Answered step by step

Verified Expert Solution

Question

1 Approved Answer

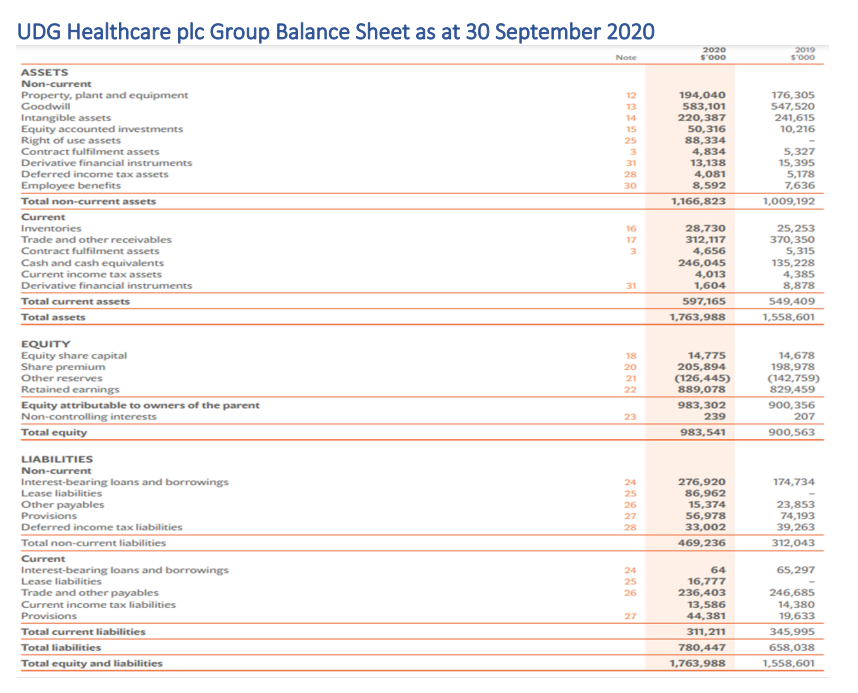

Calculate and analyze the Return on Equity (ROE) using the DuPont method for 2019 and 2020. II. Calculate the Current Ratio and Debt to Equity

Calculate and analyze the Return on Equity (ROE) using the DuPont method for 2019 and 2020.

II. Calculate the Current Ratio and Debt to Equity ratios and discuss the company's liquidity and solvency position with the help of these ratios.

III. Based on the ratios above, do you think UDG is a viable business? Justify

UDG Healthcare plc Group Balance Sheet as at 30 September 2020 2020 2019 Note $'000 $'000 ASSETS Non-current Property, plant and equipment Goodwill Intangible assets Equity accounted investments Right of use assets Contract fulfilment assets Derivative financial instruments Deferred income tax assets Employee benefits Total non-current assets Current Inventories Trade and other receivables Contract fulfilment assets Cash and cash equivalents Current income tax assets Derivative financial instruments Total current assets Total assets EQUITY Equity share capital Share premium Other reserves Retained earnings Equity attributable to owners of the parent Non-controlling interests Total equity LIABILITIES Non-current Interest-bearing loans and borrowings Lease liabilities Other payables Provisions Deferred income tax liabilities Total non-current liabilities Current Interest-bearing loans and borrowings Lease liabilities Trade and other payables Current income tax liabilities Provisions Total current liabilities Total liabilities Total equity and liabilities 12 194,040 13 583,101 176,305 547,520 14 220,387 241,615 15 50,316 10,216 25 88,334 3 4,834 31 13,138 5,327 15,395 28 4,081 30 8,592 5,178 7,636 1,166,823 1,009,192 16 17 673 28,730 312,117 4,656 246,045 25,253 370,350 5,315 135,228 4,013 4,385 31 1,604 8,878 597,165 1,763,988 549,409 1,558,601 18 20 14,775 205,894 21 (126,445) 22 889,078 14,678 198,978 (142,759) 829,459 23 983,302 239 900,356 207 983,541 900,563 24 276,920 174,734 25 86,962 26 15,374 23,853 27 56,978 74,193 28 33,002 39,263 469,236 312,043 24 25 64 16,777 65,297 26 236,403 13,586 27 44,381 246,685 14,380 19,633 311,211 780,447 345,995 658,038 1,763,988 1,558,601

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started