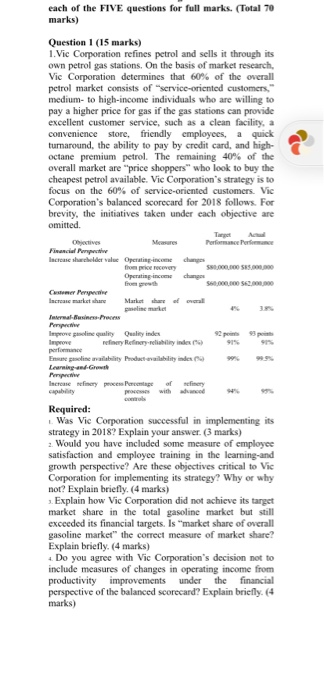

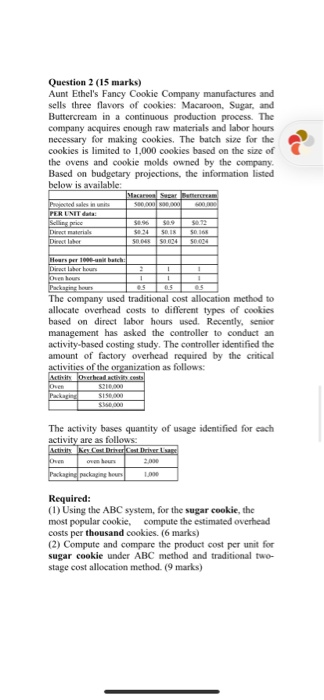

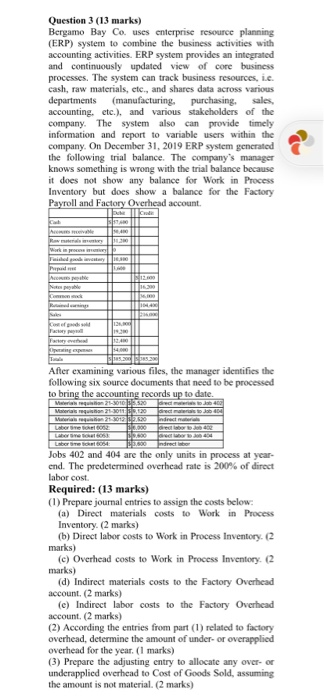

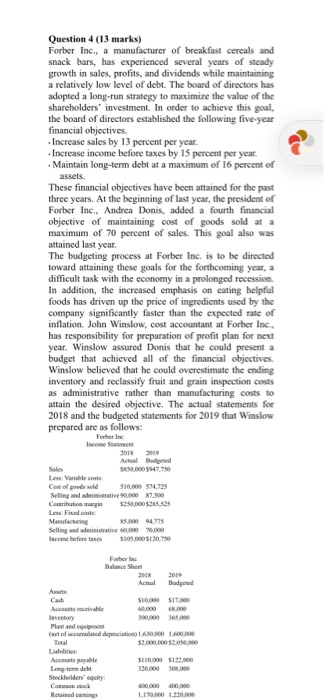

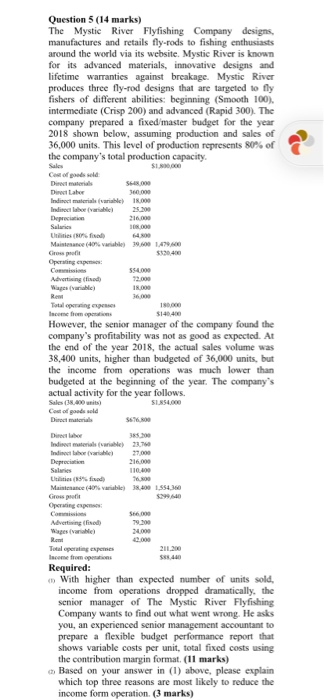

cach of the FIVE questions for full marks. (Total 70 marks) Question 1 (15 marks) 1. Vic Corporation refines petrol and sells it through its own petrol gas stations. On the basis of market research, Vic Corporation determines that 60% of the overall petrol market consists of service-oriented customers," medium- to high-income individuals who are willing to pay a higher price for gas if the gas stations can provide excellent customer service, such as a clean facility, a convenience store, friendly cmployees, a quick turnaround, the ability to pay by credit card, and high- octane premium petrol. The remaining 40% of the overall market are "price shoppers" who look to buy the cheapest petrol available. Vic Corporation's strategy is to focus on the 60% of service-oriented customers. Vic Corporation's balanced scorecard for 2018 follows. For brevity, the initiatives taken under cach objective are omitted. Performer Finci Pomposite Increase solder value Operating-ancome changes from price every Operating income changes Customer Increme market share Market share of all peline market Pont Improve geneline quality Quality index Improve refinery Referably index Enware paneline wailability Product availability index: 10 Learning Pot Increase refinery procese of winery process with me Required: Was Vic Corporation successful in implementing its strategy in 2018? Explain your answer. (3 marks) 2. Would you have included some measure of employee satisfaction and employee training in the learning and growth perspective? Are these objectives critical to Vic Corporation for implementing its strategy? Why or why nor? Explain briefly (4 marks) 1. Explain how Vic Corporation did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is market share of overall gasoline market" the correct measure of market share? Explain briefly (4 marks) 4. Do you agree with Vic Corporation's decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced Scorecard? Explain briefly. (4 marks) Question 2 (15 marks) Aunt Ethel's Fancy Cookie Company manufactures and sells three flavors of cookies: Macaroon, Sugar, and Buttercream in a continuous production process. The company acquires enough raw materials and labor hours necessary for making cookies. The batch size for the cookies is limited to 1,000 cookies based on the size of the ovens and cookie molds owned by the company Based on budgetary projections, the information listed below is available: Macera Sugar Projected sales in this 500.000,00 PER UNIT data: Selling price Dia Dilber 5034 S. SO IN S034 S01 50.004 1 Hears per 1000-batch Direct laber hours 2 1 Oven hours 1 Packaging hours The company used traditional cost allocation method to allocate overhead costs to different types of cookies based on direct labor hours used. Recently, senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: Acthy Osthad the costs Oven $210.000 SISO,000 The activity bases quantity of usage identified for each activity are as follows: Actinuity Oven Packagind packaging Required: (1) Using the ABC system, for the sugar cookie, the most popular cookie, compute the estimated overhead costs per thousand cookies. (6 marks) (2) Compute and compare the product cost per unit for sugar cookie under ABC method and traditional two- stage cost allocation method. (9 marks) Question 3 (13 marks) Bergamo Bay Co. uses enterprise resource planning (ERP) system to combine the business activities with accounting activities. ERP system provides an integrated and continuously updated view of core business processes. The system can track business resources, i.c. cash, raw materials, etc., and shares data across various departments (manufacturing, purchasing, sales, accounting, etc.), and various stakeholders of the company. The system also can provide timely information and report to variable users within the company. On December 31, 2019 ERP system generated the following trial balance. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work in Process Inventory but does show a balance for the Factory Payroll and Factory Overhead account. 