Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CA Company is established on 1/1/2XX1 and 2XX1 is the first year of operation for CA Company. Based on the information provided below, please

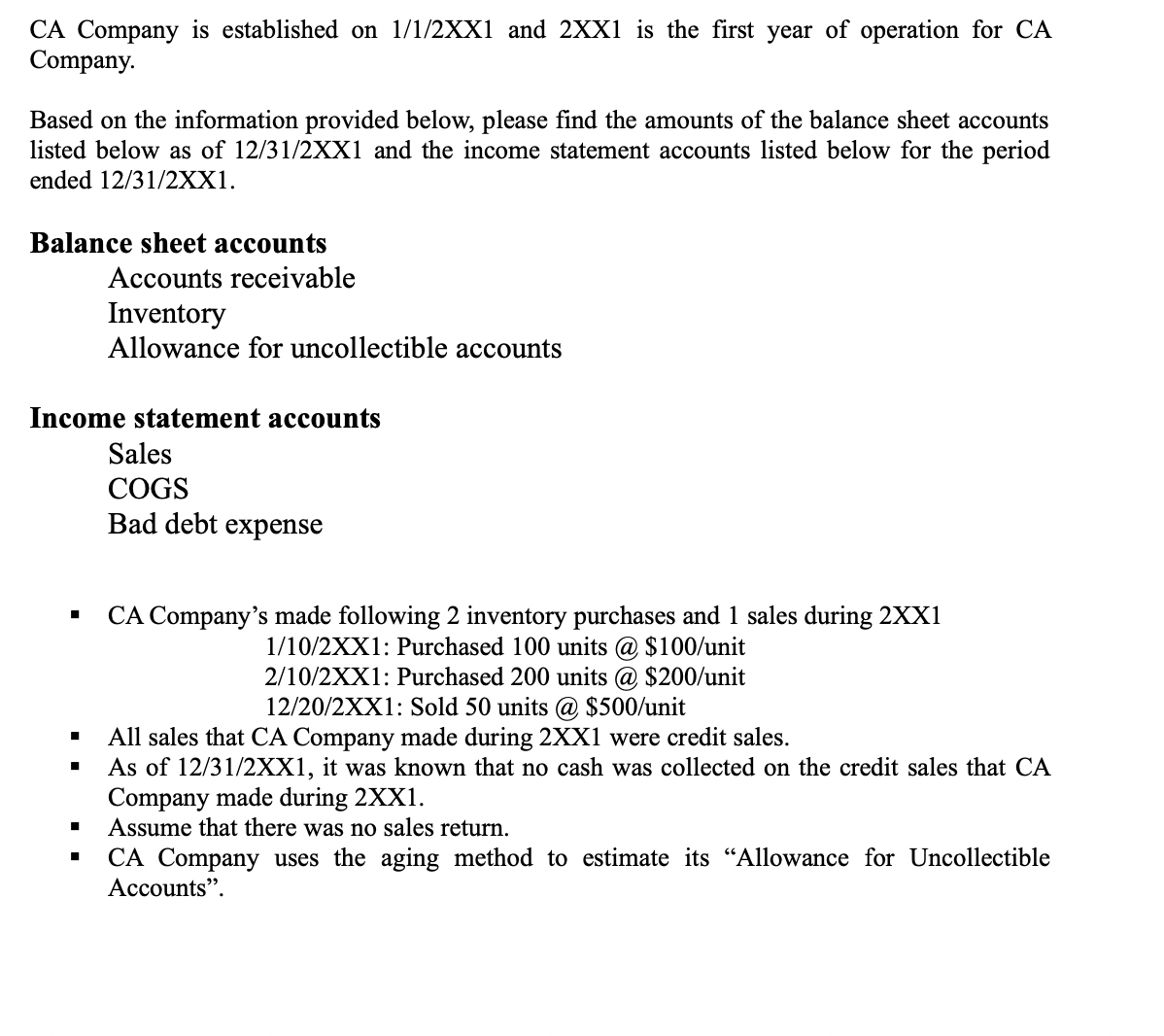

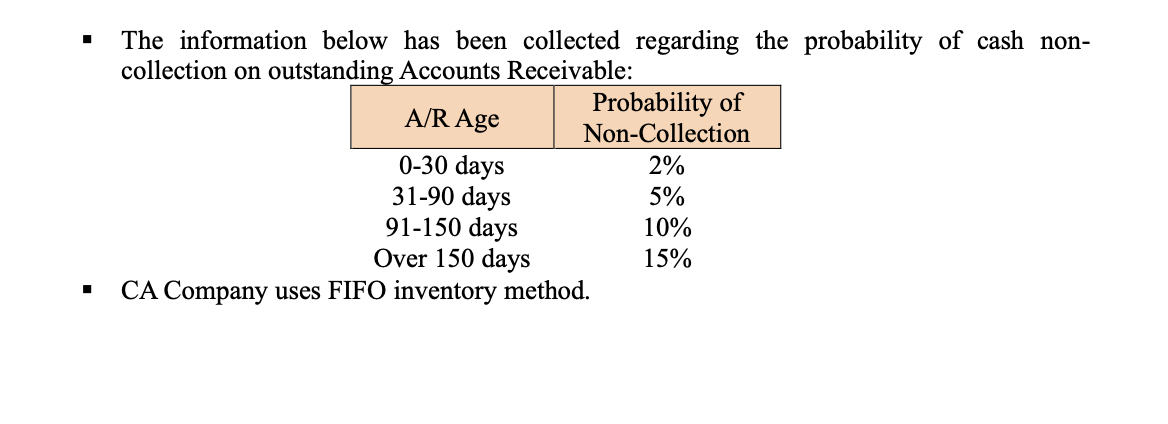

CA Company is established on 1/1/2XX1 and 2XX1 is the first year of operation for CA Company. Based on the information provided below, please find the amounts of the balance sheet accounts listed below as of 12/31/2XX1 and the income statement accounts listed below for the period ended 12/31/2XX1. Balance sheet accounts Accounts receivable Inventory Allowance for uncollectible accounts Income statement accounts Sales COGS Bad debt expense CA Company's made following 2 inventory purchases and 1 sales during 2XX1 1/10/2XX1: Purchased 100 units @ $100/unit 2/10/2XX1: Purchased 200 units @ $200/unit 12/20/2XX1: Sold 50 units @ $500/unit All sales that CA Company made during 2XX1 were credit sales. As of 12/31/2XX1, it was known that no cash was collected on the credit sales that CA Company made during 2XX1. Assume that there was no sales return. CA Company uses the aging method to estimate its "Allowance for Uncollectible Accounts". The information below has been collected regarding the probability of cash non- collection on outstanding Accounts Receivable: Probability of Non-Collection A/R Age 0-30 days 2% 31-90 days 5% 91-150 days 10% 15% Over 150 days CA Company uses FIFO inventory method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started