Help mw solve (c) please

Help mw solve (c) please

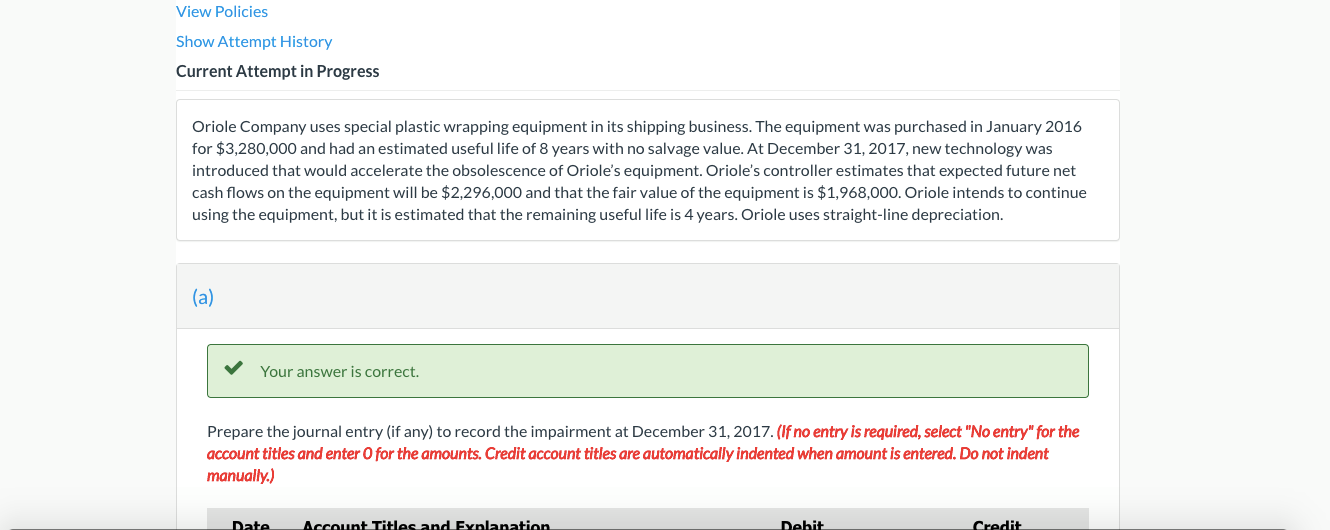

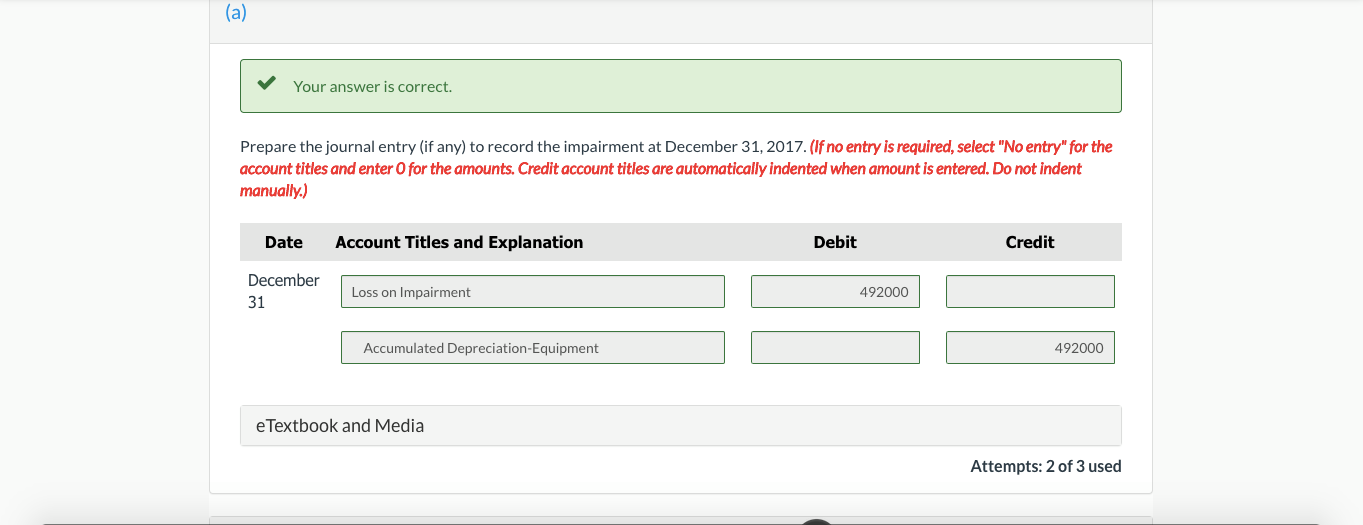

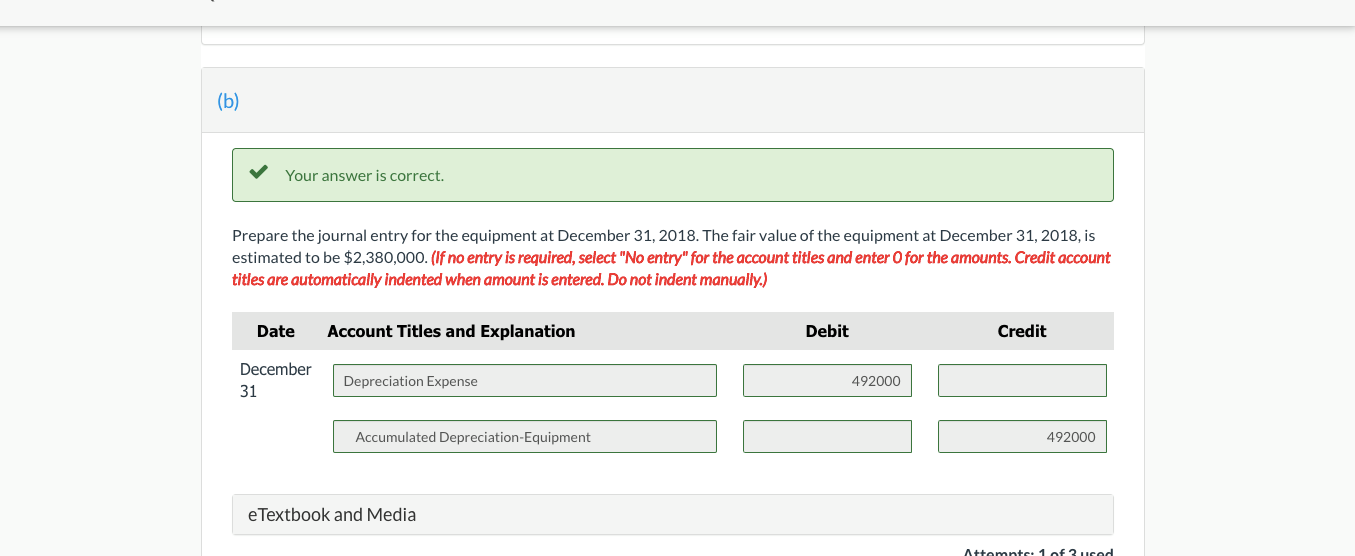

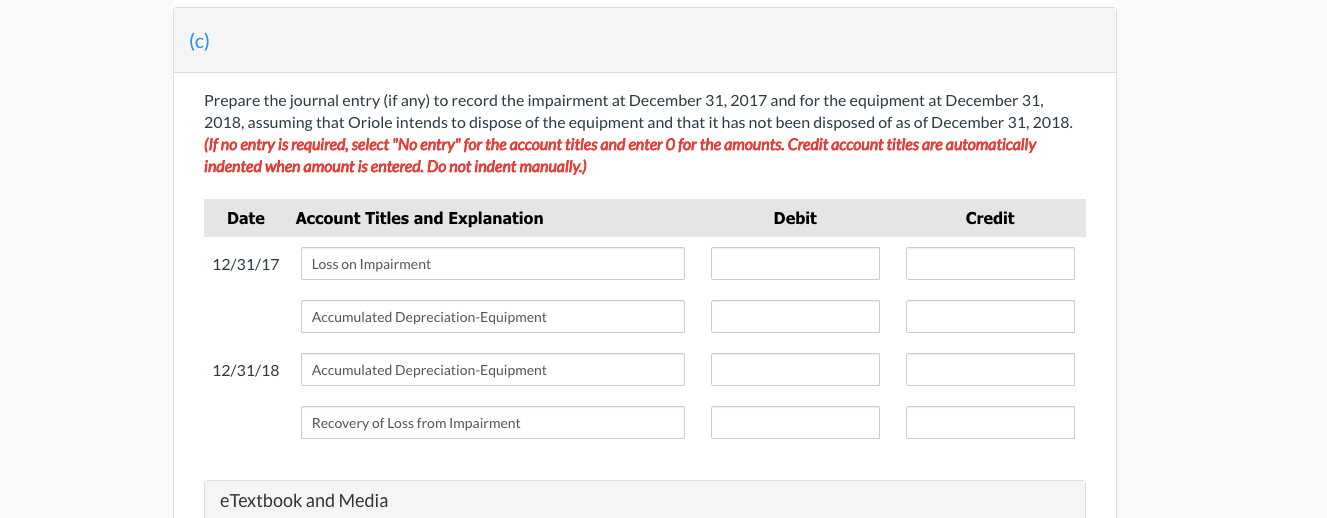

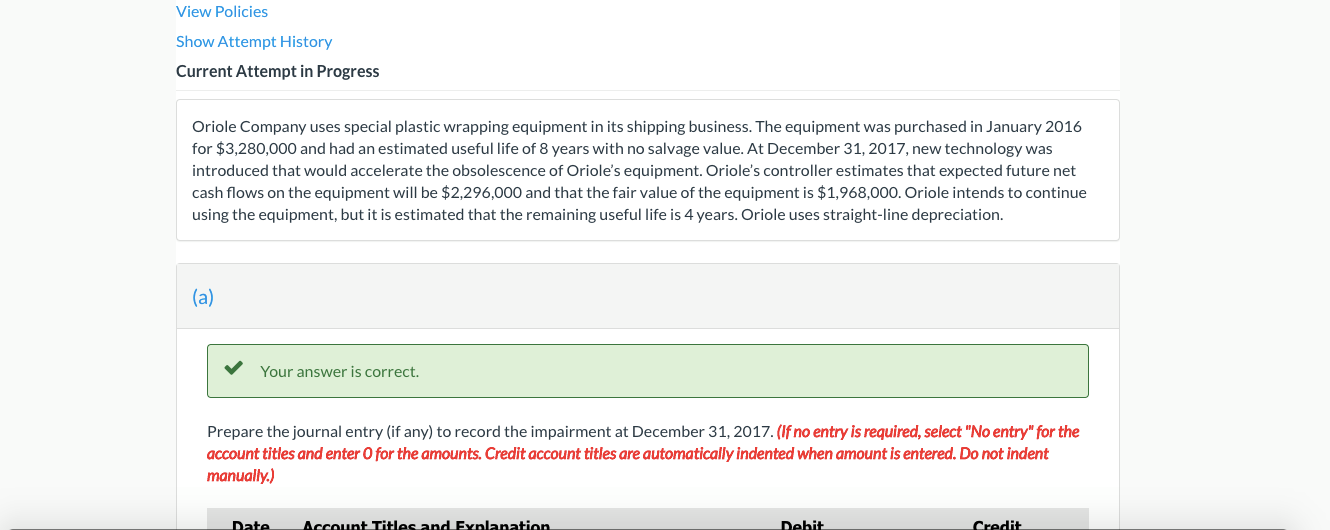

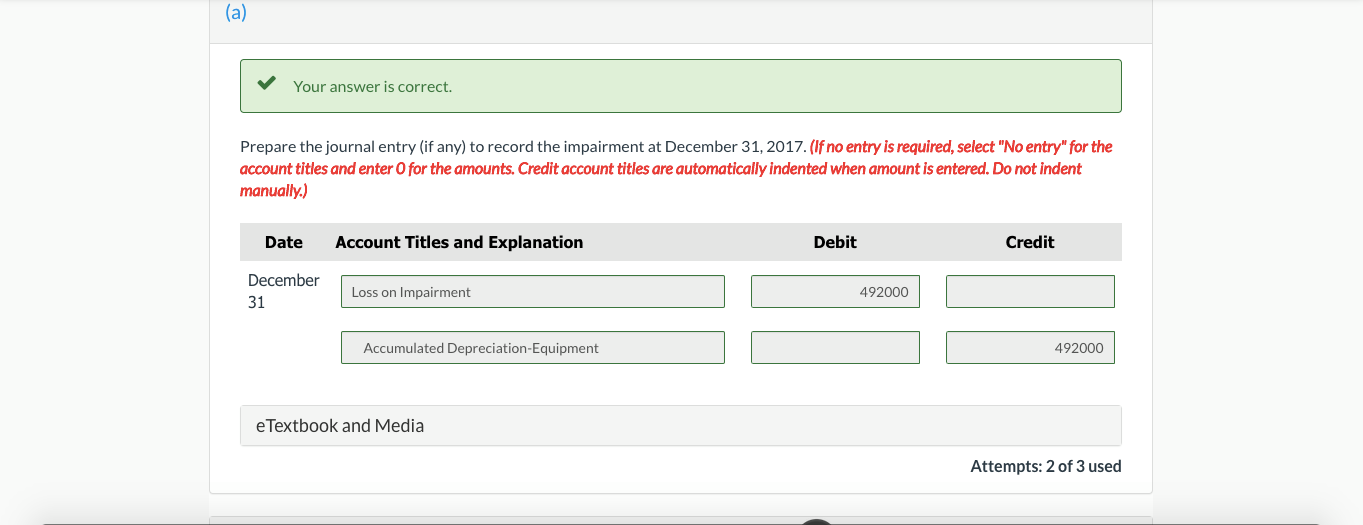

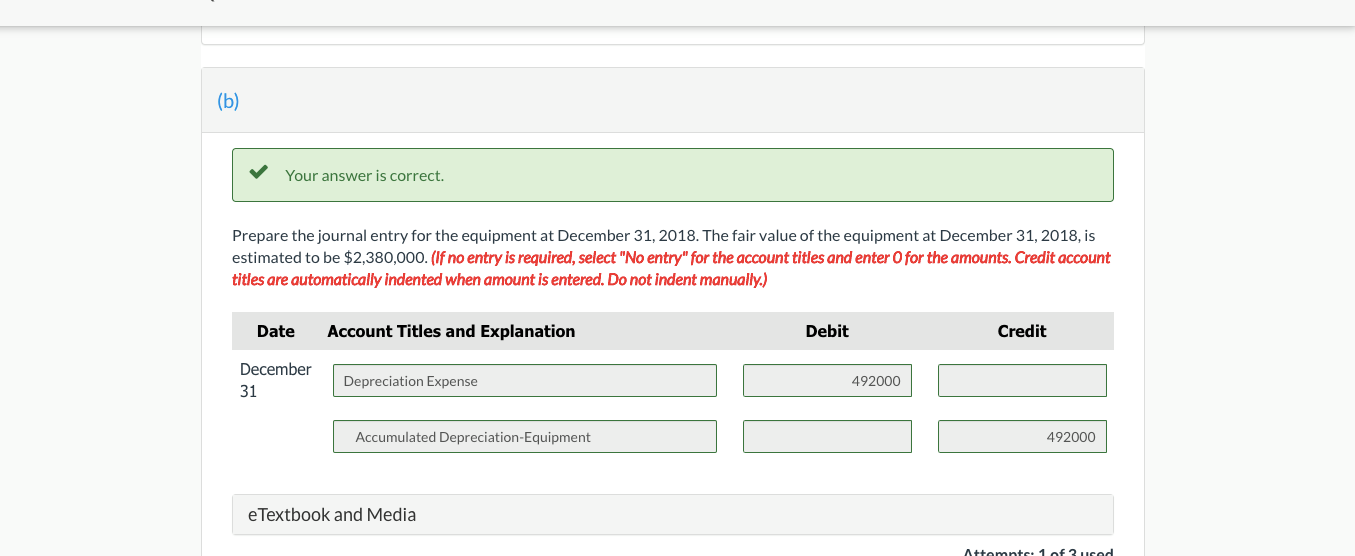

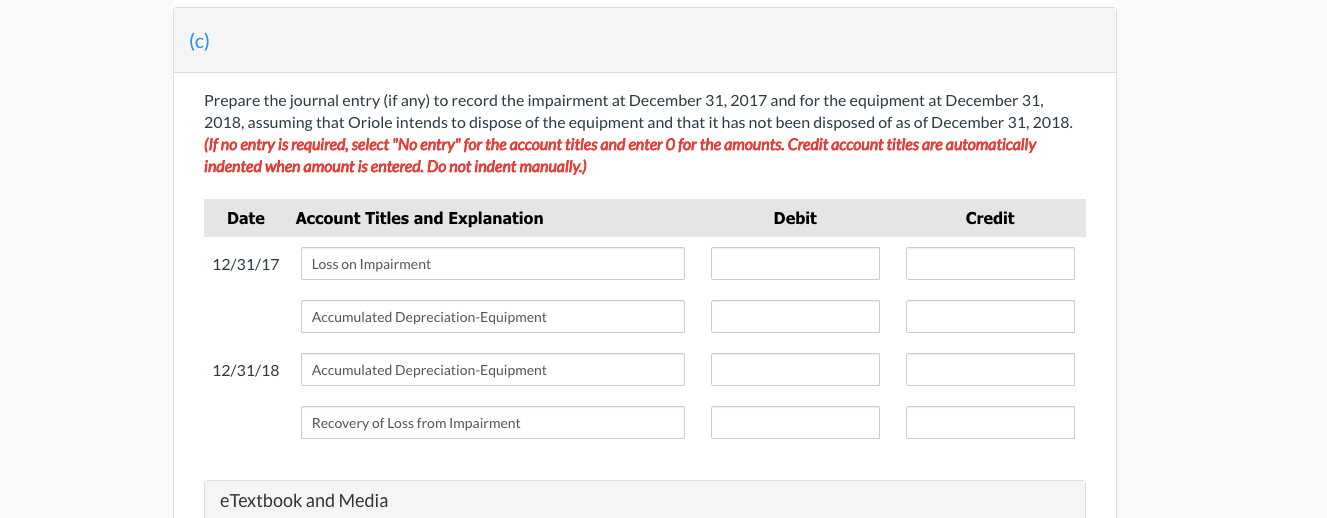

View Policies Show Attempt History Current Attempt in Progress Oriole Company uses special