Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Discuss the business's financial performance using UDG Healthcare plc Group's financial statement above. To address this question in full, you may consider the following: I.

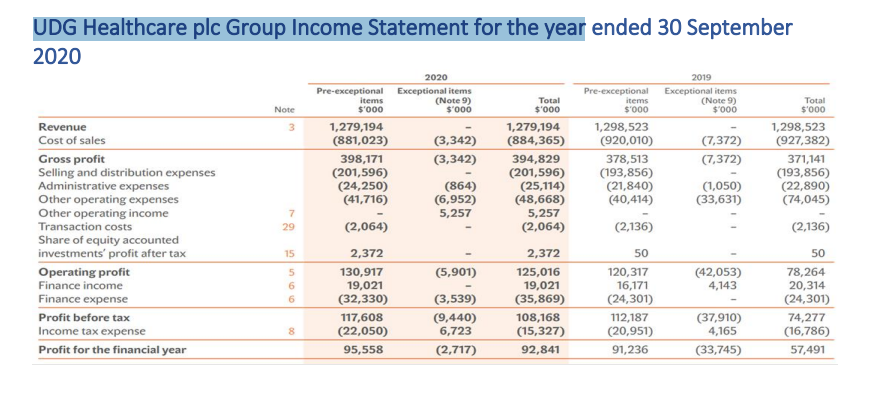

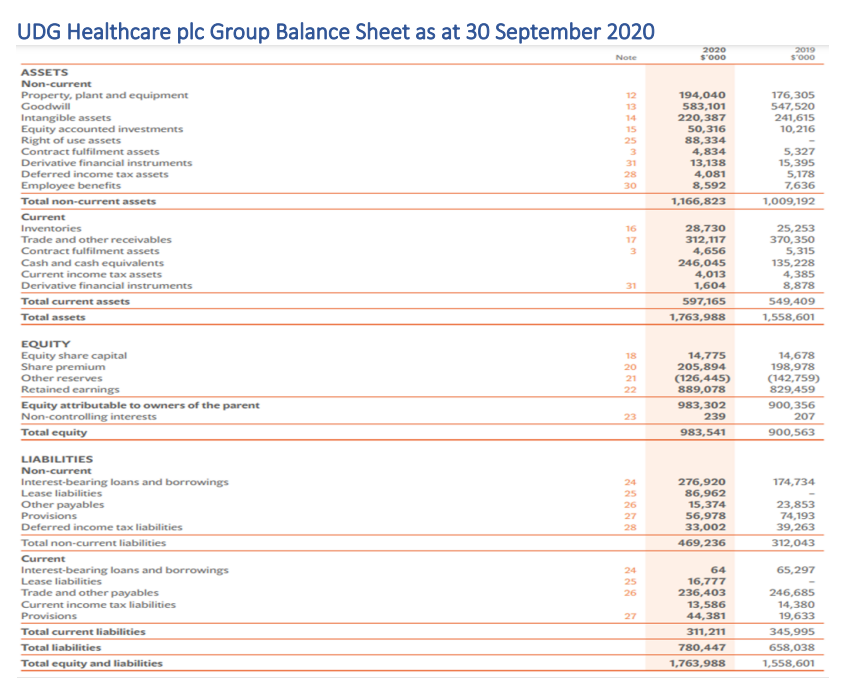

Discuss the business's financial performance using UDG Healthcare plc Group's financial statement above. To address this question in full, you may consider the following: I. Calculate and analyze the Return on Equity (ROE) using the DuPont method for 2019 and 2020.

II. Calculate the Current Ratio and Debt to Equity ratios and discuss the company's liquidity and solvency position with the help of these ratios.

III. Based on the ratios above, do you think UDG is a viable business? Justify

UDG Healthcare plc Group Income Statement for the year ended 30 September 2020 2020 Pre-exceptional Exceptional items Pre-exceptional Note items $'000 (Note 9) $'000 Total $'000 items $'000 2019 Exceptional items (Note 9) $'000 Total $'000 Revenue 3 1,279,194 Cost of sales (881,023) (3,342) 1,279,194 (884,365) 1,298,523 (920,010) 1,298,523 (7,372) (927,382) Gross profit 398,171 (3,342) 394,829 378,513 (7,372) 371,141 Selling and distribution expenses (201,596) (201,596) (193,856) (193,856) Administrative expenses (24,250) (864) (25,114) (21,840) (1,050) (22,890) Other operating expenses (41,716) (6,952) (48,668) (40,414) (33,631) (74,045) Other operating income 7 5,257 5,257 Transaction costs 29 (2,064) (2,064) (2,136) (2,136) Share of equity accounted investments' profit after tax 15 2,372 Operating profit Finance income Finance expense Profit before tax Income tax expense Profit for the financial year 8 596 00 130,917 19,021 (5,901) (32,330) (3,539) 2,372 125,016 19,021 (35,869) 50 50 120,317 16,171 (24,301) (42,053) 4,143 78,264 117,608 (9,440) 108,168 (22,050) 6,723 (15,327) 95,558 (2,717) 92,841 112,187 (20,951) 91,236 (37,910) 4,165 20,314 (24,301) 74,277 (16,786) (33,745) 57,491

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started