Answered step by step

Verified Expert Solution

Question

1 Approved Answer

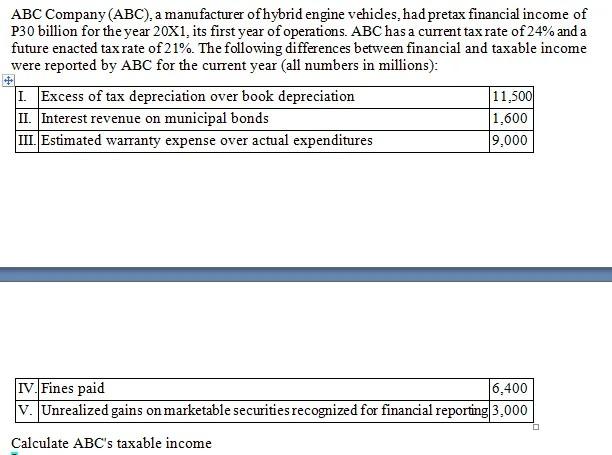

Calculate ABC's taxable income (Please show detailed solution) ABC Company (ABC), a manufacturer of hybrid engine vehides, had pretax financial income of P30 billion for

Calculate ABC's taxable income (Please show detailed solution)

ABC Company (ABC), a manufacturer of hybrid engine vehides, had pretax financial income of P30 billion for the year 20X1, its first year of operations. ABC has a current tax rate of 24% and a future enacted tax rate of 21%. The following differences between financial and taxable income were reported by ABC for the current year (all numbers in millions): I. Excess of tax depreciation over book depreciation 11,500 II. Interest revenue on municipal bonds 1,600 III. Estimated warranty expense over actual expenditures 9,000 IV. Fines paid 6.400 V. Unrealized gains on marketable securities recognized for financial reporting 3,000 Calculate ABC's taxable incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started