Answered step by step

Verified Expert Solution

Question

1 Approved Answer

) Cabell Corp. bonds pay an annual coupon rate of 10%. If the marginal investors' expected rate of return is now 12% on these bonds,

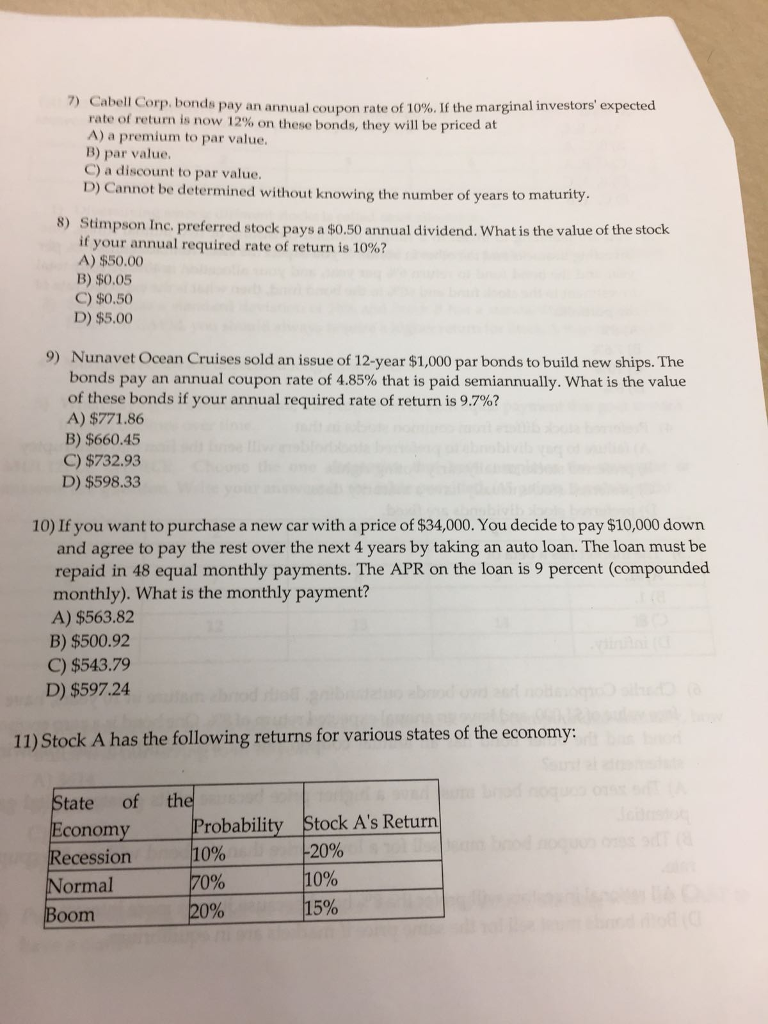

) Cabell Corp. bonds pay an annual coupon rate of 10%. If the marginal investors' expected rate of return is now 12% on these bonds, they will be priced at A) a premium to par value. B) par value. C) a discount to par value. D) Cannot be determined without knowing the number of years to matu rity 8) Stimpson Inc. preferred stock pays a s0.50 annual dividend. What is the value of the stock if your annual required rate of return is 10%? A) $50.00 B) $0.05 C) $0.50 D) $5.00 9) Nunavet Ocean Cruises sold an issue of 12-year $1,000 par bonds to build new ships. The bonds pay an annual coupon rate of 4.85% that is paid semiannually. What is the value of these bonds if your annual required rate of return is 9.7%? A) $771.86 B) $660.45 C) $732.93 D) $598.33 10) If you want to purchase a new car with a price of $34,000. You decide to pay $10,000 down and agree to pay the rest over the next 4 years by taking an auto loan. The loan must be repaid in 48 equal monthly payments. The APR on the loan is 9 percent (compounded monthly). What is the monthly payment? A) $563.82 B) $500.92 C) $543.79 D) $597.24 11) Stock A has the following returns for various states of the economy: State of the Economy Recession Normal oom Stock A's Return Probability 10% 0% 20% 20% 10% 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started