Calculate all the ratios you have learned for both Declan's Doodads and Brayden's Bobbles (pages 132 &133). Market price of Declan's is $5.00 per share and Brayden's market price per share is $6.00. Compare and contrast the two companies using the ratios you have learned.

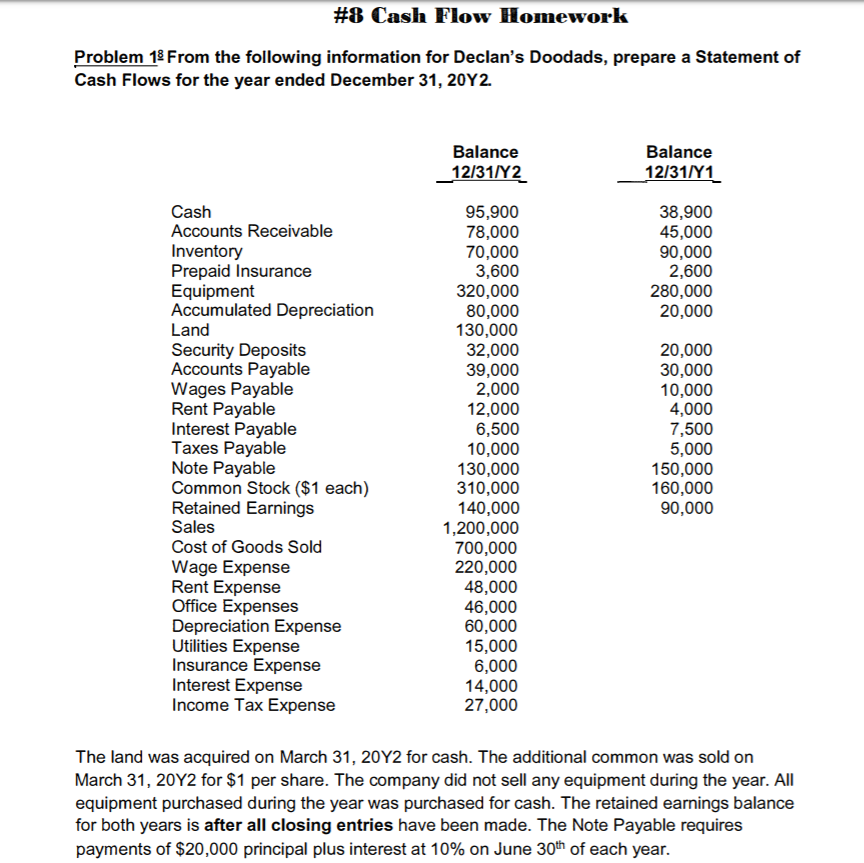

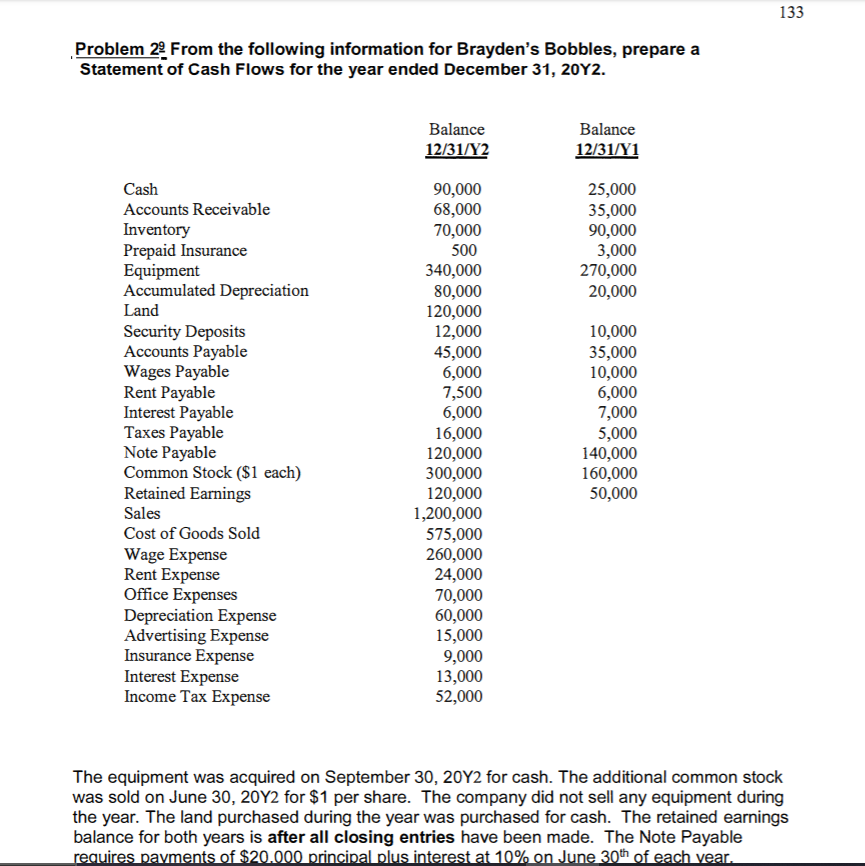

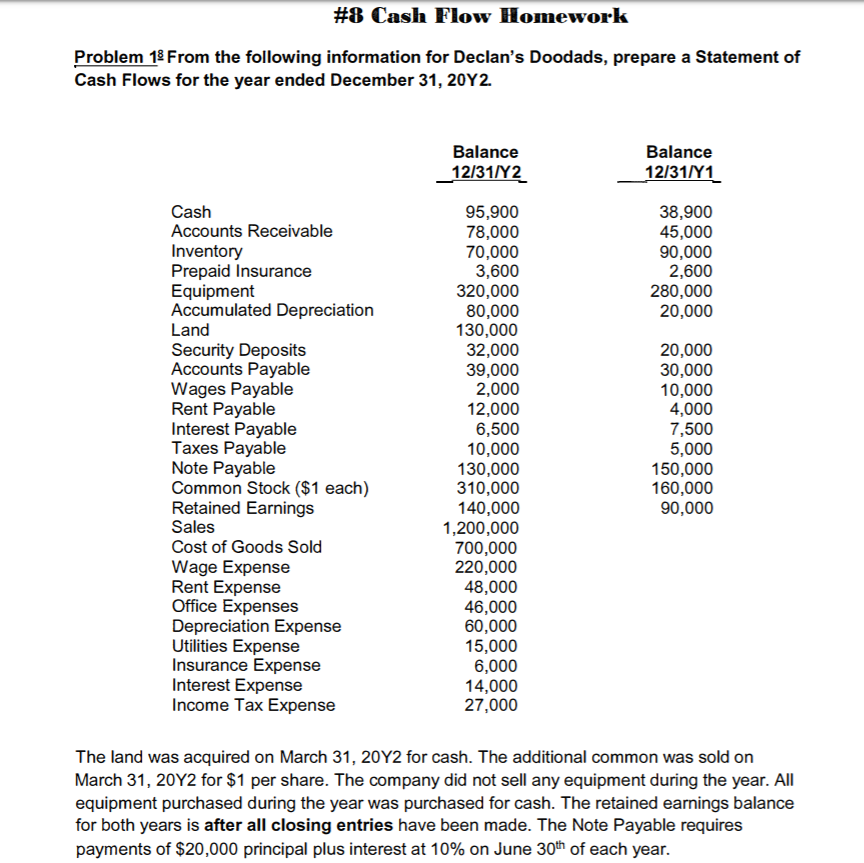

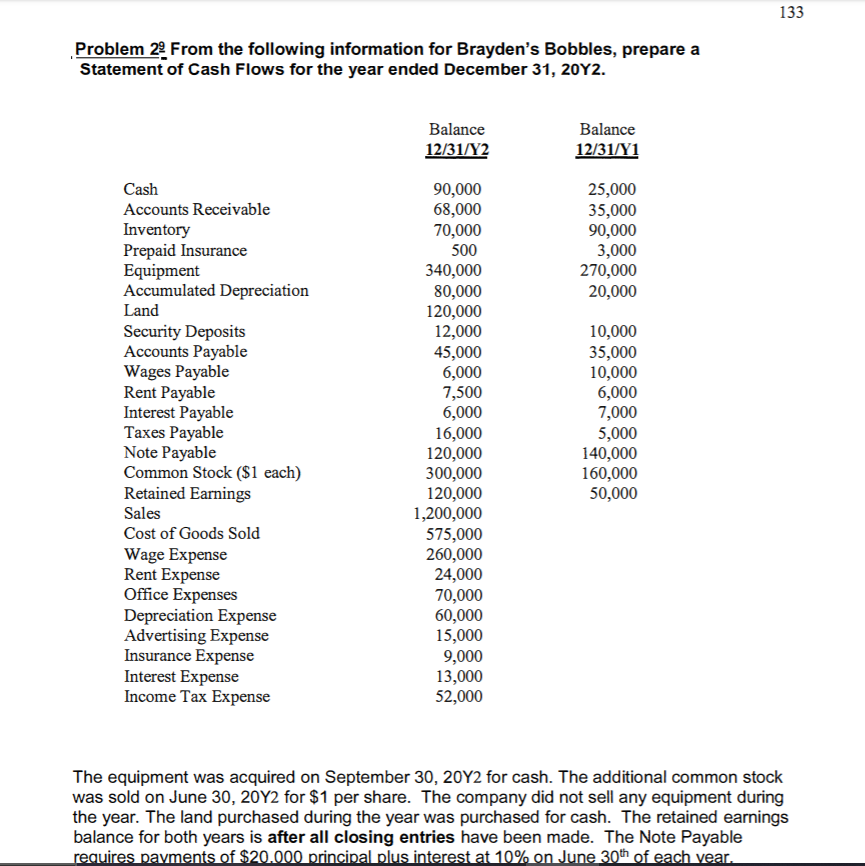

#8 Cash Flow Homework Problem 18 From the following information for Declan's Doodads, prepare a Statement of Cash Flows for the year ended December 31, 20Y2. Balance _12/31/42 Balance 12/31/Y1 38,900 45,000 90,000 2,600 280,000 20,000 Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Land Security Deposits Accounts Payable Wages Payable Rent Payable Interest Payable Taxes Payable Note Payable Common Stock ($1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Utilities