Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mountain Springs, a partnership operated by the Von Trapp family is contemplating the purchase of a new computer and software to help prepare the

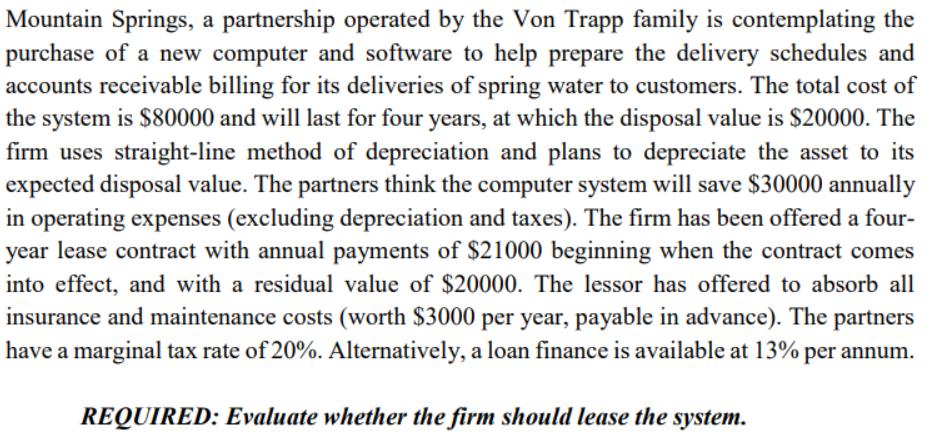

Mountain Springs, a partnership operated by the Von Trapp family is contemplating the purchase of a new computer and software to help prepare the delivery schedules and accounts receivable billing for its deliveries of spring water to customers. The total cost of the system is $80000 and will last for four years, at which the disposal value is $20000. The firm uses straight-line method of depreciation and plans to depreciate the asset to its expected disposal value. The partners think the computer system will save $30000 annually in operating expenses (excluding depreciation and taxes). The firm has been offered a four- year lease contract with annual payments of $21000 beginning when the contract comes into effect, and with a residual value of $20000. The lessor has offered to absorb all insurance and maintenance costs (worth $3000 per year, payable in advance). The partners have a marginal tax rate of 20%. Alternatively, a loan finance is available at 13% per annum. REQUIRED: Evaluate whether the firm should lease the system.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate whether Mountain Springs should lease the computer system or purchase it with a loan we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started