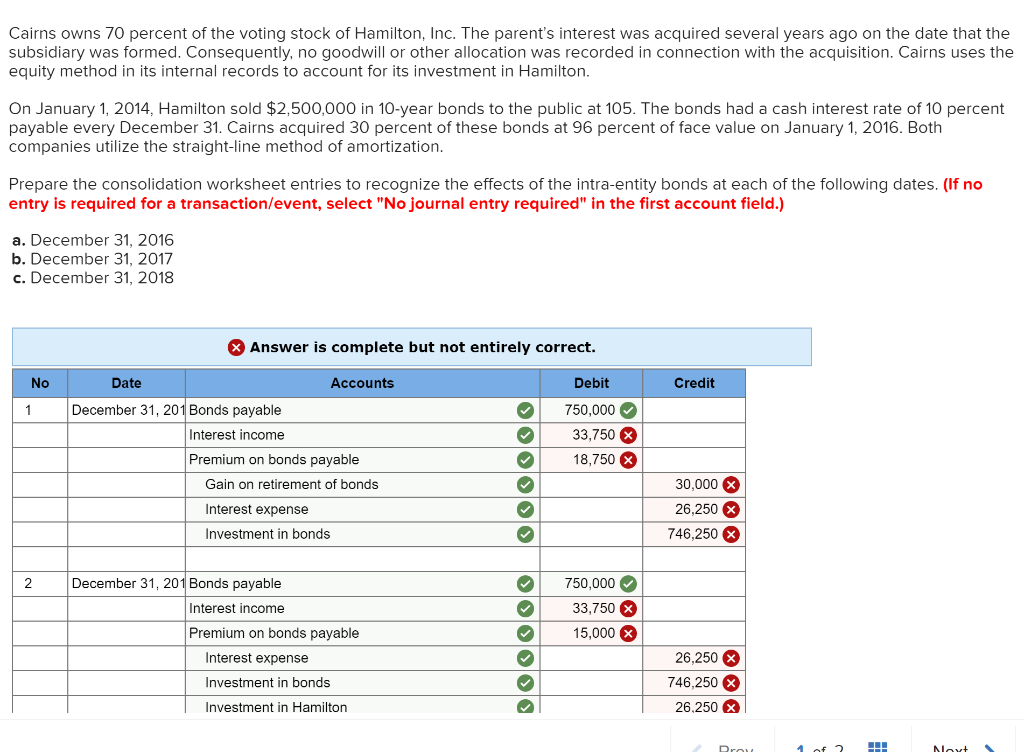

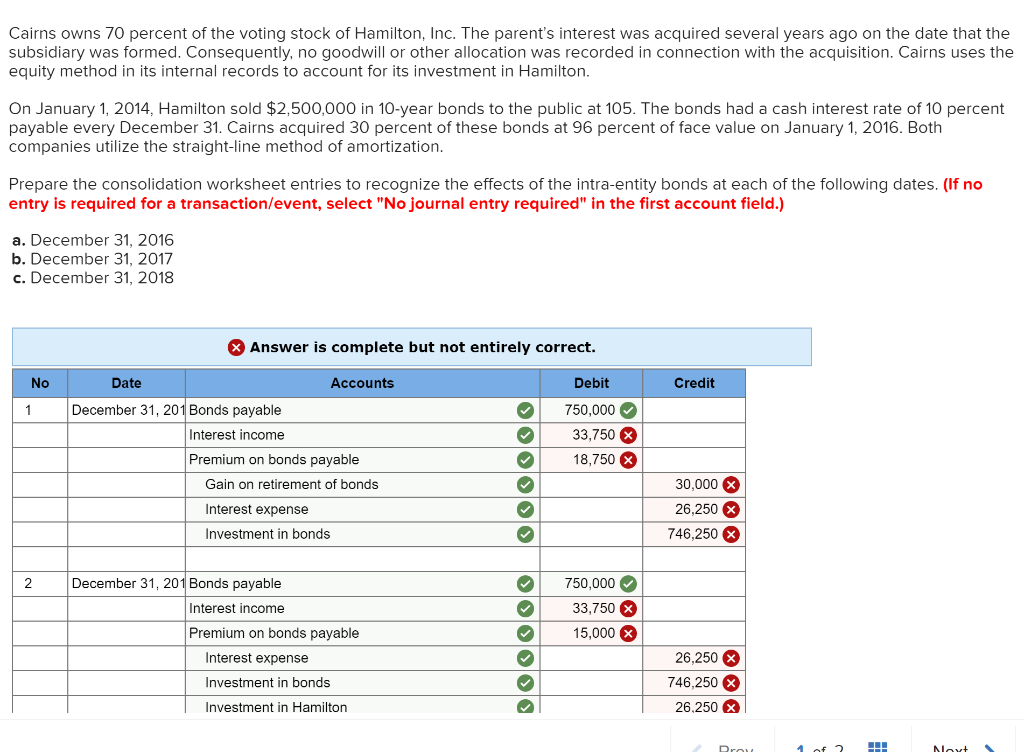

Cairns owns 70 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton. On January 1, 2014, Hamilton sold $2,500,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 10 percent payable every December 31. Cairns acquired 30 percent of these bonds at 96 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018 Answer is complete but not entirely correct. No Date Accounts Debit Credit 1 December 31, 201 Bonds payable Interest income Premium on bonds payable Gain on retirement of bonds 750,000 33,750 X 18,750 X OOOOOO Interest expense 30,000 X 26,250 X 746,250 X Investment in bonds 2 December 31, 201 Bonds payable 750,000 33,750 15,000 Interest income Premium on bonds payable Interest expense Investment in bonds Investment in Hamilton 26.250 X 746,250 X 26.250 X th Nort Cairns owns 70 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton. On January 1, 2014, Hamilton sold $2,500,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 10 percent payable every December 31. Cairns acquired 30 percent of these bonds at 96 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization. Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018 Answer is complete but not entirely correct. No Date Accounts Debit Credit 1 December 31, 201 Bonds payable Interest income Premium on bonds payable Gain on retirement of bonds 750,000 33,750 X 18,750 X OOOOOO Interest expense 30,000 X 26,250 X 746,250 X Investment in bonds 2 December 31, 201 Bonds payable 750,000 33,750 15,000 Interest income Premium on bonds payable Interest expense Investment in bonds Investment in Hamilton 26.250 X 746,250 X 26.250 X th Nort