Expense Insurance Expense Interest Expense Income Tax Expense 95,900 78,000 70,000 3,600 320,000 80,000 130,000 32,000 39,000 2,000 12,000 6,500 10,000 130,000 310,000 140,000 1,200,000 700,000 220,000 48,000 46,000 60,000 15,000 6,000 14,000 27,000 20,000 30,000 10,000 4,000 7,500 5,000 150,000 160,000 90,000 The land was acquired on March 31, 20Y2 for cash. The additional common was sold on March 31, 20Y2 for $1 per share. The company did not sell any equipment during the year. All equipment purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. The Note Payable requires payments of $20,000 principal plus interest at 10% on June 30th of each year. 133 Problem 22 From the following information for Brayden's Bobbles, prepare a Statement of Cash Flows for the year ended December 31, 20Y2. Balance 12/31/Y2 Balance 12/31/Y1 25,000 35,000 90,000 3,000 270,000 20,000 Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Land Security Deposits Accounts Payable Wages Payable Rent Payable Interest Payable Taxes Payable Note Payable Common Stock ($1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Advertising Expense Insurance Expense Interest Expense Income Tax Expense 90,000 68,000 70,000 500 340,000 80,000 120,000 12,000 45,000 6,000 7,500 6,000 16,000 120,000 300,000 120,000 1,200,000 575,000 260,000 24,000 70,000 60,000 15,000 9,000 13,000 52,000 10,000 35,000 10,000 6,000 7,000 5,000 140,000 160,000 50,000 The equipment was acquired on September 30, 20Y2 for cash. The additional common stock was sold on June 30, 20Y2 for $1 per share. The company did not sell any equipment during the year. The land purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. The Note Payable requires payments of $20.000 principal plus interest at 10% on June 30th of each vear