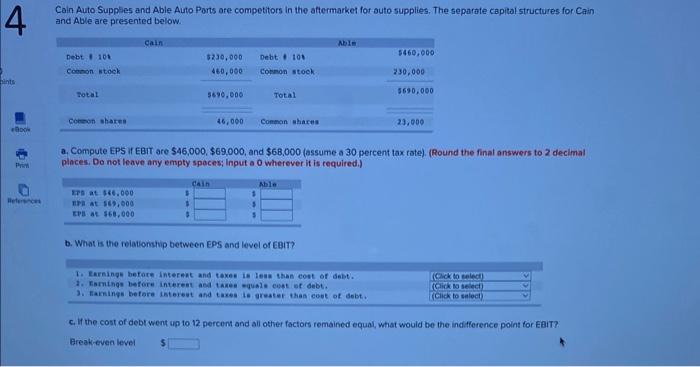

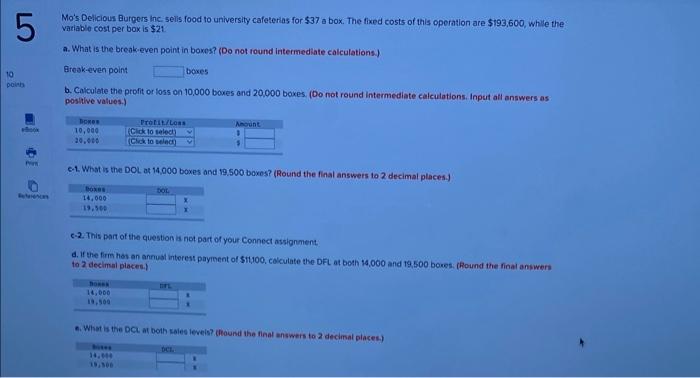

Cain Auto Suppies and Able Auto Ports are competitors in the aftermarket for outo supplies. The separate capital structures for Cain and Able are presented below. a. Compute EPS if EBit are $46,000,$69,000, and $68,000 (assume a 30 percent tax rate). (Round the final answers to 2 decimal places. Do not leaye any empty spaces; input a 0 wherever it is required.) b. What is the relationship between EPS and level of EBIT? c. If the cost of debt went up to 12 percent and all other factors remained equal, what would be the indifference point for EaiT? Oreaketven level Mo's Delicious Burpers inc selis food to university cafeterias for $37 a box. The fixed costs of this operation are $193,600, while the variable cost per box is $21 a. What is the breakeeven point in boxes? (Do not round intermediate calculations) ) Break-even point b. Caiculate the profit or loss on 10,000 boxes and 20,000 boxes. (Do not round intermediate calculations. Input all answers as positive values.) e-2. What is the DOL at 14,000 boxes and 19.500 boxos? (Round the final answers to 2 decimal places.) 6-2. This part of the question is not part of your Connect assignment. d. If the firm hoi an annust interest payinent of 51,400 . colculate the DFL at both 14,000 and 19,500 bowes. (hound the finat answers to 2 decimal places. 6. What is the DCL at both kales leveis? (lound tha finat answers to 2 decinal places) Cain Auto Suppies and Able Auto Ports are competitors in the aftermarket for outo supplies. The separate capital structures for Cain and Able are presented below. a. Compute EPS if EBit are $46,000,$69,000, and $68,000 (assume a 30 percent tax rate). (Round the final answers to 2 decimal places. Do not leaye any empty spaces; input a 0 wherever it is required.) b. What is the relationship between EPS and level of EBIT? c. If the cost of debt went up to 12 percent and all other factors remained equal, what would be the indifference point for EaiT? Oreaketven level Mo's Delicious Burpers inc selis food to university cafeterias for $37 a box. The fixed costs of this operation are $193,600, while the variable cost per box is $21 a. What is the breakeeven point in boxes? (Do not round intermediate calculations) ) Break-even point b. Caiculate the profit or loss on 10,000 boxes and 20,000 boxes. (Do not round intermediate calculations. Input all answers as positive values.) e-2. What is the DOL at 14,000 boxes and 19.500 boxos? (Round the final answers to 2 decimal places.) 6-2. This part of the question is not part of your Connect assignment. d. If the firm hoi an annust interest payinent of 51,400 . colculate the DFL at both 14,000 and 19,500 bowes. (hound the finat answers to 2 decimal places. 6. What is the DCL at both kales leveis? (lound tha finat answers to 2 decinal places)