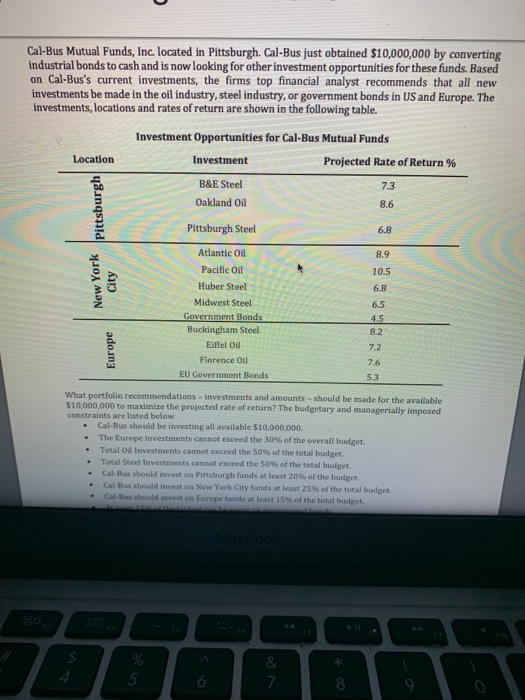

Cal-Bus Mutual Funds, Inc. located in Pittsburgh. Cal-Bus just obtained $10,000,000 by converting industrial bonds to cash and is now looking for other investment opportunities for these funds. Based on Cal-Bus's current investments, the firms top financial analyst recommends that all new investments be made in the oil industry, steel industry, or government bonds in US and Europe. The investments, locations and rates of return are shown in the following table. Investment Opportunities for Cal-Bus Mutual Funds Location Investment Projected Rate of Return % B&E Steel 7.3 Oakland Oil Pittsburgh 8.6 Pittsburgh Steel 6.8 8.9 10.5 New York City 6.8 Atlantic Oil Pacific Oil Huber Steel Midwest Steel Government Bonds Buckingham Steel Eiffel Oil Florence Oil EU Government Bonds 6.5 4.5 8.2 7.2 Europe 7.6 5.3 What portfolio recommendations - investments and amounts should be made for the available $10,000,000 to maximize the projected rate of return? The budgetary and managerially imposed constraints are listed below Cal-Bus should be investing all available $10,000,000 The Europe investments cannot exceed the 30% of the overall budget. Total Oil Investments cannot exceed the 50% of the total budget. Total Steel Investments cannot exceed the 50% of the total budget. Cal-Bus should invest on Pittsburgh funds at least 20% of the budget. Cal Bus should invest on New York City funds at least 25% of the total budget Callus should invest on Europe funds at least 15% of the total budget. % 4 & 7 6 8 9. Cal-Bus Mutual Funds, Inc. located in Pittsburgh. Cal-Bus just obtained $10,000,000 by converting industrial bonds to cash and is now looking for other investment opportunities for these funds. Based on Cal-Bus's current investments, the firms top financial analyst recommends that all new investments be made in the oil industry, steel industry, or government bonds in US and Europe. The investments, locations and rates of return are shown in the following table. Investment Opportunities for Cal-Bus Mutual Funds Location Investment Projected Rate of Return % B&E Steel 7.3 Oakland Oil Pittsburgh 8.6 Pittsburgh Steel 6.8 8.9 10.5 New York City 6.8 Atlantic Oil Pacific Oil Huber Steel Midwest Steel Government Bonds Buckingham Steel Eiffel Oil Florence Oil EU Government Bonds 6.5 4.5 8.2 7.2 Europe 7.6 5.3 What portfolio recommendations - investments and amounts should be made for the available $10,000,000 to maximize the projected rate of return? The budgetary and managerially imposed constraints are listed below Cal-Bus should be investing all available $10,000,000 The Europe investments cannot exceed the 30% of the overall budget. Total Oil Investments cannot exceed the 50% of the total budget. Total Steel Investments cannot exceed the 50% of the total budget. Cal-Bus should invest on Pittsburgh funds at least 20% of the budget. Cal Bus should invest on New York City funds at least 25% of the total budget Callus should invest on Europe funds at least 15% of the total budget. % 4 & 7 6 8 9