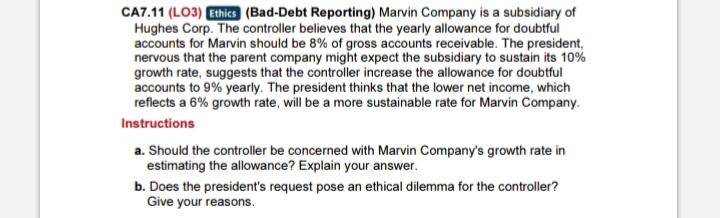

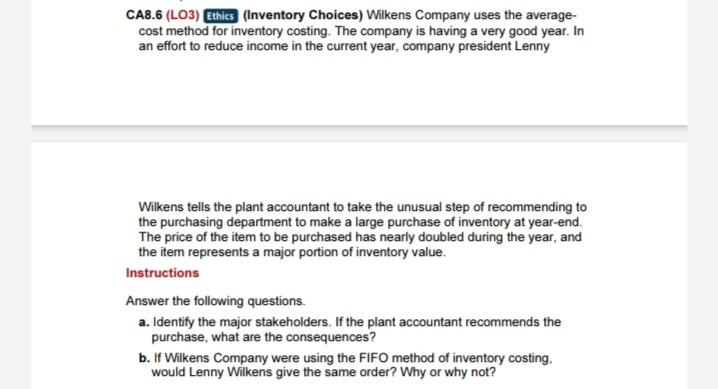

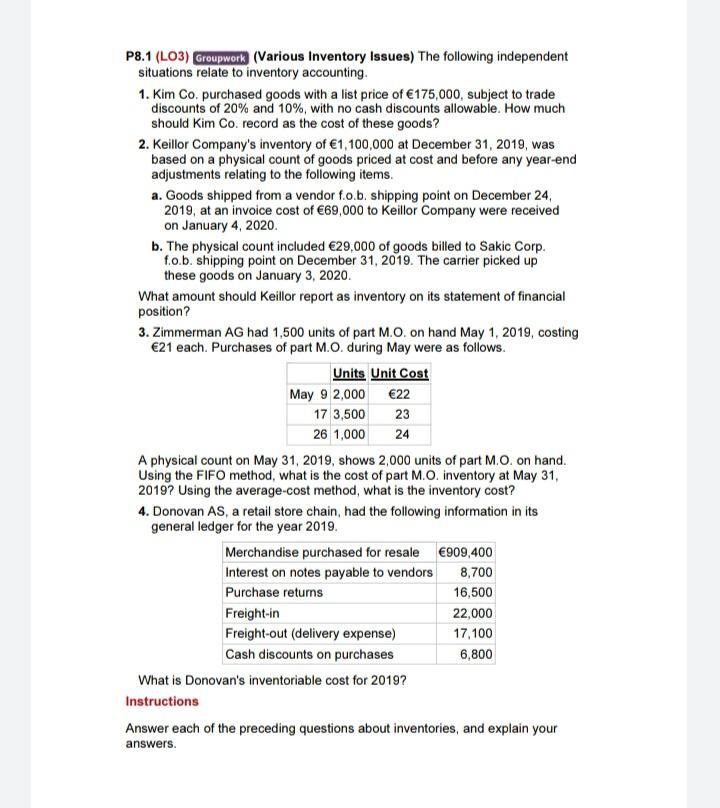

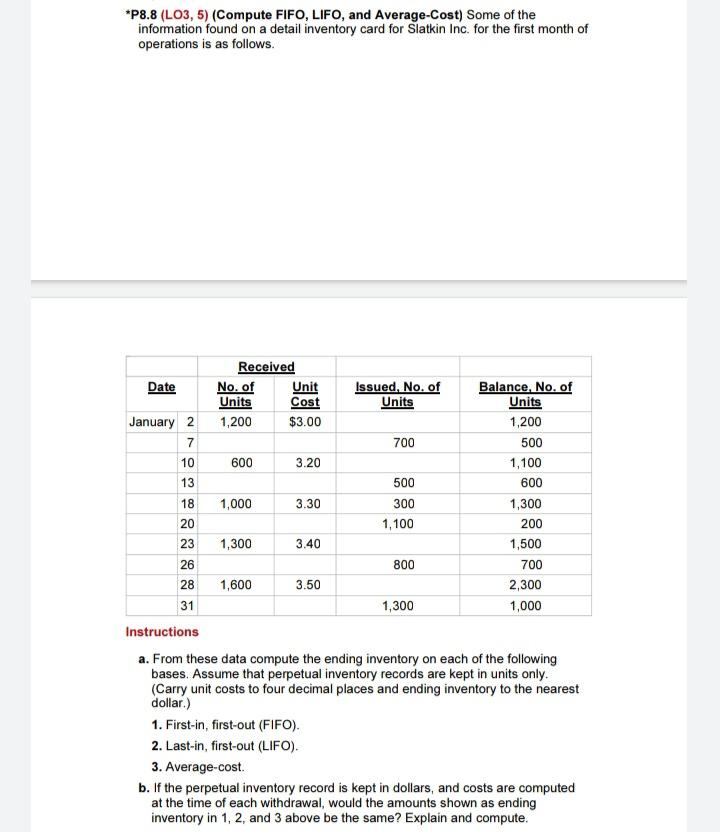

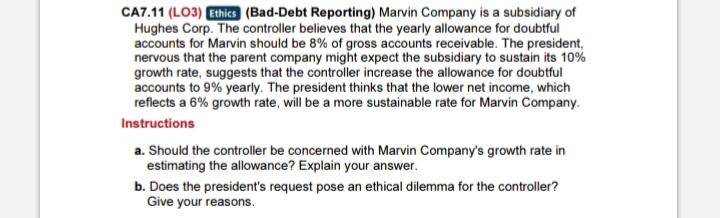

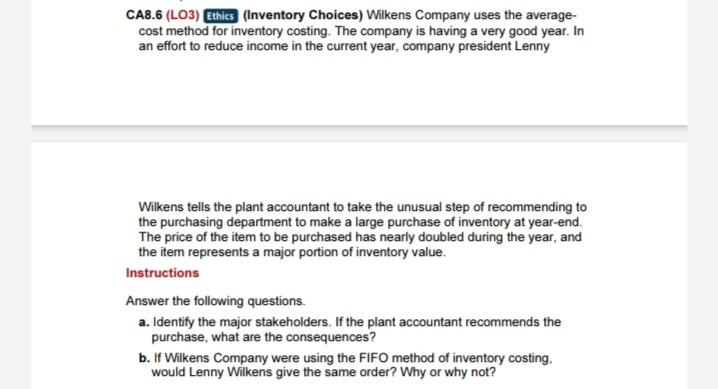

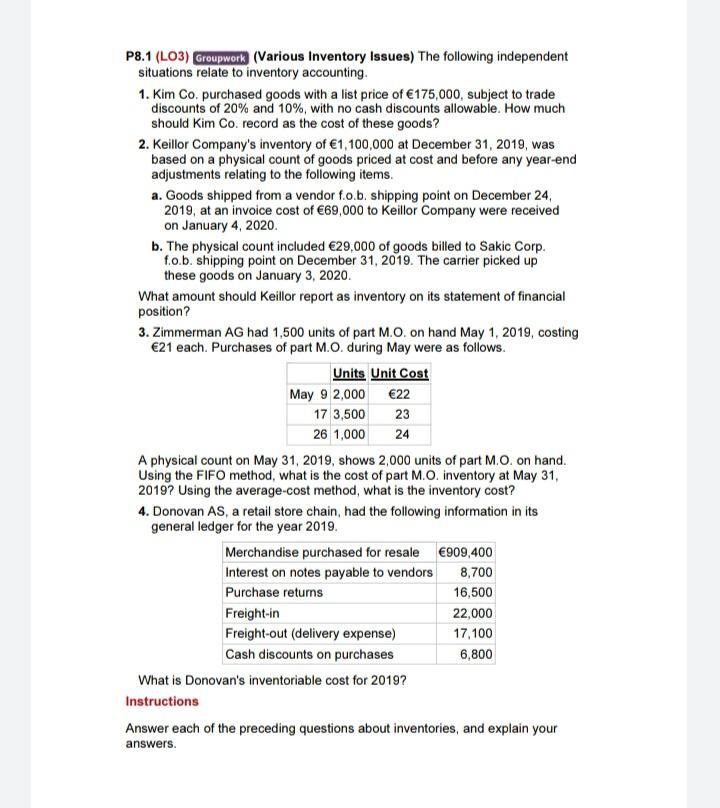

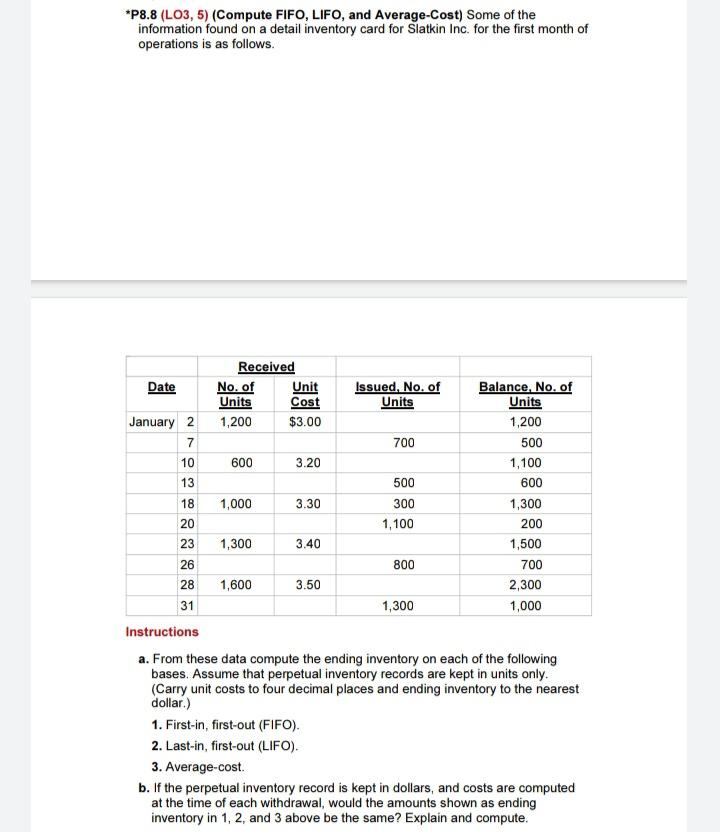

CA7.11 (L03) Ethics (Bad-Debt Reporting) Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. The president, nervous that the parent company might expect the subsidiary to sustain its 10% growth rate, suggests that the controller increase the allowance for doubtful accounts to 9% yearly. The president thinks that the lower net income, which reflects a 6% growth rate, will be a more sustainable rate for Marvin Company. Instructions a. Should the controller be concerned with Marvin Company's growth rate in estimating the allowance? Explain your answer. b. Does the president's request pose an ethical dilemma for the controller? Give your reasons. CA8.6 (L03) Ethics (Inventory Choices) Wilkens Company uses the average- cost method for inventory costing. The company is having a very good year. In an effort to reduce income in the current year, company president Lenny Wilkens tells the plant accountant to take the unusual step of recommending to the purchasing department to make a large purchase of inventory at year-end. The price of the item to be purchased has nearly doubled during the year, and the item represents a major portion of inventory value. Instructions Answer the following questions. a. Identify the major stakeholders. If the plant accountant recommends the purchase, what are the consequences? b. If Wilkens Company were using the FIFO method of inventory costing, would Lenny Wilkens give the same order? Why or why not? P8.1 (L03) Groupwork (Various Inventory Issues) The following independent situations relate to inventory accounting. 1. Kim Co. purchased goods with a list price of 175,000, subject to trade discounts of 20% and 10%, with no cash discounts allowable. How much should Kim Co. record as the cost of these goods? 