Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate: a) Bank One-Two ROA b) Bank One-Two ROE c) Bank One-Two Capital Adequacy Ratio (Basel 1) In the context of Asset and Liability Management

Calculate:

a) Bank One-Two ROA

b) Bank One-Two ROE

c) Bank One-Two Capital Adequacy Ratio

(Basel 1) In the context of Asset and Liability Management and Capital Management, Bank One-Two intends to replace a long-term B-rated bond issuance with less expensive funding and to free-

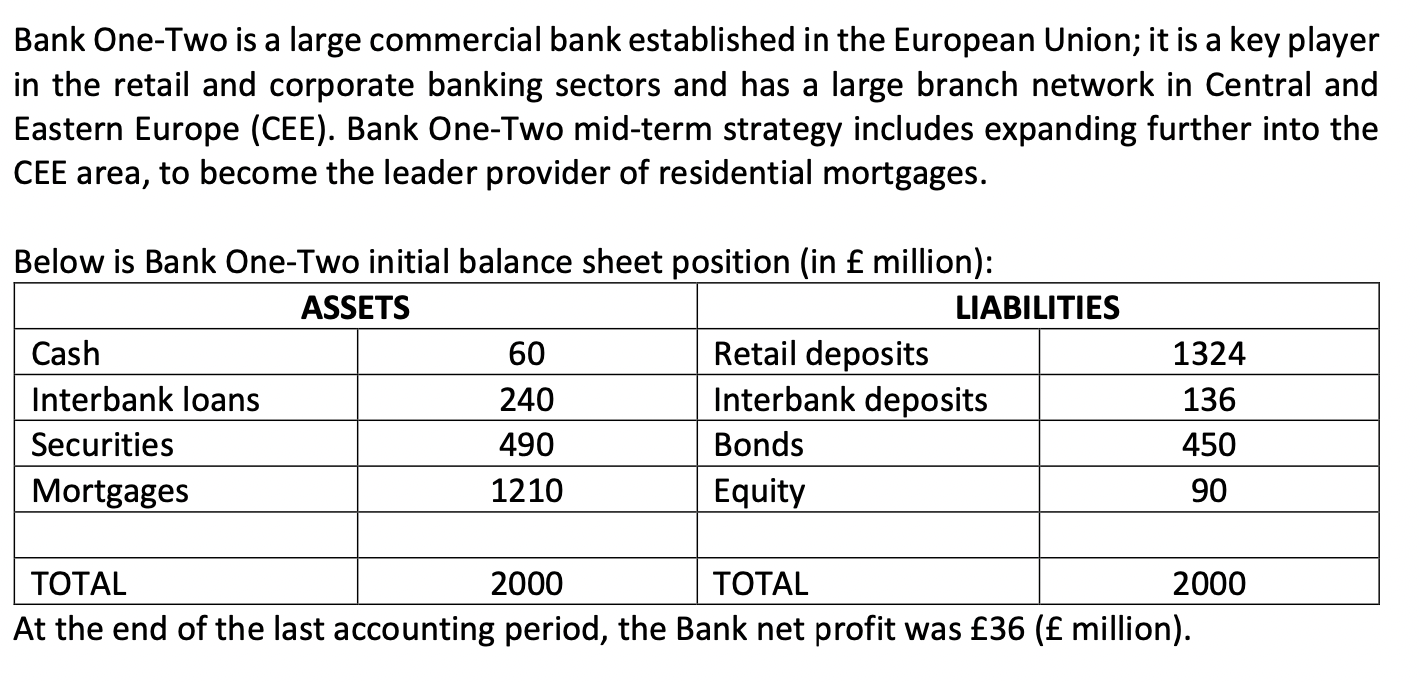

Bank One-Two is a large commercial bank established in the European Union; it is a key player in the retail and corporate banking sectors and has a large branch network in Central and Eastern Europe (CEE). Bank One-Two mid-term strategy includes expanding further into the CEE area, to become the leader provider of residential mortgages. Below is Bank One-Two initial balance sheet position (in million): ASSETS Cash Interbank loans Securities Mortgages 60 240 490 1210 LIABILITIES Retail deposits Interbank deposits Bonds Equity 1324 136 450 90 TOTAL 2000 TOTAL At the end of the last accounting period, the Bank net profit was 36 ( million). 2000

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Bank OneTwo ROA ROA Return on Assets is calculated by dividing the net income by the average total assets First lets calculate the average total ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started