Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cake Company manufactures different types of cakes for evening-parties. The usual order for a party includes a few cakes: chocolate, honey, layer or particular

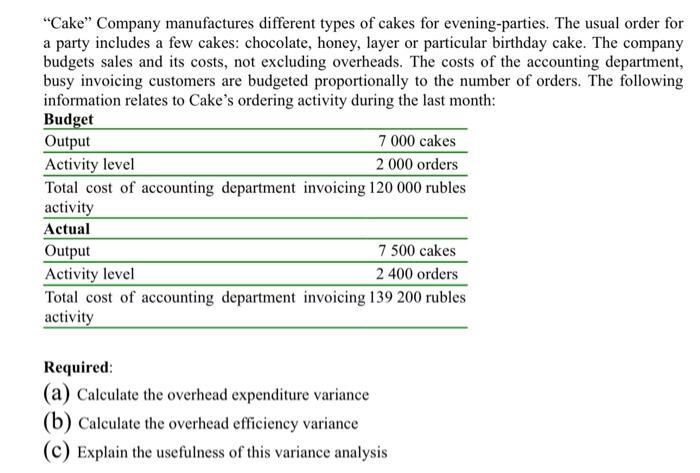

"Cake" Company manufactures different types of cakes for evening-parties. The usual order for a party includes a few cakes: chocolate, honey, layer or particular birthday cake. The company budgets sales and its costs, not excluding overheads. The costs of the accounting department, busy invoicing customers are budgeted proportionally to the number of orders. The following information relates to Cake's ordering activity during the last month: Budget Output Activity level 7 000 cakes 2 000 orders Total cost of accounting department invoicing 120 000 rubles activity Actual Output 7 500 cakes Activity level 2 400 orders Total cost of accounting department invoicing 139 200 rubles activity Required: (a) Calculate the overhead expenditure variance (b) Calculate the overhead efficiency variance (c) Explain the usefulness of this variance analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the overhead expenditure variance and the overhead efficiency variance we can use the following formulas a Overhead Expenditure Variance Overhead Expenditure Variance measures the differe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started