roles of Chairman and Chief Executive and suggest what changes Paul should make in this area. (Word limit: 150) (4 marks) (c) Under the latest changes to the Corporate Governance Code, directors are required to confirm that they have carried out a robust assessment of the principal risks facing the company, including those that would threaten its business model, future performance, solvency or liquidity. Explain what is meant by business risk and give two examples of business risks facing Utopia, explaining why they are risks. (Word limit: 150) (4 marks) Total: 12 marks Question A2 As an auditor, you are interested in audit risk, which is made up of different elements. (a) Describe the different types of risk which make up audit risk (Word limit: 150) (6 marks) (b) Explain the difference between inherent risk and business risk (Word limit: 100) (2 marks) (c) Identify 3 aspects of Utopia which suggests that inherent Risk is high, explaining your answers (Word limit: 150) (6 marks) Total: 14 marks Question A3 You have identified that you wish to focus a significant amount of audit testing on the value of capitalised Research and Development costs in the balance sheet. You remember from your studies that 'blue sky' research costs can never be capitalised and that other R&D can only be capitalised when there is a strong probability that the product will be successful and will generate profits in the future. (a) Which are the key management assertions you will wish to test with regards to capitalised R&D costs? Explain your answer. (Word limit: 200) (6 marks) (b) Briefly describe 4 tests you would do to obtain audit evidence about these assertions (Word limit: 250) (8 marks) Total: 14 marks Section Total: 40 marks