Question

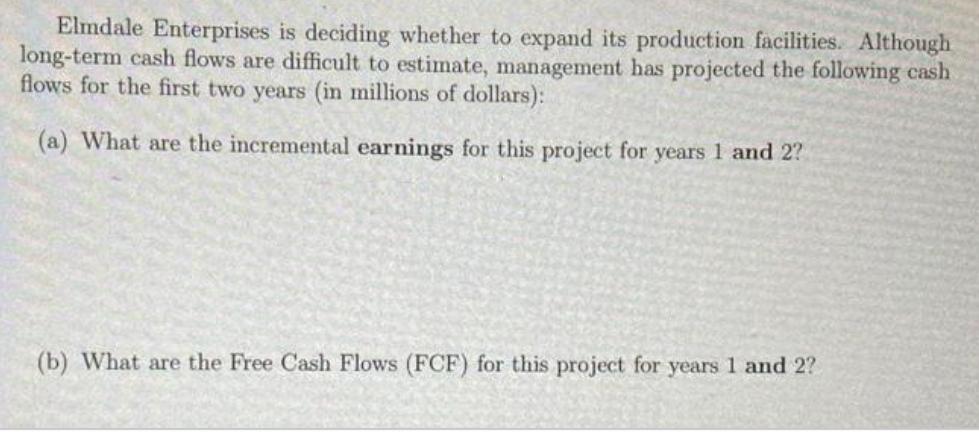

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash

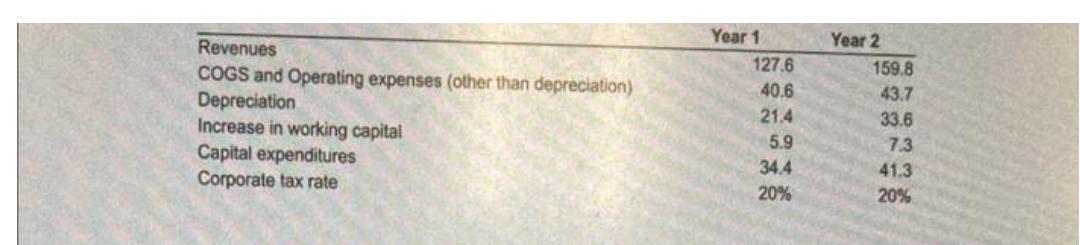

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): (a) What are the incremental earnings for this project for years 1 and 2? (b) What are the Free Cash Flows (FCF) for this project for years 1 and 2? Year 1 Year 2 Revenues 127.6 159.8 COGS and Operating expenses (other than depreciation) 40.6 43.7 Depreciation 21.4 33.6 Increase in working capital 5.9 7.3 Capital expenditures 34.4 41.3 Corporate tax rate 20% 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk and Peter DeMarzo

3rd edition

978-0132992473, 132992477, 978-0133097894

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App