Question

CA Limited (CA) has a financial year ends on each 31 March. Closing inventory was $750,000 as at 31 March 2020. Inventory turnover was 2.43

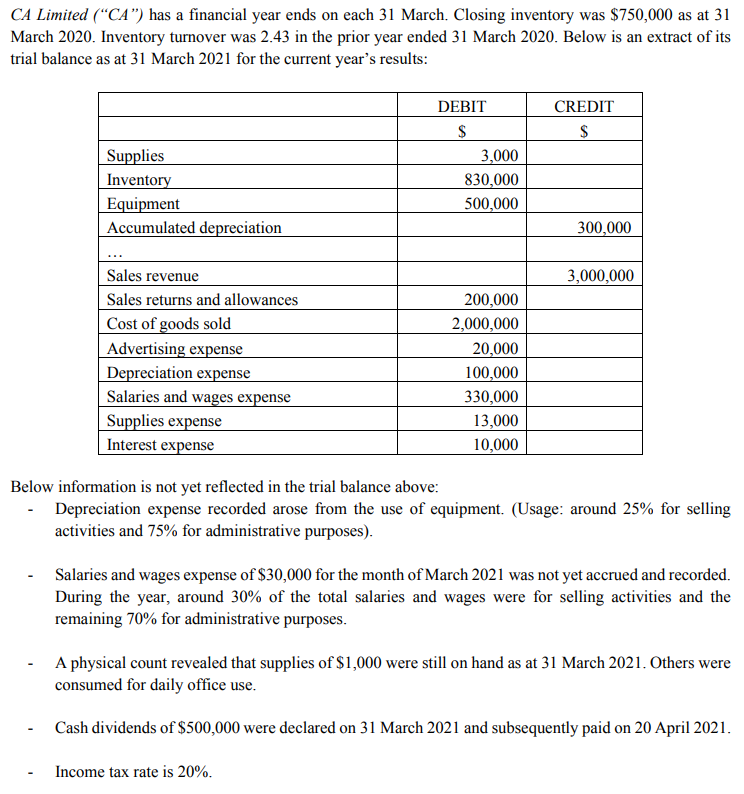

CA Limited (CA) has a financial year ends on each 31 March. Closing inventory was $750,000 as at 31 March 2020. Inventory turnover was 2.43 in the prior year ended 31 March 2020. Below is an extract of its trial balance as at 31 March 2021 for the current years results:

Required:

(a) Prepare all the adjusting entries required for the year ended 31 March 2021. (8 marks)

(b) Prepare the statement of profit or loss for the year. (22 marks)

(c) Calculate the inventory turnover and evaluate CAs management efficiency in the year. (8 marks)

In part (c) of this question, round your answers to two decimal places in amount / dollar / percentage (if applicable)

CA Limited (CA) has a financial year ends on each 31 March. Closing inventory was $750,000 as at 31 March 2020. Inventory turnover was 2.43 in the prior year ended 31 March 2020. Below is an extract of its trial balance as at 31 March 2021 for the current year's results: CREDIT $ Supplies Inventory Equipment Accumulated depreciation DEBIT $ 3,000 830,000 500,000 300,000 3,000,000 Sales revenue Sales returns and allowances Cost of goods sold Advertising expense Depreciation expense Salaries and wages expense Supplies expense Interest expense 200,000 2,000,000 20,000 100,000 330,000 13,000 10,000 Below information is not yet reflected in the trial balance above: Depreciation expense recorded arose from the use of equipment. (Usage: around 25% for selling activities and 75% for administrative purposes). Salaries and wages expense of $30,000 for the month of March 2021 was not yet accrued and recorded. During the year, around 30% of the total salaries and wages were for selling activities and the remaining 70% for administrative purposes. A physical count revealed that supplies of $1,000 were still on hand as at 31 March 2021. Others were consumed for daily office use. Cash dividends of $500,000 were declared on 31 March 2021 and subsequently paid on 20 April 2021. Income tax rate is 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started