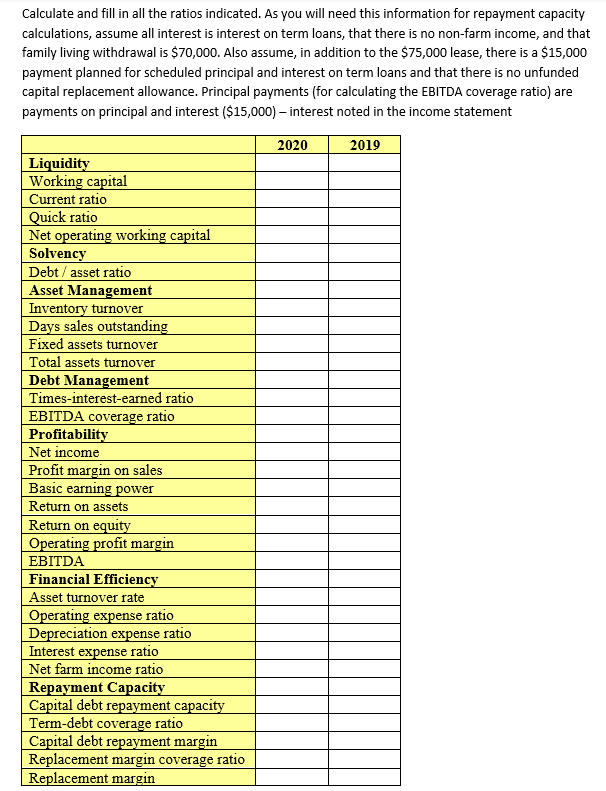

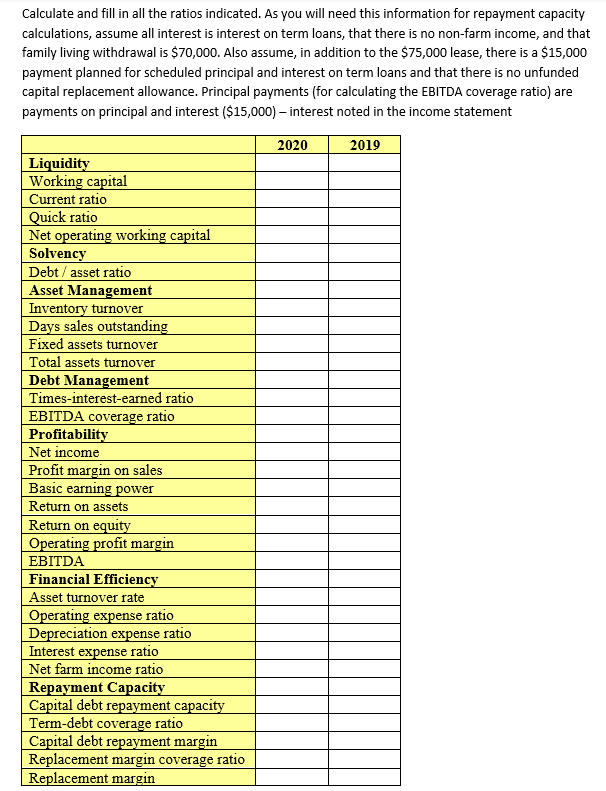

Calculate and fill in all the ratios indicated. As you will need this information for repayment capacity calculations, assume all interest is interest on term loans, that there is no non-farm income, and that family living withdrawal is $70,000. Also assume, in addition to the $75,000 lease, there is a $15,000 payment planned for scheduled principal and interest on term loans and that there is no unfunded capital replacement allowance. Principal payments (for calculating the EBITDA coverage ratio) are payments on principal and interest ($15,000) interest noted in the income statement 2020 2019 Liquidity Working capital Current ratio Quick ratio Net operating working capital Solvency Debt/asset ratio Asset Management Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Debt Management Times-interest-earned ratio EBITDA coverage ratio Profitability Net income Profit margin on sales Basic earning power Return on assets Return on equity Operating profit margin EBITDA Financial Efficiency Asset turnover rate Operating expense ratio Depreciation expense ratio Interest expense ratio Net farm income ratio Repayment Capacity Capital debt repayment capacity Term-debt coverage ratio Capital debt repayment margin Replacement margin coverage ratio Replacement margin Calculate and fill in all the ratios indicated. As you will need this information for repayment capacity calculations, assume all interest is interest on term loans, that there is no non-farm income, and that family living withdrawal is $70,000. Also assume, in addition to the $75,000 lease, there is a $15,000 payment planned for scheduled principal and interest on term loans and that there is no unfunded capital replacement allowance. Principal payments (for calculating the EBITDA coverage ratio) are payments on principal and interest ($15,000) interest noted in the income statement 2020 2019 Liquidity Working capital Current ratio Quick ratio Net operating working capital Solvency Debt/asset ratio Asset Management Inventory turnover Days sales outstanding Fixed assets turnover Total assets turnover Debt Management Times-interest-earned ratio EBITDA coverage ratio Profitability Net income Profit margin on sales Basic earning power Return on assets Return on equity Operating profit margin EBITDA Financial Efficiency Asset turnover rate Operating expense ratio Depreciation expense ratio Interest expense ratio Net farm income ratio Repayment Capacity Capital debt repayment capacity Term-debt coverage ratio Capital debt repayment margin Replacement margin coverage ratio Replacement margin