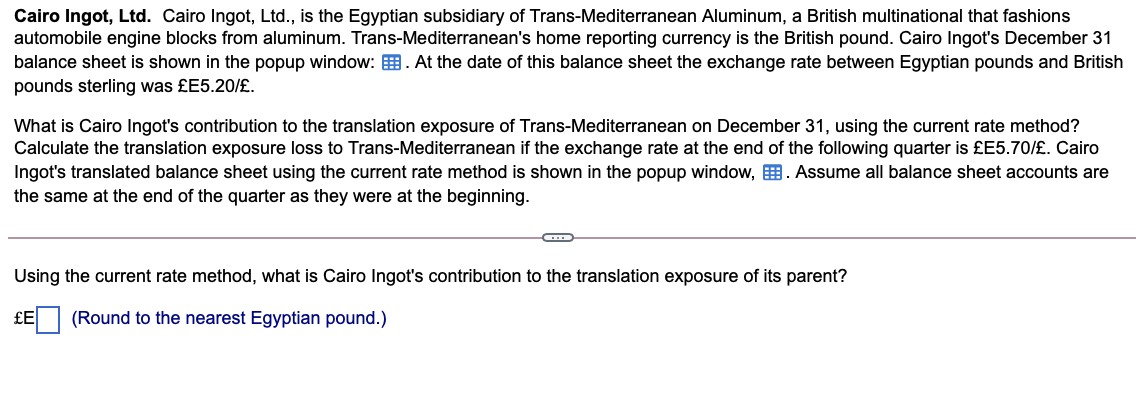

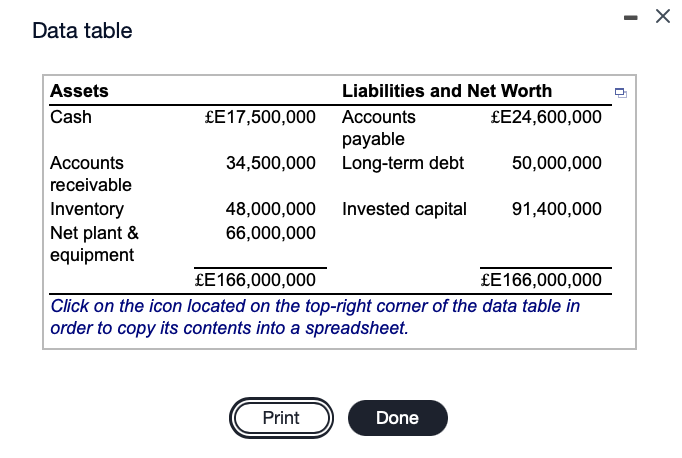

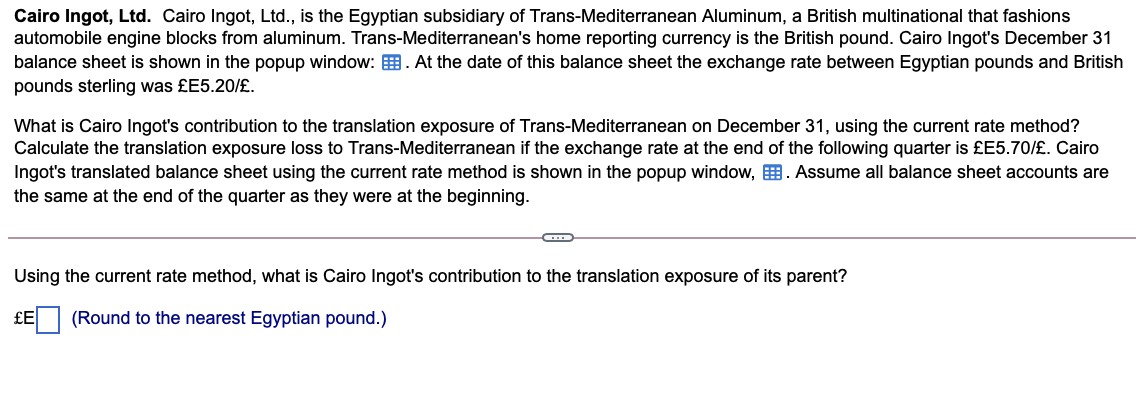

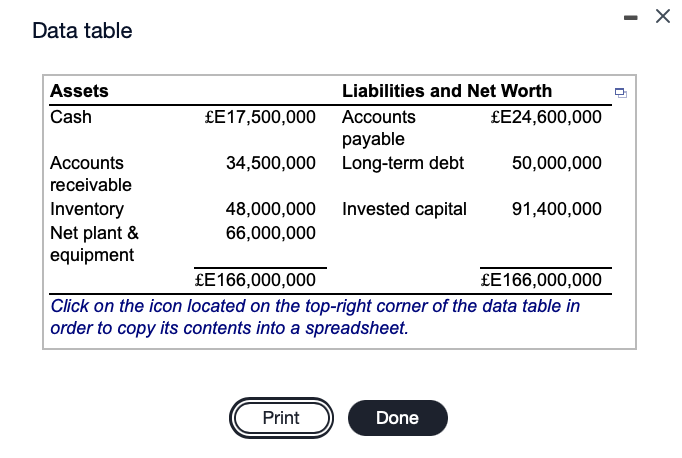

Cairo Ingot, Ltd. Cairo Ingot, Ltd., is the Egyptian subsidiary of Trans-Mediterranean Aluminum, a British multinational that fashions automobile engine blocks from aluminum. Trans-Mediterranean's home reporting currency is the British pound. Cairo Ingot's December 31 balance sheet is shown in the popup window: B. At the date of this balance sheet the exchange rate between Egyptian pounds and British pounds sterling was E5.20/. What is Cairo Ingot's contribution to the translation exposure of Trans-Mediterranean on December 31, using the current rate method? Calculate the translation exposure loss to Trans-Mediterranean if the exchange rate at the end of the following quarter is E5.70/. Cairo Ingot's translated balance sheet using the current rate method is shown in the popup window, 6. Assume balance sheet accounts are the same at the end of the quarter as they were at the beginning. O Using the current rate method, what is Cairo Ingot's contribution to the translation exposure of its parent? LE (Round to the nearest Egyptian pound.) Data table Assets Liabilities and Net Worth Cash E17,500,000 Accounts E24,600,000 payable Accounts 34,500,000 Long-term debt 50,000,000 receivable Inventory 48,000,000 Invested capital 91,400,000 Net plant & 66,000,000 equipment E 166,000,000 E 166,000,000 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Print Done - Data table Cairo Ingot's Translation Gain (Loss) After Depreciation of the Egyptian pound: Current Rate Method December 31 March 31 Exchange Translated Exchange Translated In Egyptian Rate Accounts Rate Accounts Assets pounds (E) (E/) () (E/) () Cash E17,500,000 5.20 3,365,385 5.70 3,070,175 Accounts 34,500,000 5.20 6,634,615 5.70 6,052,632 receivable Inventory 48,000,000 5.20 9,230,769 5.70 8,421,053 Net plant and 66,000,000 5.20 12,692,308 5.70 11,578,947 equipment Total E 166,000,000 31,923,077 29,122,807 Liabilities and Net Worth Accounts payable E24,600,000 5.20 4,730,769 5.70 4,315,789 Long-term debt 50,000,000 5.20 9,615,385 5.70 8,771,930 Invested capital 91,400,000 5.20 17,576,923 5.20 17,576,923 Translation ? 0 (1,541,835) adjustment (CTA) Total E166,000,000 31,923,077 29,122,807 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Print Done