2. Keillor Company's inventory of 1,100,000 at December 31, 2019, was based on a physical count of goods priced at cost and before any year-end adjustments relating to the following items. a. Goods shipped from a vendor fo.b. shipping point on December 24, 2019, at an invoice cost of 69,000 to Keillor Company were received on January 4, 2020. b. The physical count included 29,000 of goods billed to Sakic Corp. f.o.b. shipping point on December 31, 2019. The carrier picked up these goods on January 3, 2020. What amount should Keillor report as inventory on its statement of financial position? 3. Zimmerman AG had 1,500 units of part M.O. on hand May 1, 2019, costing 21 each. Purchases of part M.O. during May were as follows. Units Unit Cost May 9 2,000 22 17 3,500 23 26 1,000 24 A physical count on May 31, 2019, shows 2,000 units of part M.O. on hand. Using the FIFO method, what is the cost of part M.O. inventory at May 31, 2019? Using the average-cost method, what is the inventory cost? 4. Donovan AS, a retail store chain, had the following information in its general ledger for the year 2019. Merchandise purchased for resale 909,400 Interest on notes payable to vendors 8,700 Purchase returns 16,500 Freight-in 22,000 Freight-out (delivery expense) 17,100 Cash discounts on purchases 6,800 What is Donovan's inventoriable cost for 2019? Instructions Answer each of the preceding questions about inventories, and explain your answers. *P8.8 (LO3, 5) (Compute FIFO, LIFO, and Average-Cost) Some of the information found on a detail inventory card for Slatkin Inc. for the first month of operations is as follows. Received Date No. of Unit Issued, No. of Balance No. of Units Cost Units Units January 2 1,200 $3.00 1,200 7 700 500 10 600 3.20 1,100 13 500 600 18 1,000 3.30 300 1,300 20 1,100 200 23 1,300 3.40 1,500 26 800 700 28 1,600 3.50 2,300 31 1,300 1,000 Instructions a. From these data compute the ending inventory on each of the following bases. Assume that perpetual inventory records are kept in units only. (Carry unit costs to four decimal places and ending inventory to the nearest dollar.) 1. First-in, first-out (FIFO). 2. Last-in, first-out (LIFO). 