plastic wrapping equipment in its shipping business. The equipment was purchased in January 2016 for $3,280,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2017, new technology was introduced that would accelerate the obsolescence of Oriole's equipment. Oriole's controller estimates that expected future net cash flows on the equipment will be $2,296,000 and that the fair value of the equipment is $1,968,000. Oriole intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Oriole uses straight-line depreciation. (a) Your answer is correct. Prepare the journal entry (if any) to record the impairment at December 31, 2017. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Synlanation Debit Credit (a) Your answer is correct. Prepare the journal entry (if any) to record the impairment at December 31, 2017. (If no entry is required, select "No entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31 Loss on Impairment 492000 Accumulated Depreciation Equipment 492000 e Textbook and Media Attempts: 2 of 3 used (b) Your answer is correct. Prepare the journal entry for the equipment at December 31, 2018. The fair value of the equipment at December 31, 2018, is estimated to be $2,380,000. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31 Depreciation Expense 492000 Accumulated Depreciation-Equipment 492000 e Textbook and Media Attempte.1 of 3 usad (c) Prepare the journal entry (if any) to record the impairment at December 31, 2017 and for the equipment at December 31, 2018, assuming that Oriole intends to dispose of the equipment and that it has not been disposed of as of December 31, 2018. (If no entry is required, select "No entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 12/31/17 Loss on Impairment Accumulated Depreciation-Equipment 12/31/18 Accumulated Depreciation-Equipment Recovery of Loss from Impairment e Textbook and Media

Help mw solve (c) please

Help mw solve (c) please