Answered step by step

Verified Expert Solution

Question

1 Approved Answer

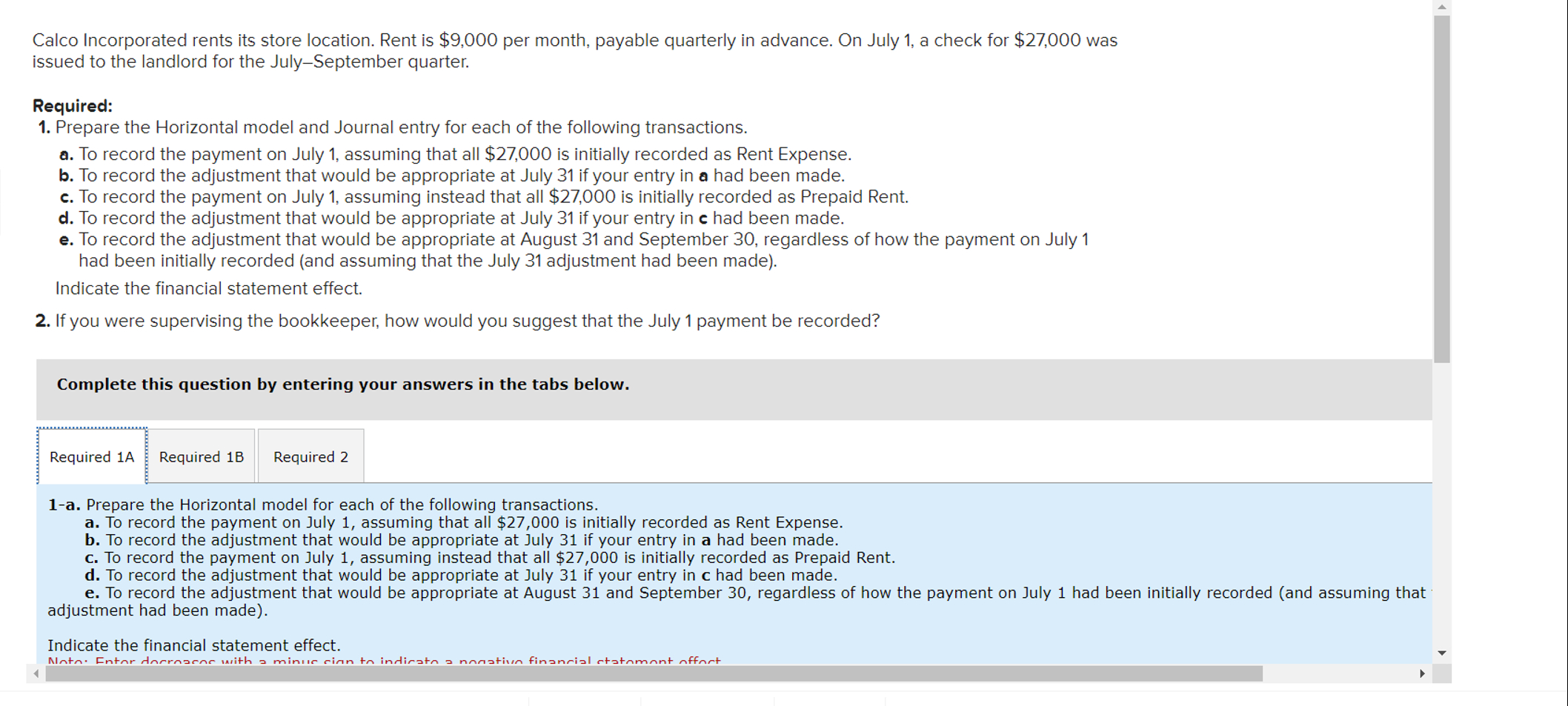

Calco Incorporated rents its store location. Rent is $ 9 , 0 0 0 per month, payable quarterly in advance. On July 1 , a

Calco Incorporated rents its store location. Rent is $ per month, payable quarterly in advance. On July a check for $ was Required A

Required B

a Prepare the Horizontal model for each of the following transactions.

a To record the payment on July assuming that all $ is initially recorded as Rent Expense.

b To record the adjustment that would be appropriate at July if your entry in a had been made.

c To record the payment on July assuming instead that all $ is initially recorded as Prepaid Rent.

d To record the adjustment that would be appropriate at July if your entry in c had been made.

adjustment had been made

Indicate the financial statement effect.

Note: Enter decreases with a minus sign to indicate a negative financial statement effect.

issued to the landlord for the JulySeptember quarter.

Required:

Prepare the Horizontal model and Journal entry for each of the following transactions.

a To record the payment on July assuming that all $ is initially recorded as Rent Expense.

b To record the adjustment that would be appropriate at July if your entry in a had been made.

c To record the payment on July assuming instead that all $ is initially recorded as Prepaid Rent.

d To record the adjustment that would be appropriate at July if your entry in c had been made.

e To record the adjustment that would be appropriate at August and September regardless of how the payment on July

had been initially recorded and assuming that the July adjustment had been made

Indicate the financial statement effect.

If you were supervising the bookkeeper, how would you suggest that the July payment be recorded?

Complete this question by entering your answers in the tabs below.

Required A

Required

a Prepare the Horizontal model for each of the following transactions.

a To record the payment on July assuming that all $ is initially recorded as Rent Expense.

b To record the adjustment that would be appropriate at July if your entry in a had been made.

c To record the payment on July assuming instead that all $ is initially recorded as Prepaid Rent.

d To record the adjustment that would be appropriate at July if your entry in chad been made.

e To record the adjustment that would be appropriate at August and September regardless of how the payment on July had been initially recorded and assuming that

adjustment had been made

Indicate the financial statement effect.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started