Answered step by step

Verified Expert Solution

Question

1 Approved Answer

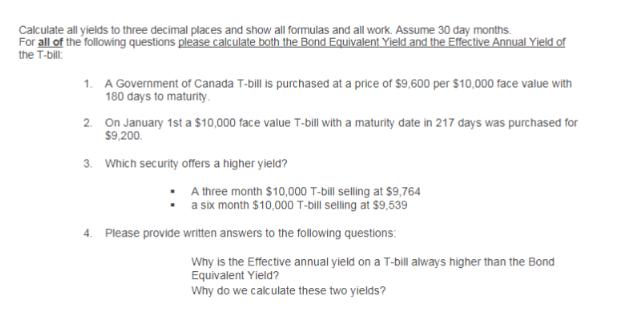

Calculate all yields to three decimal places and show all formulas and all work. Assume 30 day months. For all of the following questions

Calculate all yields to three decimal places and show all formulas and all work. Assume 30 day months. For all of the following questions please calculate both the Bond Equivalent Yield and the Effective Annual Yield of the T-bill: 1. A Government of Canada T-bill is purchased at a price of $9,600 per $10,000 face value with 180 days to maturity. 2. On January 1st a $10,000 face value T-bill with a maturity date in 217 days was purchased for $9,200. 3. Which security offers a higher yield? A three month $10,000 T-bill selling at $9,764 a six month $10,000 T-bill selling at $9,539 4. Please provide written answers to the following questions: Why is the Effective annual yield on a T-bill always higher than the Bond Equivalent Yield? Why do we calculate these two yields? Calculate all yields to three decimal places and show all formulas and all work. Assume 30 day months. For all of the following questions please calculate both the Bond Equivalent Yield and the Effective Annual Yield of the T-bill: 1. A Government of Canada T-bill is purchased at a price of $9,600 per $10,000 face value with 180 days to maturity. 2. On January 1st a $10,000 face value T-bill with a maturity date in 217 days was purchased for $9,200. 3. Which security offers a higher yield? A three month $10,000 T-bill selling at $9,764 a six month $10,000 T-bill selling at $9,539 4. Please provide written answers to the following questions: Why is the Effective annual yield on a T-bill always higher than the Bond Equivalent Yield? Why do we calculate these two yields?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the Bond Equivalent Yield BEY and Effective Annual Yield EAY for the first question we need to know the discount or purchase price the face value of the Tbill and the time to maturity G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started