13 in proces aidai Papas After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date. Material regulation 2010 10 Sec. Materials requis - O Sem 3600 Indirect were borR borse 2: directo Cabernet Jobs 402 and 404 are the only units in process at year end. The predetermined overhead rate is 200% of direct labor cost. Required: (13 marks) (I) Prepare journal entries to assign the costs below: (a) Direct materials costs to Work in Process Inventory. (2 marks) (6) Direct labor costs to Work in Process Inventory (2 marks) (C) Overhead costs to Work in Process Inventory (2 marks) (d) Indirect materials costs to the Factory Overhead account. (2 marks) (e) Indirect labor costs to the Factory Overhead account. (2 marks) (2) According the entries from part (1) related to factory overhead, determine the amount of under-or overapplied overhead for the year. (1 marks) (3) Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. (2 marks) Question 4 (13 marks) Forber Inc., a manufacturer of breakfast cereals and snack bars, has experienced several years of steady growth in sales, profits, and dividends while maintaining a relatively low level of debt. The board of directors has adopted a long-run strategy to maximize the value of the shareholders' investment. In order to achieve this goal, the board of directors established the following five-year financial objectives. Increase sales by 13 percent per year. Increase income before taxes by 15 percent per year. Maintain long-term debt at a maximum of 16 percent of assets. These financial objectives have been attained for the past three years. At the beginning of last year, the president of Forber Inc., Andrea Donis, added a fourth financial objective of maintaining cost of goods sold at a maximum of 70 percent of sales. This goal also was attained last year. The budgeting process at Forber Inc. is to be directed toward attaining these goals for the forthcoming year, a difficult task with the economy in a prolonged recession. In addition, the increased emphasis on eating helpful foods has driven up the price of ingredients used by the company significantly faster than the expected rate of inflation. John Winslow, cost accountant at Forber Inc., has responsibility for preparation of profit plan for next year. Winslow assured Donis that he could present a budget that achieved all of the financial objectives. Winslow believed that he could overestimate the ending inventory and reclassify fruit and grain inspection costs as administrative rather than manufacturing costs to attain the desired objective. The actual statements for 2018 and the budgeted statements for 2019 that Winslow prepared are as follows: Forberin 2018 2019 Actul Budgeted Sales Lese: Variable costs Cost of goods sold 510.000 $74,735 Selling and 7.500 Contribution margin 350,000 25.585 Les Finest Manufacturing Selling and administrative 0000 70.000 Income before and $10.00 $130.750 Forbere Balance Sheet 2013 Actual Bled $10.000 $17.000 60.000.000 300,000 365.000 Plast and set of mod depreciation 1000 100 Accounts payable Long-term dicht Stockholders' equilty S110.000 $122.000 320.000 300.000 200.000 400.000 1.170,000 1,220,000 Question 5 (14 marks) The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, innovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100). intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity Sales $1.800.000 Cost of goods sold Diret materials Direct Labor 360.000 Indirect material (variable) 18.000 Depreciation Salari Utilities (80find Maintenance (40% vaible) 39.00 149.00 $320,400 : Commi 55-4000 Advertising finde 18.000 Rew Totalpring However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows. Sales (38.000 units Cost of goods sold Indirect materials (variable) 23.760 Depreciation 216.000 Salaries 110.000 Maintenance (40% variabile) 38.400 1.554,360 Groupe Operating expenses Advertising find 2000 Totalpring expenses 211.200 Income from operations Required: With higher than expected number of units sold, income from operations dropped dramatically, the senior manager of The Mystic River Flyfishing Company wants to find out what went wrong. He asks you, an experienced senior management accountant to prepare a flexible budget performance report that shows variable costs per unit, total fixed costs using the contribution margin format. (11 marks) Based on your answer in (1) above, please explain which top three reasons are most likely to reduce the income form operation. (3 marks) cach of the FIVE questions for full marks. (Total 70 marks) Question 1 (15 marks) 1. Vic Corporation refines petrol and sells it through its own petrol gas stations. On the basis of market research, Vic Corporation determines that 60% of the overall petrol market consists of service-oriented customers," medium- to high-income individuals who are willing to pay a higher price for gas if the gas stations can provide excellent customer service, such as a clean facility, a convenience store, friendly cmployees, a quick turnaround, the ability to pay by credit card, and high- octane premium petrol. The remaining 40% of the overall market are "price shoppers" who look to buy the cheapest petrol available. Vic Corporation's strategy is to focus on the 60% of service-oriented customers. Vic Corporation's balanced scorecard for 2018 follows. For brevity, the initiatives taken under cach objective are omitted. Performer Finci Pomposite Increase solder value Operating-ancome changes from price every Operating income changes Customer Increme market share Market share of all peline market Pont Improve geneline quality Quality index Improve refinery Referably index Enware paneline wailability Product availability index: 10 Learning Pot Increase refinery procese of winery process with me Required: Was Vic Corporation successful in implementing its strategy in 2018? Explain your answer. (3 marks) 2. Would you have included some measure of employee satisfaction and employee training in the learning and growth perspective? Are these objectives critical to Vic Corporation for implementing its strategy? Why or why nor? Explain briefly (4 marks) 1. Explain how Vic Corporation did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is market share of overall gasoline market" the correct measure of market share? Explain briefly (4 marks) 4. Do you agree with Vic Corporation's decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced Scorecard? Explain briefly. (4 marks) Question 2 (15 marks) Aunt Ethel's Fancy Cookie Company manufactures and sells three flavors of cookies: Macaroon, Sugar, and Buttercream in a continuous production process. The company acquires enough raw materials and labor hours necessary for making cookies. The batch size for the cookies is limited to 1,000 cookies based on the size of the ovens and cookie molds owned by the company Based on budgetary projections, the information listed below is available: Macera Sugar Projected sales in this 500.000,00 PER UNIT data: Selling price Dia Dilber 5034 S. SO IN S034 S01 50.004 1 Hears per 1000-batch Direct laber hours 2 1 Oven hours 1 Packaging hours The company used traditional cost allocation method to allocate overhead costs to different types of cookies based on direct labor hours used. Recently, senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: Acthy Osthad the costs Oven $210.000 SISO,000 The activity bases quantity of usage identified for each activity are as follows: Actinuity Oven Packagind packaging Required: (1) Using the ABC system, for the sugar cookie, the most popular cookie, compute the estimated overhead costs per thousand cookies. (6 marks) (2) Compute and compare the product cost per unit for sugar cookie under ABC method and traditional two- stage cost allocation method. (9 marks) Question 3 (13 marks) Bergamo Bay Co. uses enterprise resource planning (ERP) system to combine the business activities with accounting activities. ERP system provides an integrated and continuously updated view of core business processes. The system can track business resources, i.c. cash, raw materials, etc., and shares data across various departments (manufacturing, purchasing, sales, accounting, etc.), and various stakeholders of the company. The system also can provide timely information and report to variable users within the company. On December 31, 2019 ERP system generated the following trial balance. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work in Process Inventory but does show a balance for the Factory Payroll and Factory Overhead account. 