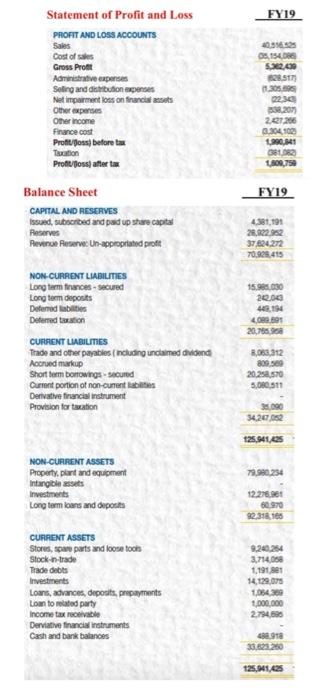

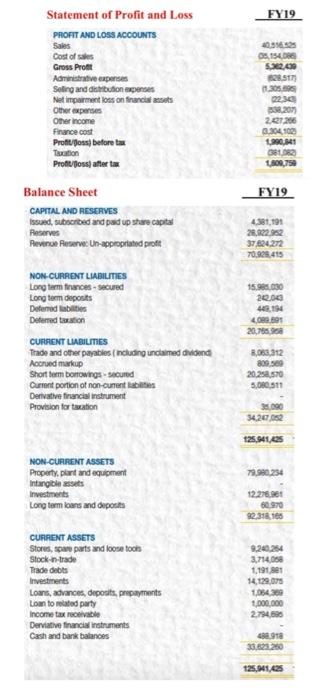

Calculate AFN, MVA and EVA of the following accounts:

FY19 40. O, 154,066 5.902.00 ST Statement of Profit and Loss PROFIT AND LOSS ACCOUNTS Sales Cost of Gross Profit Administrative expenses Seling and distributions Net impairment loss on financial assets Other experie Other income Finance cost Profits before Taxation Profitufoss after ta 1230 207 2.2.206 2.04.100 90.1 38102 100,750 FY19 Balance Sheet CAPITAL AND RESERVES ssend subscribed and paid up share capital Reserves Revenue Reserve: Un-appropriated profit 4.381,191 28,22952 37.624.272 70.929.415 NON-CURRENT LIABILITIES Long term for secured Long term deposits Deferred Deferred tation 15.986.030 20.00 49.194 4.01 207669 CURRENT LIABILITIES Trade and other payables including unclaimed diod Acued markup Short form borrowings-secured Current portion of non-cunettes Derivative financial instrument Provision for taxation 3,060,312 800.00 20.253.570 5.080.511 34,247052 126,941, 79.980.234 NON-CURRENT ASSETS Property, plant and equipment Intangible assets Investments Long term loans and deposits 12.276.61 92.38.106 CURRENT ASSETS Stores, spare parts and loose tools Stock-in-trade Trade debts Investments Loans, advances, deposits, prepayments Loan tomated party Income tax cable Derviative financial Instruments Cash and bark balances 9.240.254 3.714.05 1.1911 14.129.075 105436 1.000.000 2.794.600 4889 33.6.200 125,041,25 FY19 40. O, 154,066 5.902.00 ST Statement of Profit and Loss PROFIT AND LOSS ACCOUNTS Sales Cost of Gross Profit Administrative expenses Seling and distributions Net impairment loss on financial assets Other experie Other income Finance cost Profits before Taxation Profitufoss after ta 1230 207 2.2.206 2.04.100 90.1 38102 100,750 FY19 Balance Sheet CAPITAL AND RESERVES ssend subscribed and paid up share capital Reserves Revenue Reserve: Un-appropriated profit 4.381,191 28,22952 37.624.272 70.929.415 NON-CURRENT LIABILITIES Long term for secured Long term deposits Deferred Deferred tation 15.986.030 20.00 49.194 4.01 207669 CURRENT LIABILITIES Trade and other payables including unclaimed diod Acued markup Short form borrowings-secured Current portion of non-cunettes Derivative financial instrument Provision for taxation 3,060,312 800.00 20.253.570 5.080.511 34,247052 126,941, 79.980.234 NON-CURRENT ASSETS Property, plant and equipment Intangible assets Investments Long term loans and deposits 12.276.61 92.38.106 CURRENT ASSETS Stores, spare parts and loose tools Stock-in-trade Trade debts Investments Loans, advances, deposits, prepayments Loan tomated party Income tax cable Derviative financial Instruments Cash and bark balances 9.240.254 3.714.05 1.1911 14.129.075 105436 1.000.000 2.794.600 4889 33.6.200 125,041,25