Question

Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $29,000 (original cost of

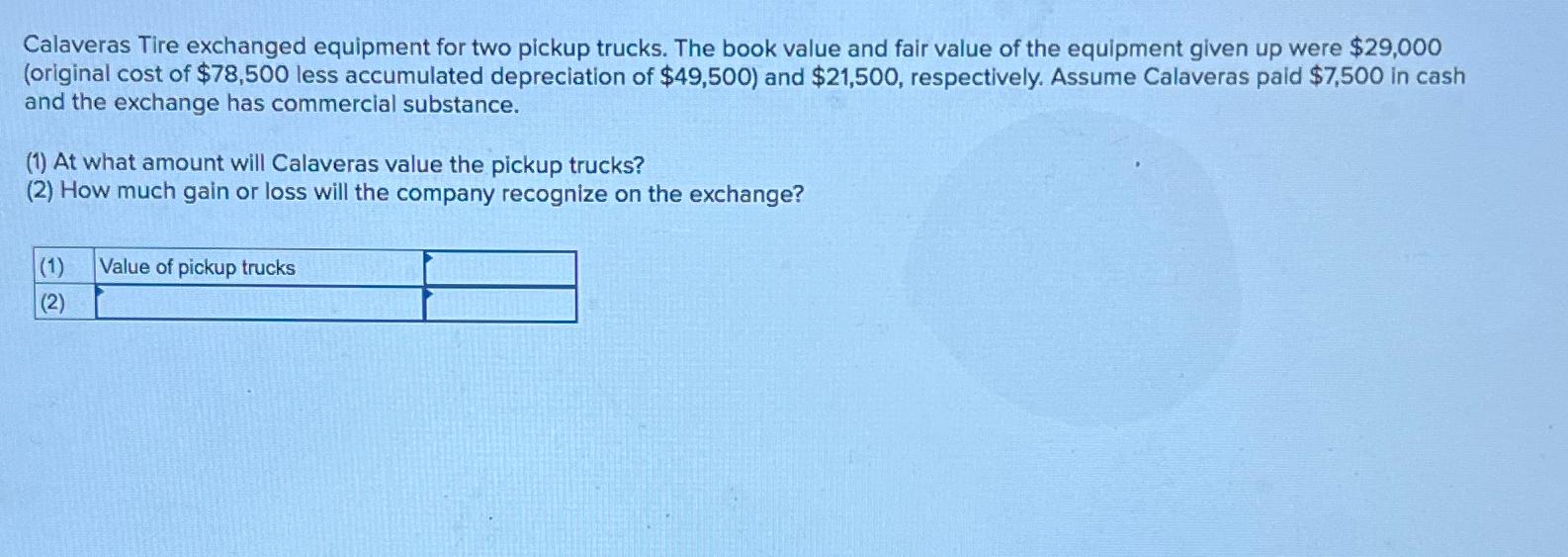

Calaveras Tire exchanged equipment for two pickup trucks. The book value and fair value of the equipment given up were $29,000 (original cost of $78,500 less accumulated depreciation of $49,500) and $21,500, respectively. Assume Calaveras paid $7,500 in cash and the exchange has commercial substance. (1) At what amount will Calaveras value the pickup trucks? (2) How much gain or loss will the company recognize on the exchange? (1) Value of pickup trucks (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To determine the value of the pickup trucks we need to compare the fair value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland

11th Edition

1264134525, 9781264134526

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App