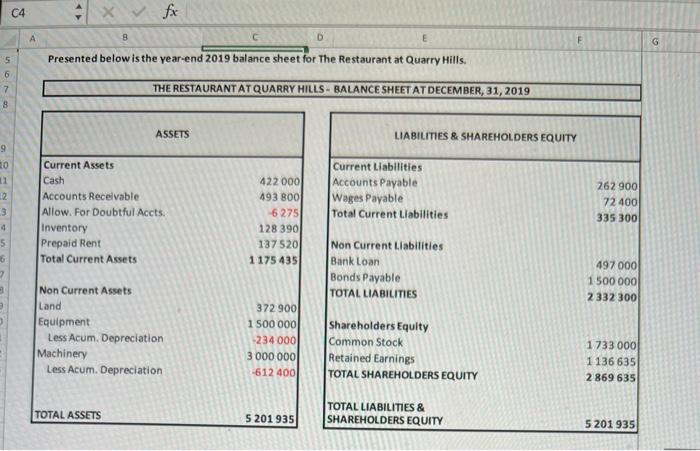

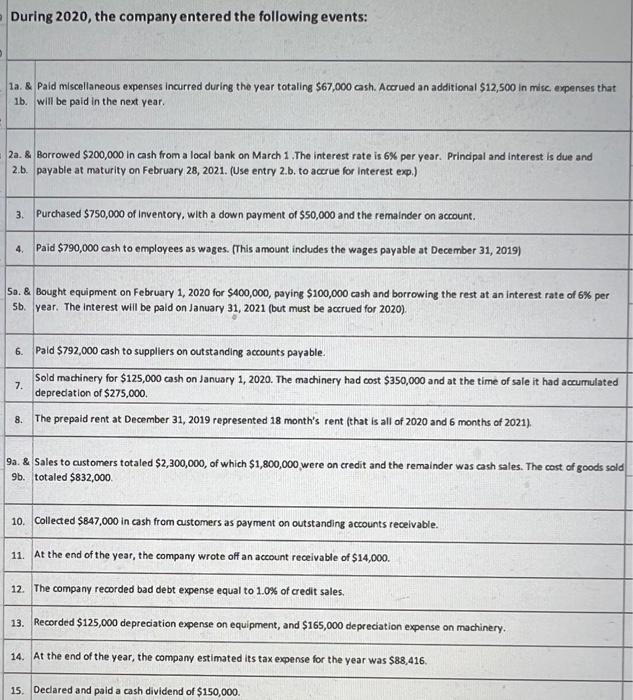

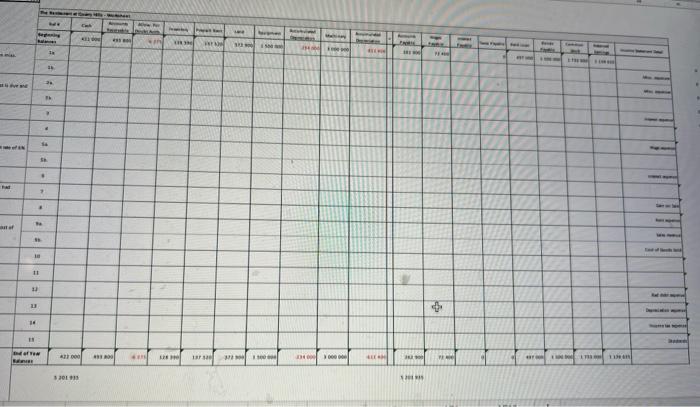

c4 1 x fx 8 D E G 5 Presented below is the year-end 2019 balance sheet for The Restaurant at Quarry Hills. 6 7 THE RESTAURANT AT QUARRY HILLS - BALANCE SHEET AT DECEMBER 31, 2019 8 ASSETS LIABILITIES & SHAREHOLDERS EQUITY 9 30 11 2 3 4 5 Current Assets Cash Accounts Receivable Allow. For Doubtful Accts. Inventory Prepaid Rent Total Current Assets Current Liabilities Accounts Payable Wages Payable Total Current Liabilities 422 000 493 800 6275 128 390 137 520 1175 435 262 900 72 400 335 300 7 Non Current Liabilities Bank Loan Bonds Payable TOTAL LIABILITIES 497 000 1 500 000 2 332 300 Non Current Assets Land Equipment Less Acum. Depreciation Machinery Less Acum. Depreciation 372 900 1 500 000 -234 000 3 000 000 -612 400 shareholders Equity Common Stock Retained Earnings TOTAL SHAREHOLDERS EQUITY 1733 000 1136 635 2 869 635 TOTAL ASSETS TOTAL LIABILITIES & SHAREHOLDERS EQUITY 5 201 935 5 201 935 During 2020, the company entered the following events: 1a. & Paid miscellaneous expenses incurred during the year totaling $67,000 cash. Accrued an additional $12,500 in mise expenses that 1b. will be paid in the next year. 2a. & Borrowed $200,000 in cash from a local bank on March 1. The interest rate is 6% per year. Principal and interest is due and 2.b payable at maturity on February 28, 2021. (Use entry 2.b. to accrue for interest exp) 3. Purchased $750,000 of Inventory, with a down payment of $50,000 and the remainder on account. 4. Paid $790,000 cash to employees as wages. (This amount includes the wages payable at December 31, 2019) 5o. & Bought equipment on February 1, 2020 for $400,000, paying $100,000 cash and borrowing the rest at an interest rate of 6% per 5b. year. The Interest will be paid on January 31, 2021 (but must be accrued for 2020) 6. 7. Pald $792,000 cash to suppllers on outstanding accounts payable. Sold machinery for $125,000 cash on January 1, 2020. The machinery had cost $350,000 and at the time of sale it had accumulated depreciation of $275,000 The prepaid rent at December 31, 2019 represented 18 month's rent (that is all of 2020 and 6 months of 2021), 8. 9a. & Sales to customers totaled $2,300,000, of which $1,800,000 were on credit and the remainder was cash sales. The cost of goods sold 9b. totaled $832,000 10. Collected $847,000 in cash from customers as payment on outstanding accounts receivable. 11. At the end of the year, the company wrote off an account receivable of $14,000. 12. The company recorded bad debt expense equal to 1.0% of credit sales, 13. Recorded $125,000 depreciation expense on equipment, and $165,000 depreciation expense on machinery, 14. At the end of the year, the company estimated its tax expense for the year was $88,416. 