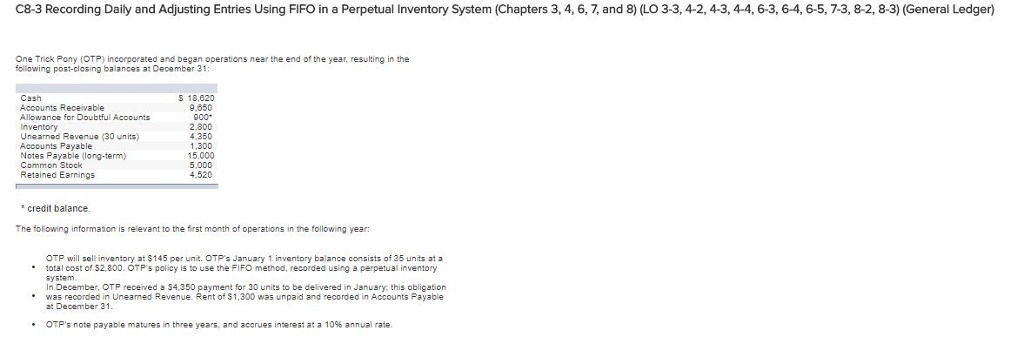

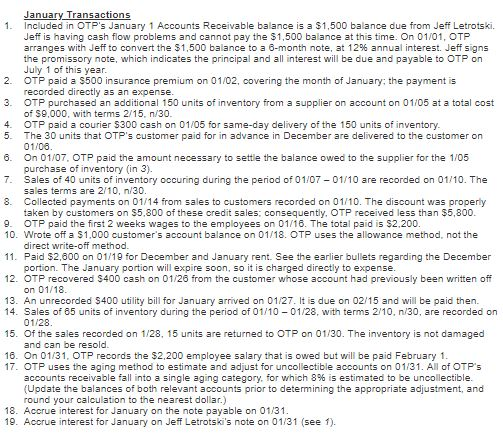

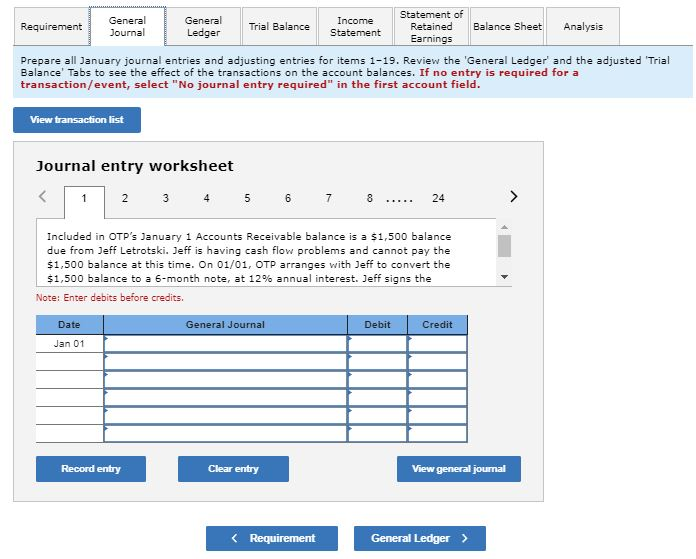

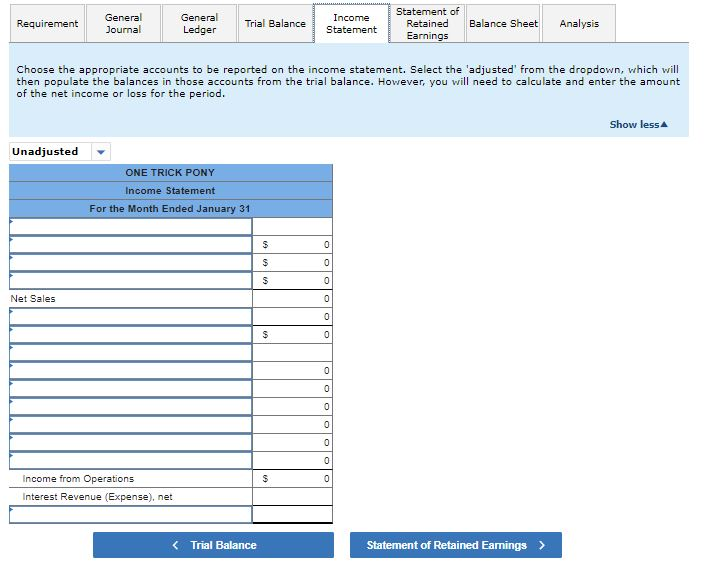

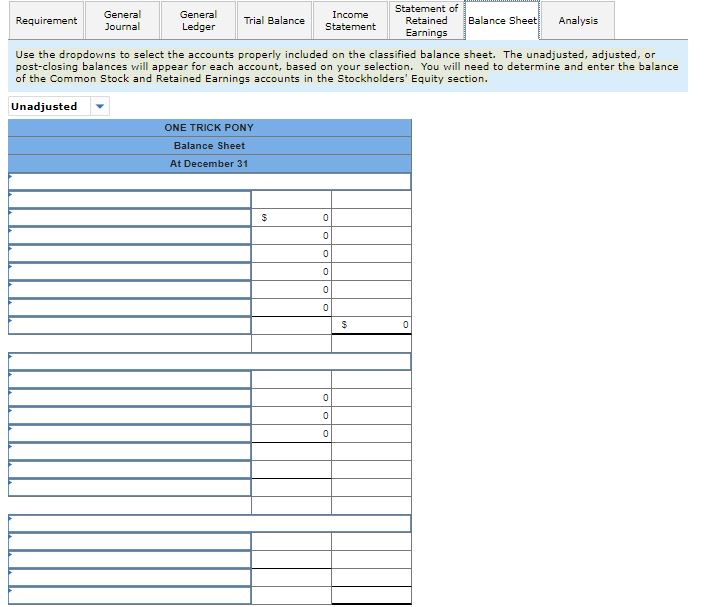

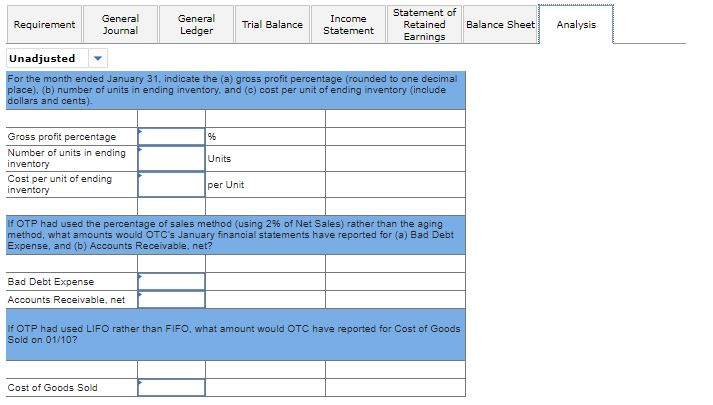

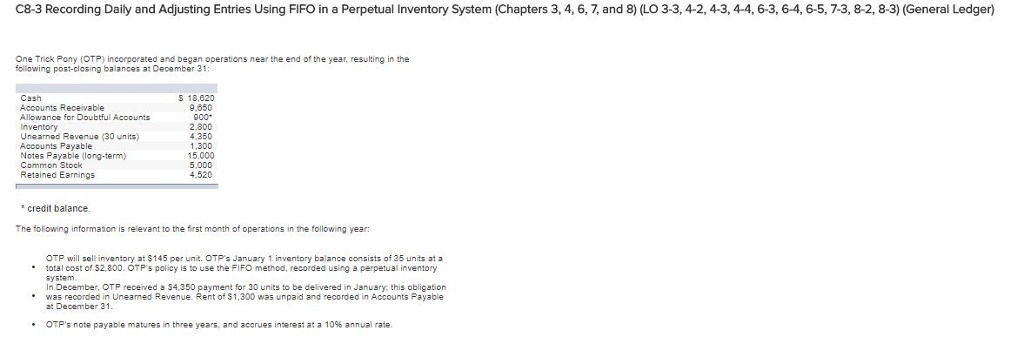

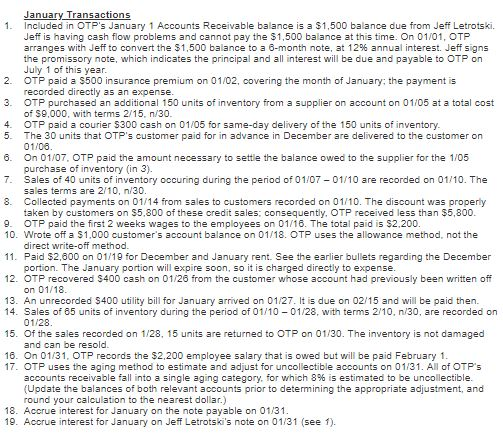

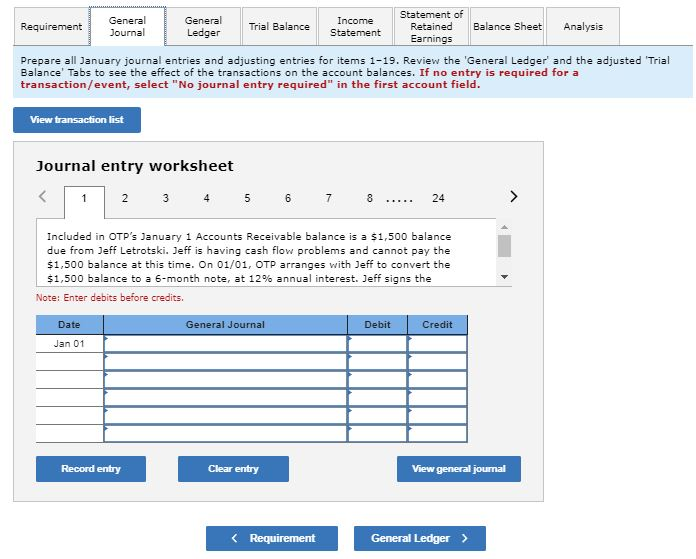

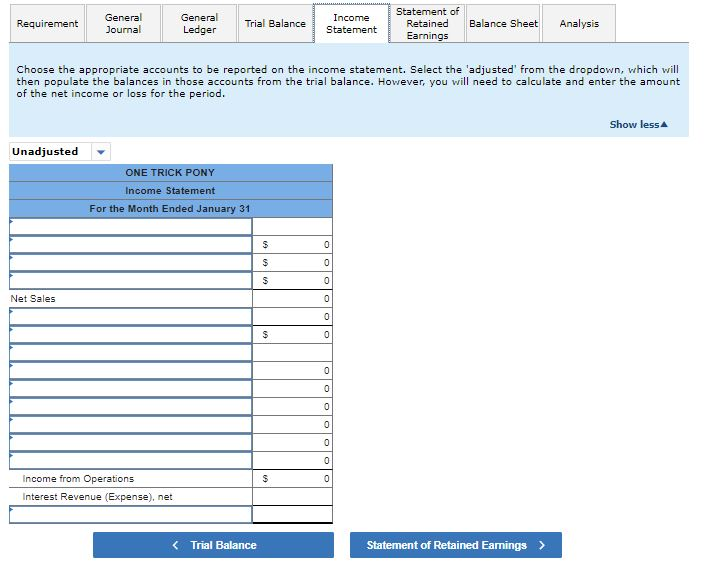

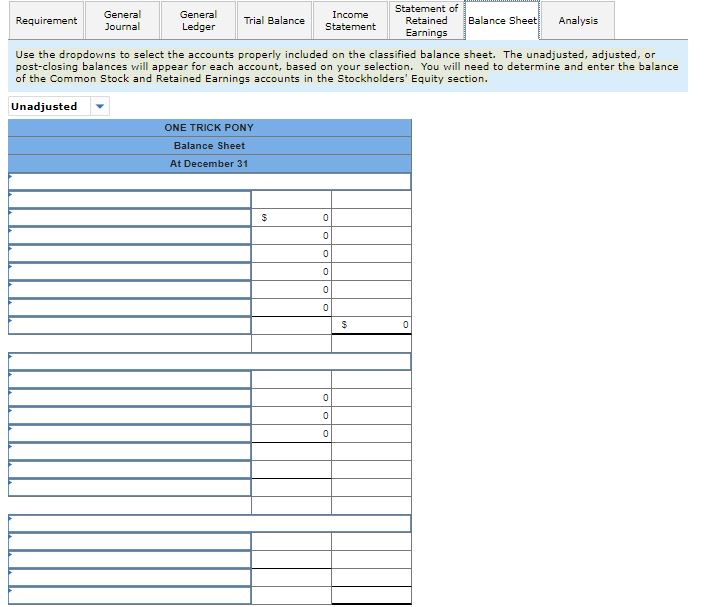

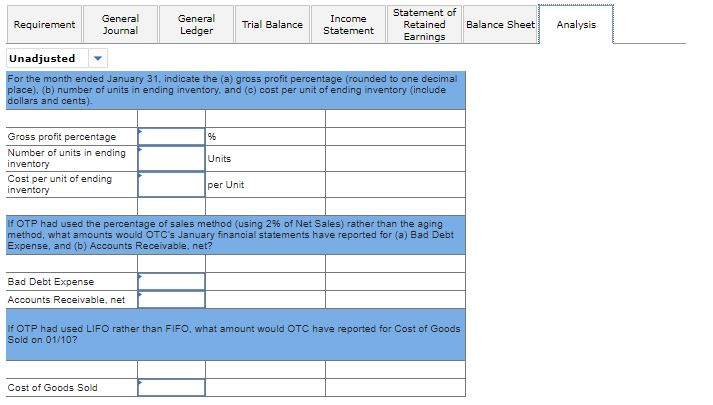

C8-3 Recording Daily and Adjusting Entries Using FIFO in a Perpetual Inventory System (Chapters 3, 4, 6,7, and 8) (LO 3-3, 4-2, 4-3, 4-4, 6-3, 6-4, 6-5, 7-3, 8-2, 