13 in proces aidai Papas After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date. Material regulation 2010 10 Sec. Materials requis - O Sem 3600 Indirect were borR borse 2: directo Cabernet Jobs 402 and 404 are the only units in process at year end. The predetermined overhead rate is 200% of direct labor cost. Required: (13 marks) (I) Prepare journal entries to assign the costs below: (a) Direct materials costs to Work in Process Inventory. (2 marks) (6) Direct labor costs to Work in Process Inventory (2 marks) (C) Overhead costs to Work in Process Inventory (2 marks) (d) Indirect materials costs to the Factory Overhead account. (2 marks) (e) Indirect labor costs to the Factory Overhead account. (2 marks) (2) According the entries from part (1) related to factory overhead, determine the amount of under-or overapplied overhead for the year. (1 marks) (3) Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. (2 marks) Question 4 (13 marks) Forber Inc., a manufacturer of breakfast cereals and snack bars, has experienced several years of steady growth in sales, profits, and dividends while maintaining a relatively low level of debt. The board of directors has adopted a long-run strategy to maximize the value of the shareholders' investment. In order to achieve this goal, the board of directors established the following five-year financial objectives. Increase sales by 13 percent per year. Increase income before taxes by 15 percent per year. Maintain long-term debt at a maximum of 16 percent of assets. These financial objectives have been attained for the past three years. At the beginning of last year, the president of Forber Inc., Andrea Donis, added a fourth financial objective of maintaining cost of goods sold at a maximum of 70 percent of sales. This goal also was attained last year. The budgeting process at Forber Inc. is to be directed toward attaining these goals for the forthcoming year, a difficult task with the economy in a prolonged recession. In addition, the increased emphasis on eating helpful foods has driven up the price of ingredients used by the company significantly faster than the expected rate of inflation. John Winslow, cost accountant at Forber Inc., has responsibility for preparation of profit plan for next year. Winslow assured Donis that he could present a budget that achieved all of the financial objectives. Winslow believed that he could overestimate the ending inventory and reclassify fruit and grain inspection costs as administrative rather than manufacturing costs to attain the desired objective. The actual statements for 2018 and the budgeted statements for 2019 that Winslow prepared are as follows: Forberin 2018 2019 Actul Budgeted Sales Lese: Variable costs Cost of goods sold 510.000 $74,735 Selling and 7.500 Contribution margin 350,000 25.585 Les Finest Manufacturing Selling and administrative 0000 70.000 Income before and $10.00 $130.750 Forbere Balance Sheet 2013 Actual Bled $10.000 $17.000 60.000.000 300,000 365.000 Plast and set of mod depreciation 1000 100 Accounts payable Long-term dicht Stockholders' equilty S110.000 $122.000 320.000 300.000 200.000 400.000 1.170,000 1,220,000 Question 5 (14 marks) The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, innovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100). intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity Sales $1.800.000 Cost of goods sold Diret materials Direct Labor 360.000 Indirect material (variable) 18.000 Depreciation Salari Utilities (80find Maintenance (40% vaible) 39.00 149.00 $320,400 : Commi 55-4000 Advertising finde 18.000 Rew Totalpring However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows. Sales (38.000 units Cost of goods sold Indirect materials (variable) 23.760 Depreciation 216.000 Salaries 110.000 Maintenance (40% variabile) 38.400 1.554,360 Groupe Operating expenses Advertising find 2000 Totalpring expenses 211.200 Income from operations Required: With higher than expected number of units sold, income from operations dropped dramatically, the senior manager of The Mystic River Flyfishing Company wants to find out what went wrong. He asks you, an experienced senior management accountant to prepare a flexible budget performance report that shows variable costs per unit, total fixed costs using the contribution margin format. (11 marks) Based on your answer in (1) above, please explain which top three reasons are most likely to reduce the income form operation