calaculate Horizontal analysis

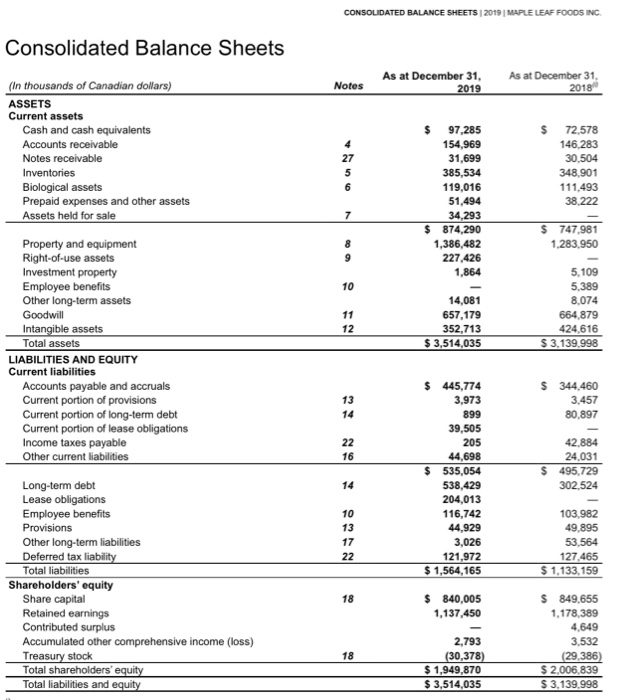

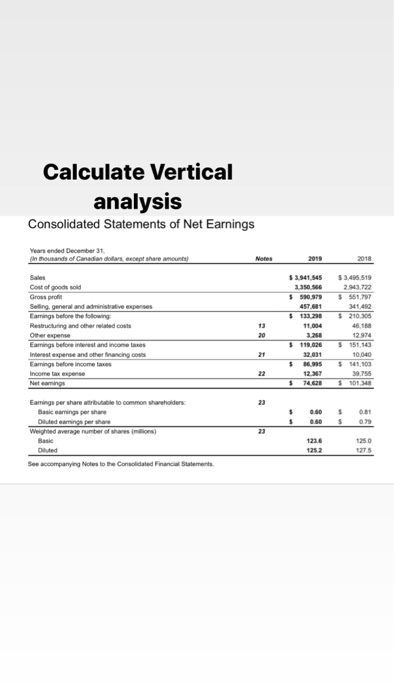

CONSOLIDATED BALANCE SHEETS | 2019 | MAPLE LEAF FOODS INC. Consolidated Balance Sheets Notes As at December 31, 2019 As at December 31 2018 (In thousands of Canadian dollars) ASSETS Current assets Cash and cash equivalents Accounts receivable Notes receivable Inventories Biological assets Prepaid expenses and other assets Assets held for sale 27 5 6 $ 97,285 154,969 31,699 385,534 119,016 51,494 34,293 $ 874,290 1,386,482 227,426 1,864 $ 72,578 146,283 30.504 348.901 111,493 38.222 7 $ 747.981 1.283.950 10 Property and equipment Right-of-use assets Investment property Employee benefits Other long-term assets Goodwill Intangible assets Total assets LIABILITIES AND EQUITY Current liabilities Accounts payable and accruals Current portion of provisions Current portion of long-term debt Current portion of lease obligations Income taxes payable Other current liabilities 14,081 657,179 352,713 $ 3,514,035 5,109 5,389 8,074 664.879 424,616 $ 3.139.998 12 13 $ 344,460 3.457 80.897 22 16 $ 445,774 3,973 899 39,505 205 44,698 $ 535,054 538,429 204,013 116,742 44,929 3,026 121,972 $ 1,564,165 42.884 24.031 $ 495,729 302.524 14 10 13 17 22 103,982 49,895 53,564 127,465 $ 1.133.159 Long-term debt Lease obligations Employee benefits Provisions Other long-term liabilities Deferred tax liability Total liabilities Shareholders' equity Share capital Retained earnings Contributed surplus Accumulated other comprehensive income (loss) Treasury stock Total shareholders' equity Total liabilities and equity 18 $ 840,005 1,137,450 $ 849,655 1.178.389 4,649 3.532 (29,386) $ 2.006.839 $ 3.139.998 2,793 (30,378) $ 1,949,870 $ 3,514,035 18 Calculate Vertical analysis Consolidated Statements of Net Earnings Yours ended December 31 in thousands of Canadian dollars, except share amounts 2018 $ 3.941.545 230.06 $50 373 457,681 $ 133 208 13 20 $3,435,519 29722 $ 551,797 341 492 $ 210.06 48,18 12.974 $ 151,143 10,040 $ 541,100 39.755 $ 101 Cost of goods sold Gross profit Selling general and administrative expenses Earnings before the following Restructuring and other related.com Other expense Earnings before interest and income taxes Interest expense and other financing cost Earnings before income Income tax expense Netcomings Earnings per share ble to common shareholders Basic earrings per share Diluted camins perhe Weighted average number of shares (milions) Basie 21 3.280 $ 119.026 32,031 5 16.995 123 5 74620 23 5 $ $ $ 0.50 081 0.79 1250 1775 1252 See accompanying Notes to the Consolidated Financial Statements