Question: Chloe, age 48, divorced her husband in 2017. Chloe's 8 year old grandson, Marcus, has been living with her since his parents were incarcerated

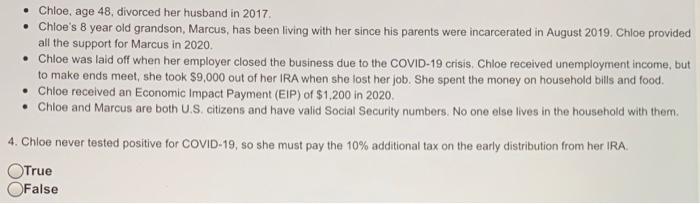

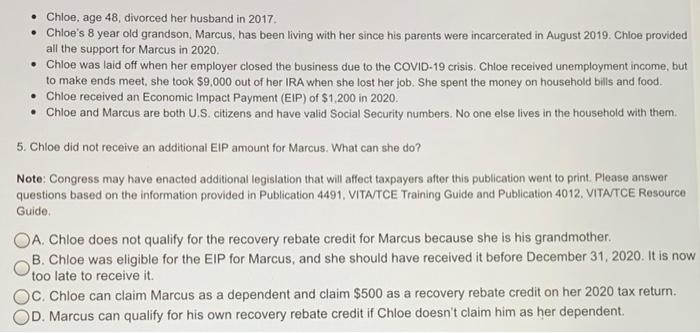

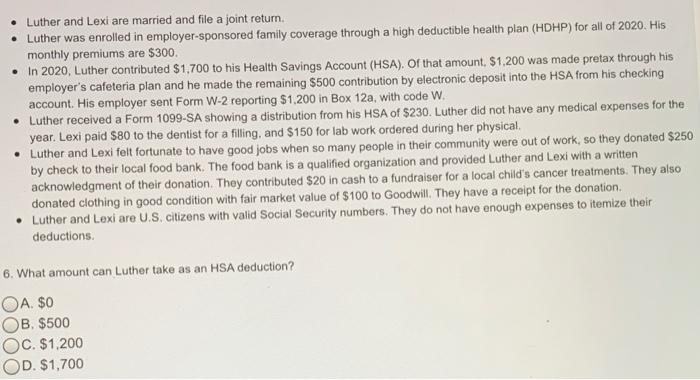

Chloe, age 48, divorced her husband in 2017. Chloe's 8 year old grandson, Marcus, has been living with her since his parents were incarcerated in August 2019. Chloe provided all the support for Marcus in 2020. Chloe was laid off when her employer closed the business due to the COVID-19 crisis. Chloe received unemployment income, but to make ends meet, she took $9,000 out of her IRA when she lost her job. She spent the money on household bills and food. Chloe received an Economic Impact Payment (EIP) of $1,200 in 2020. Chloe and Marcus are both U.S. citizens and have valid Social Security numbers. No one else lives in the household with them. 4. Chloe never tested positive for COVID-19, so she must pay the 10% additional tax on the early distribution from her IRA. True OFalse . Chloe, age 48, divorced her husband in 2017. Chloe's 8 year old grandson, Marcus, has been living with her since his parents were incarcerated in August 2019. Chloe provided all the support for Marcus in 2020. Chloe was laid off when her employer closed the business due to the COVID-19 crisis. Chloe received unemployment income, but to make ends meet, she took $9,000 out of her IRA when she lost her job. She spent the money on household bills and food. Chloe received an Economic Impact Payment (EIP) of $1,200 in 2020. Chloe and Marcus are both U.S. citizens and have valid Social Security numbers. No one else lives in the household with them. 5. Chloe did not receive an additional EIP amount for Marcus. What can she do? Note: Congress may have enacted additional legislation that will affect taxpayers after this publication went to print. Please answer questions based on the information provided in Publication 4491, VITA/TCE Training Guide and Publication 4012, VITA/TCE Resource Guide. OA. Chloe does not qualify for the recovery rebate credit for Marcus because she is his grandmother. B. Chloe was eligible for the EIP for Marcus, and she should have received it before December 31, 2020. It is now too late to receive it. OC. Chloe can claim Marcus as a dependent and claim $500 as a recovery rebate credit on her 2020 tax return. D. Marcus can qualify for his own recovery rebate credit if Chloe doesn't claim him as her dependent. Luther and Lexi are married and file a joint return. Luther was enrolled in employer-sponsored family coverage through a high deductible health plan (HDHP) for all of 2020. His monthly premiums are $300. In 2020, Luther contributed $1,700 to his Health Savings Account (HSA). Of that amount, $1,200 was made pretax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic deposit into the HSA from his checking account. His employer sent Form W-2 reporting $1,200 in Box 12a, with code W. Luther received a Form 1099-SA showing a distribution from his HSA of $230. Luther did not have any medical expenses for the year. Lexi paid $80 to the dentist for a filling, and $150 for lab work ordered during her physical. Luther and Lexi felt fortunate to have good jobs when so many people in their community were out of work, so they donated $250 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lexi with a written acknowledgment of their donation. They contributed $20 in cash to a fundraiser for a local child's cancer treatments. They also donated clothing in good condition with fair market value of $100 to Goodwill. They have a receipt for the donation. Luther and Lexi are U.S. citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions. 6. What amount can Luther take as an HSA deduction? OA. $0 OB. $500 OC. $1,200 OD. $1,700

Step by Step Solution

3.39 Rating (180 Votes )

There are 3 Steps involved in it

4 True a person who made a withdrawal from his or her IRA will have to pay 10 tax for his or her ear... View full answer

Get step-by-step solutions from verified subject matter experts