Ricky Bobby is divorced with two dependent children, ages 9 and 11. During 2022, Ricky had the following gross receipts: Salary income Passive loss

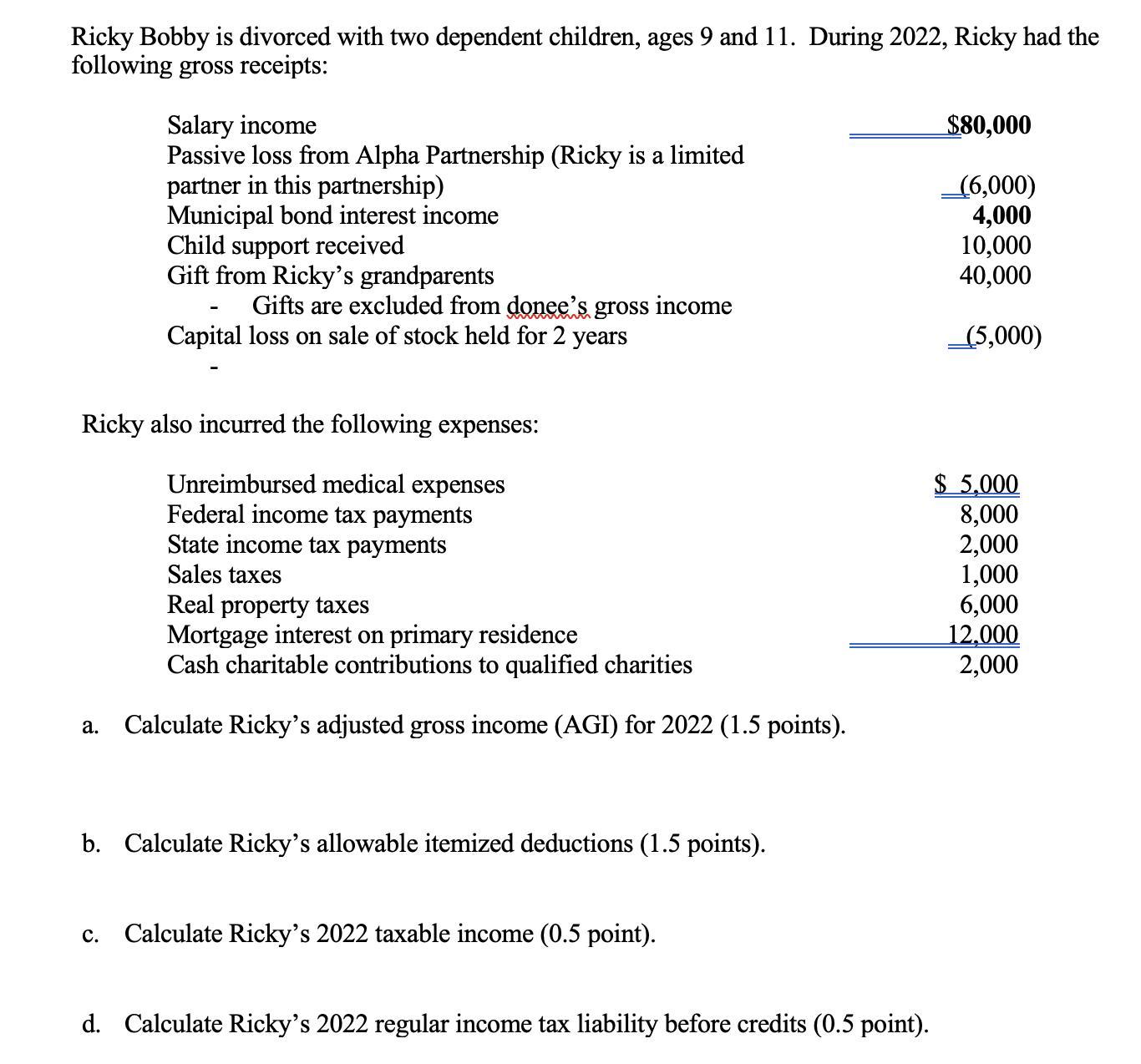

Ricky Bobby is divorced with two dependent children, ages 9 and 11. During 2022, Ricky had the following gross receipts: Salary income Passive loss from Alpha Partnership (Ricky is a limited partner in this partnership) Municipal bond interest income a. Child support received Gift from Ricky's grandparents Gifts are excluded from donee's gross income Capital loss on sale of stock held for 2 years Ricky also incurred the following expenses: Unreimbursed medical expenses Federal income tax payments State income tax payments Sales taxes Real property taxes Mortgage interest on primary residence Cash charitable contributions to qualified charities Calculate Ricky's adjusted gross income (AGI) for 2022 (1.5 points). b. Calculate Ricky's allowable itemized deductions (1.5 points). C. Calculate Ricky's 2022 taxable income (0.5 point). d. Calculate Ricky's 2022 regular income tax liability before credits (0.5 point). $80,000 (6,000) 4,000 10,000 40,000 (5,000) $5,000 8,000 2,000 1,000 6,000 12,000 2,000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Calculate Rickys adjusted gross income AGI for 2022 Adjusted Gross Income Sala...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started