Answered step by step

Verified Expert Solution

Question

1 Approved Answer

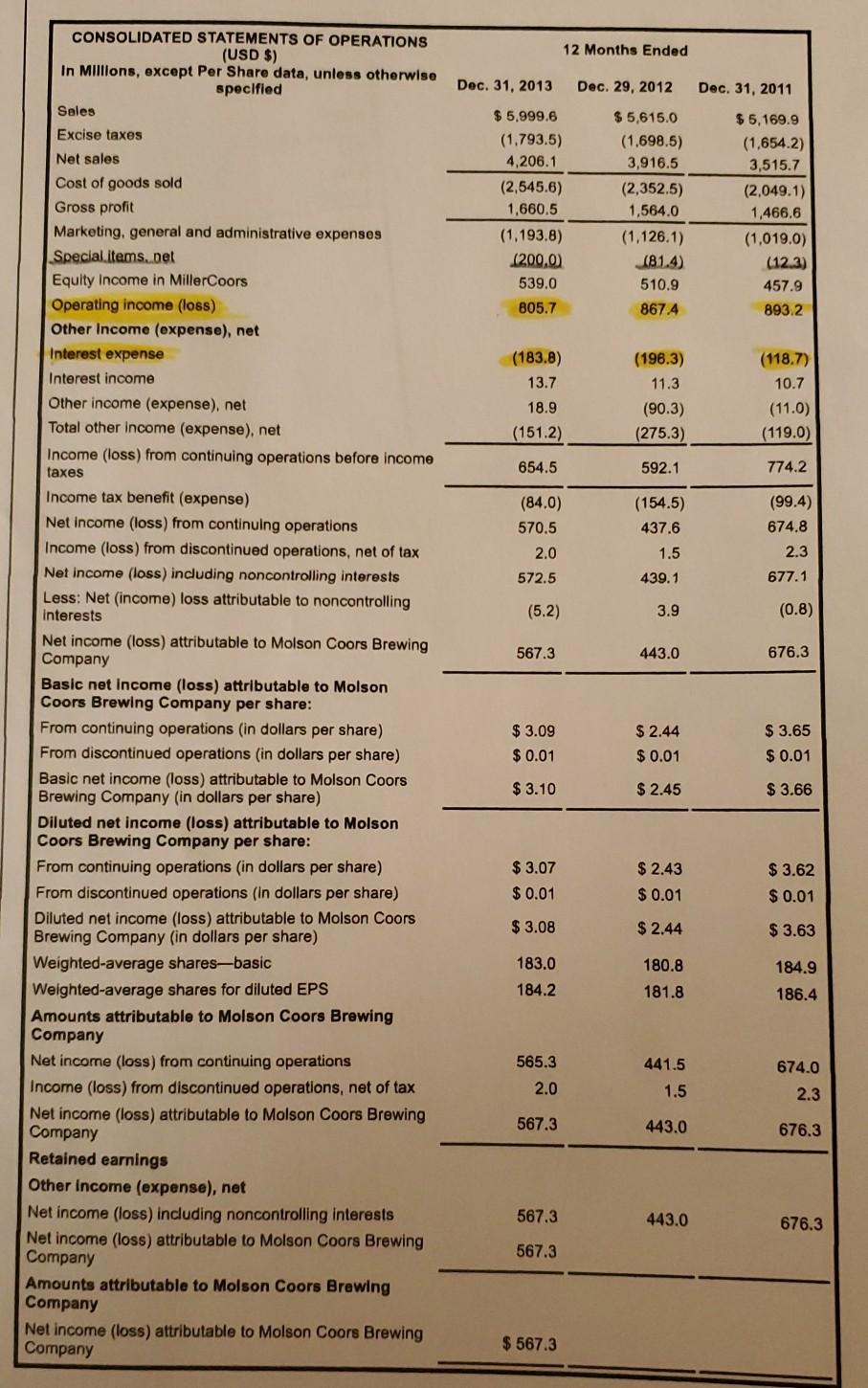

calculate an estimate of persistent income of molson coors. 12 Months Ended CONSOLIDATED STATEMENTS OF OPERATIONS (USD $) In Millions, except Per Share data, unless

calculate an estimate of persistent income of molson coors.

