Answered step by step

Verified Expert Solution

Question

1 Approved Answer

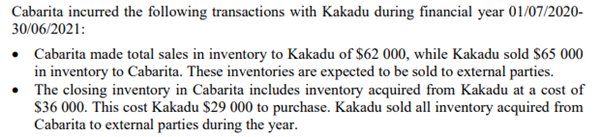

Cabarita incurred the following transactions with Kakadu during financial year 01/07/2020- 30/06/2021: Cabarita made total sales in inventory to Kakadu of $62 000, while Kakadu

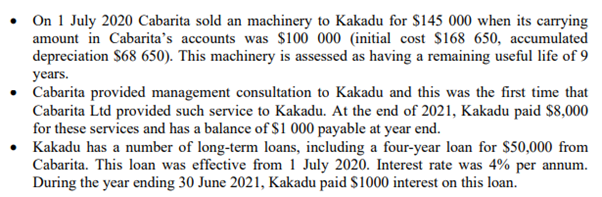

Cabarita incurred the following transactions with Kakadu during financial year 01/07/2020- 30/06/2021: Cabarita made total sales in inventory to Kakadu of $62 000, while Kakadu sold $65 000 in inventory to Cabarita. These inventories are expected to be sold to external parties. The closing inventory in Cabarita includes inventory acquired from Kakadu at a cost of $36 000. This cost Kakadu $29 000 to purchase. Kakadu sold all inventory acquired from Cabarita to external parties during the year. On 1 July 2020 Cabarita sold an machinery to Kakadu for $145 000 when its carrying amount in Cabarita's accounts was $100 000 (initial cost $168 650, accumulated depreciation $68 650). This machinery is assessed as having a remaining useful life of 9 years. Cabarita provided management consultation to Kakadu and this was the first time that Cabarita Ltd provided such service to Kakadu. At the end of 2021, Kakadu paid $8,000 for these services and has a balance of $1 000 payable at year end. Kakadu has a number of long-term loans, including a four-year loan for $50,000 from Cabarita. This loan was effective from 1 July 2020. Interest rate was 4% per annum. During the year ending 30 June 2021, Kakadu paid $1000 interest on this loan. You were requested to prepare the followings: III. adjustment/elimination journal entries for consolidation as at 30 June 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started