8-3) (General Ledger) One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post-closing balances at Decamber 3f Cash S 18,620 .650 Allowance for Doubtful Acoounts Inventory Unearned Revenue (30 units) Accounts Payable Notes Payable (long-term) Common Stock Retained Earnings 2.800 4.350 1,300 15.000 5,000 4.520 " credit balance The fol owing information is relevant to the first month of operations in the following year OTP will sell inventory at $145 per unit. OTP's January 1 inventory balance consists of 35 units at a total cost of S2.800. OTP's policy is to use the FIFO method, recorded using a perpetual inventory ystem In December, OTP received $4,350 payment for 30 units to be delivered in January this obligation . * was recorded in Unearned Revenue. Rent of $1,300 was unpaid and recorded in Accounts Payable at December 31 OTP's note payable matures in three years, and accrues inerest at a 10% annual rate C8-3 Recording Daily and Adjusting Entries Using FIFO in a Perpetual Inventory System (Chapters 3, 4, 6,7, and 8) (LO 3-3, 4-2, 4-3, 4-4, 6-3, 6-4, 6-5, 7-3, 8-2, 8-3) (General Ledger) One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post-closing balances at Decamber 3f Cash S 18,620 .650 Allowance for Doubtful Acoounts Inventory Unearned Revenue (30 units) Accounts Payable Notes Payable (long-term) Common Stock Retained Earnings 2.800 4.350 1,300 15.000 5,000 4.520 " credit balance The fol owing information is relevant to the first month of operations in the following year OTP will sell inventory at $145 per unit. OTP's January 1 inventory balance consists of 35 units at a total cost of S2.800. OTP's policy is to use the FIFO method, recorded using a perpetual inventory ystem In December, OTP received $4,350 payment for 30 units to be delivered in January this obligation . * was recorded in Unearned Revenue. Rent of $1,300 was unpaid and recorded in Accounts Payable at December 31 OTP's note payable matures in three years, and accrues inerest at a 10% annual rate