12 Months Ended CONSOLIDATED STATEMENTS OF OPERATIONS (USD $) In Millions, except Per Share data, unless otherwise specified Seles Dec. 31, 2013 Dec. 29, 2012 Dec. 31, 2011 Excise taxes $5.999.6 (1.793.5) 4,206.1 (2,545.6) 1,660.5 (1.193.8) (200,0) 539.0 805.7 $ 5,615.0 (1.698.5) 3,916.5 (2,352.5) 1,564.0 (1.126.1) (81.4) 510.9 867.4 $ 5,169.9 (1.654.2) 3,515.7 (2,049.1) 1,466.6 (1.019.0) (12.3) 457.9 893.2 (183.8) 13.7 (1963) 11.3 (90.3) (275.3) (118.7) 10.7 (11.0) (119.0) 18.9 (151.2) 654.5 592.1 774.2 (154.5) 437.6 (84.0) 570.5 2.0 572.5 (99.4) 674.8 2.3 1.5 439.1 677.1 (5.2) 3.9 (0.8) 567.3 443.0 676.3 Net sales Cost of goods sold Gross profit Marketing, general and administrative expenses Special items.net Equity Income in MillerCoors Operating income (loss) Other Income (expense), net Interest expense Interest income Other income (expense), net Total other Income (expense), net Income (loss) from continuing operations before income taxes Income tax benefit (expense) Net Income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Net Income (loss) including noncontrolling interests Less: Net (income) loss attributable to noncontrolling Interests Net income (loss) attributable to Molson Coors Brewing Company Basic net Income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations (in dollars per share) From discontinued operations (in dollars per share) Basic net income (loss) attributable to Molson Coors Brewing Company (in dollars per share) Diluted net income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations (in dollars per share) From discontinued operations (in dollars per share) Diluted net income (loss) attributable to Molson Coors Brewing Company (in dollars per share) Weighted average shares-basic Weighted average shares for diluted EPS Amounts attributable to Molson Coors Brewing Company Net income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Net income (loss) attributable to Molson Coors Brewing Company Retained earnings Other income (expense), net Net income (loss) including noncontrolling interests Net income (loss) attributable to Molson Coors Brewing Company Amounts attributable to Molson Coors Brewing Company Net income (loss) attributable to Molson Coors Brewing Company $ 3.09 $ 0.01 $ 2.44 $ 0.01 $ 3.65 $ 0.01 $ 3.10 $ 2.45 $ 3.66 $ 3.07 $ 0.01 $ 2.43 $ 0.01 $ 3.62 $ 0.01 $ 3.08 $ 2.44 $ 3.63 180.8 183.0 184.2 184.9 186.4 181.8 441,5 674.0 565.3 2.0 1.5 2.3 567.3 443.0 676.3 567.3 443.0 676.3 567.3 $ 567.3 12 Months Ended CONSOLIDATED STATEMENTS OF OPERATIONS (USD $) In Millions, except Per Share data, unless otherwise specified Seles Dec. 31, 2013 Dec. 29, 2012 Dec. 31, 2011 Excise taxes $5.999.6 (1.793.5) 4,206.1 (2,545.6) 1,660.5 (1.193.8) (200,0) 539.0 805.7 $ 5,615.0 (1.698.5) 3,916.5 (2,352.5) 1,564.0 (1.126.1) (81.4) 510.9 867.4 $ 5,169.9 (1.654.2) 3,515.7 (2,049.1) 1,466.6 (1.019.0) (12.3) 457.9 893.2 (183.8) 13.7 (1963) 11.3 (90.3) (275.3) (118.7) 10.7 (11.0) (119.0) 18.9 (151.2) 654.5 592.1 774.2 (154.5) 437.6 (84.0) 570.5 2.0 572.5 (99.4) 674.8 2.3 1.5 439.1 677.1 (5.2) 3.9 (0.8) 567.3 443.0 676.3 Net sales Cost of goods sold Gross profit Marketing, general and administrative expenses Special items.net Equity Income in MillerCoors Operating income (loss) Other Income (expense), net Interest expense Interest income Other income (expense), net Total other Income (expense), net Income (loss) from continuing operations before income taxes Income tax benefit (expense) Net Income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Net Income (loss) including noncontrolling interests Less: Net (income) loss attributable to noncontrolling Interests Net income (loss) attributable to Molson Coors Brewing Company Basic net Income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations (in dollars per share) From discontinued operations (in dollars per share) Basic net income (loss) attributable to Molson Coors Brewing Company (in dollars per share) Diluted net income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations (in dollars per share) From discontinued operations (in dollars per share) Diluted net income (loss) attributable to Molson Coors Brewing Company (in dollars per share) Weighted average shares-basic Weighted average shares for diluted EPS Amounts attributable to Molson Coors Brewing Company Net income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Net income (loss) attributable to Molson Coors Brewing Company Retained earnings Other income (expense), net Net income (loss) including noncontrolling interests Net income (loss) attributable to Molson Coors Brewing Company Amounts attributable to Molson Coors Brewing Company Net income (loss) attributable to Molson Coors Brewing Company $ 3.09 $ 0.01 $ 2.44 $ 0.01 $ 3.65 $ 0.01 $ 3.10 $ 2.45 $ 3.66 $ 3.07 $ 0.01 $ 2.43 $ 0.01 $ 3.62 $ 0.01 $ 3.08 $ 2.44 $ 3.63 180.8 183.0 184.2 184.9 186.4 181.8 441,5 674.0 565.3 2.0 1.5 2.3 567.3 443.0 676.3 567.3 443.0 676.3 567.3 $ 567.3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started