3. Average-cost b. If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, would the amounts shown as ending inventory in 1, 2, and 3 above be the same? Explain and compute. CA7.11 (L03) Ethics (Bad-Debt Reporting) Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. The president, nervous that the parent company might expect the subsidiary to sustain its 10% growth rate, suggests that the controller increase the allowance for doubtful accounts to 9% yearly. The president thinks that the lower net income, which reflects a 6% growth rate, will be a more sustainable rate for Marvin Company. Instructions a. Should the controller be concerned with Marvin Company's growth rate in estimating the allowance? Explain your answer. b. Does the president's request pose an ethical dilemma for the controller? Give your reasons. CA8.6 (L03) Ethics (Inventory Choices) Wilkens Company uses the average- cost method for inventory costing. The company is having a very good year. In an effort to reduce income in the current year, company president Lenny Wilkens tells the plant accountant to take the unusual step of recommending to the purchasing department to make a large purchase of inventory at year-end. The price of the item to be purchased has nearly doubled during the year, and the item represents a major portion of inventory value. Instructions Answer the following questions. a. Identify the major stakeholders. If the plant accountant recommends the purchase, what are the consequences? b. If Wilkens Company were using the FIFO method of inventory costing, would Lenny Wilkens give the same order? Why or why not? P8.1 (L03) Groupwork (Various Inventory Issues) The following independent situations relate to inventory accounting. 1. Kim Co. purchased goods with a list price of 175,000, subject to trade discounts of 20% and 10%, with no cash discounts allowable. How much should Kim Co. record as the cost of these goods? 