15. Declared and paid a cash dividend of $150,000 1 MET LE - OR 000 1373 BE free I an 7 . -- + PF THE PER ! w c4 1 x fx 8 D E G 5 Presented below is the year-end 2019 balance sheet for The Restaurant at Quarry Hills. 6 7 THE RESTAURANT AT QUARRY HILLS - BALANCE SHEET AT DECEMBER 31, 2019 8 ASSETS LIABILITIES & SHAREHOLDERS EQUITY 9 30 11 2 3 4 5 Current Assets Cash Accounts Receivable Allow. For Doubtful Accts. Inventory Prepaid Rent Total Current Assets Current Liabilities Accounts Payable Wages Payable Total Current Liabilities 422 000 493 800 6275 128 390 137 520 1175 435 262 900 72 400 335 300 7 Non Current Liabilities Bank Loan Bonds Payable TOTAL LIABILITIES 497 000 1 500 000 2 332 300 Non Current Assets Land Equipment Less Acum. Depreciation Machinery Less Acum. Depreciation 372 900 1 500 000 -234 000 3 000 000 -612 400 shareholders Equity Common Stock Retained Earnings TOTAL SHAREHOLDERS EQUITY 1733 000 1136 635 2 869 635 TOTAL ASSETS TOTAL LIABILITIES & SHAREHOLDERS EQUITY 5 201 935 5 201 935 During 2020, the company entered the following events: 1a. & Paid miscellaneous expenses incurred during the year totaling $67,000 cash. Accrued an additional $12,500 in mise expenses that 1b. will be paid in the next year. 2a. & Borrowed $200,000 in cash from a local bank on March 1. The interest rate is 6% per year. Principal and interest is due and 2.b payable at maturity on February 28, 2021. (Use entry 2.b. to accrue for interest exp) 3. Purchased $750,000 of Inventory, with a down payment of $50,000 and the remainder on account. 4. Paid $790,000 cash to employees as wages. (This amount includes the wages payable at December 31, 2019) 5o. & Bought equipment on February 1, 2020 for $400,000, paying $100,000 cash and borrowing the rest at an interest rate of 6% per 5b. year. The Interest will be paid on January 31, 2021 (but must be accrued for 2020) 6. 7. Pald $792,000 cash to suppllers on outstanding accounts payable. Sold machinery for $125,000 cash on January 1, 2020. The machinery had cost $350,000 and at the time of sale it had accumulated depreciation of $275,000 The prepaid rent at December 31, 2019 represented 18 month's rent (that is all of 2020 and 6 months of 2021), 8. 9a. & Sales to customers totaled $2,300,000, of which $1,800,000 were on credit and the remainder was cash sales. The cost of goods sold 9b. totaled $832,000 10. Collected $847,000 in cash from customers as payment on outstanding accounts receivable. 11. At the end of the year, the company wrote off an account receivable of $14,000. 12. The company recorded bad debt expense equal to 1.0% of credit sales, 13. Recorded $125,000 depreciation expense on equipment, and $165,000 depreciation expense on machinery, 14. At the end of the year, the company estimated its tax expense for the year was $88,416. 15. Declared and paid a cash dividend of $150,000 1 MET LE - OR 000 1373 BE free I an 7 . -- + PF THE PER ! w