2. Keillor Company's inventory of 1,100,000 at December 31, 2019, was based on a physical count of goods priced at cost and before any year-end adjustments relating to the following items. a. Goods shipped from a vendor fo.b. shipping point on December 24, 2019, at an invoice cost of 69,000 to Keillor Company were received on January 4, 2020. b. The physical count included 29,000 of goods billed to Sakic Corp. f.o.b. shipping point on December 31, 2019. The carrier picked up these goods on January 3, 2020. What amount should Keillor report as inventory on its statement of financial position? 3. Zimmerman AG had 1,500 units of part M.O. on hand May 1, 2019, costing 21 each. Purchases of part M.O. during May were as follows. Units Unit Cost May 9 2,000 22 17 3,500 23 26 1,000 24 A physical count on May 31, 2019, shows 2,000 units of part M.O. on hand. Using the FIFO method, what is the cost of part M.O. inventory at May 31, 2019? Using the average-cost method, what is the inventory cost? 4. Donovan AS, a retail store chain, had the following information in its general ledger for the year 2019. Merchandise purchased for resale 909,400 Interest on notes payable to vendors 8,700 Purchase returns 16,500 Freight-in 22,000 Freight-out (delivery expense) 17,100 Cash discounts on purchases 6,800 What is Donovan's inventoriable cost for 2019? Instructions Answer each of the preceding questions about inventories, and explain your answers. *P8.8 (LO3, 5) (Compute FIFO, LIFO, and Average-Cost) Some of the information found on a detail inventory card for Slatkin Inc. for the first month of operations is as follows. Received Date No. of Unit Issued, No. of Balance No. of Units Cost Units Units January 2 1,200 $3.00 1,200 7 700 500 10 600 3.20 1,100 13 500 600 18 1,000 3.30 300 1,300 20 1,100 200 23 1,300 3.40 1,500 26 800 700 28 1,600 3.50 2,300 31 1,300 1,000 Instructions a. From these data compute the ending inventory on each of the following bases. Assume that perpetual inventory records are kept in units only. (Carry unit costs to four decimal places and ending inventory to the nearest dollar.) 1. First-in, first-out (FIFO). 2. Last-in, first-out (LIFO). 3. Average-cost b. If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, would the amounts shown as ending inventory in 1, 2, and 3 above be the same? Explain and compute