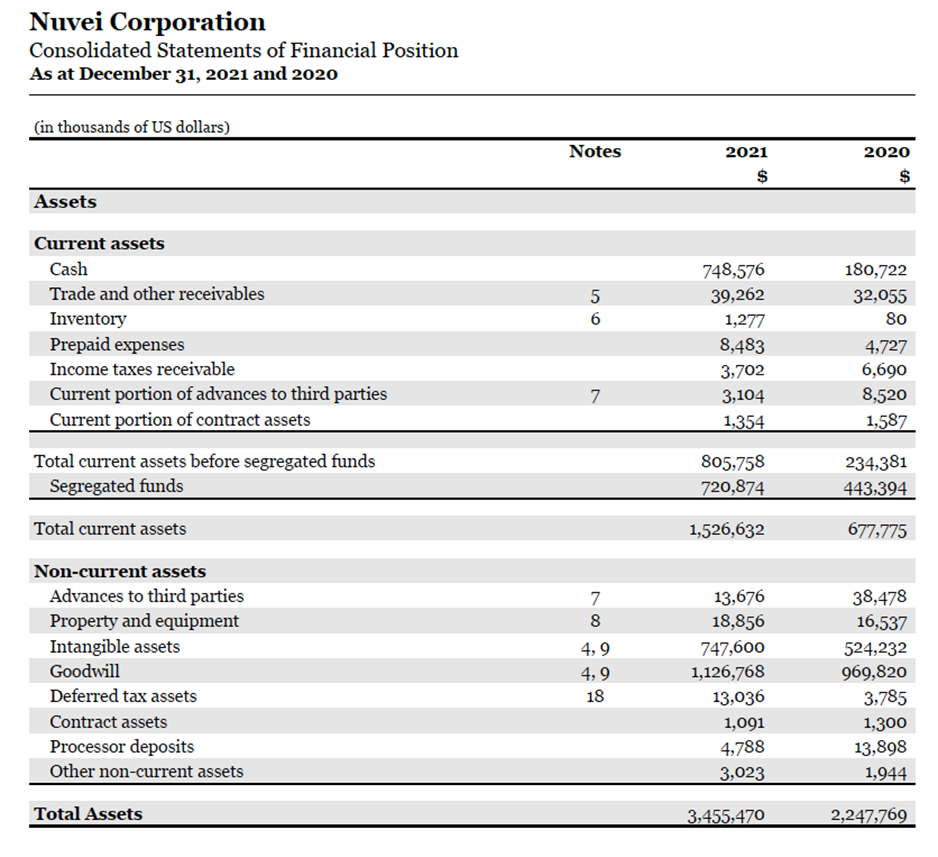

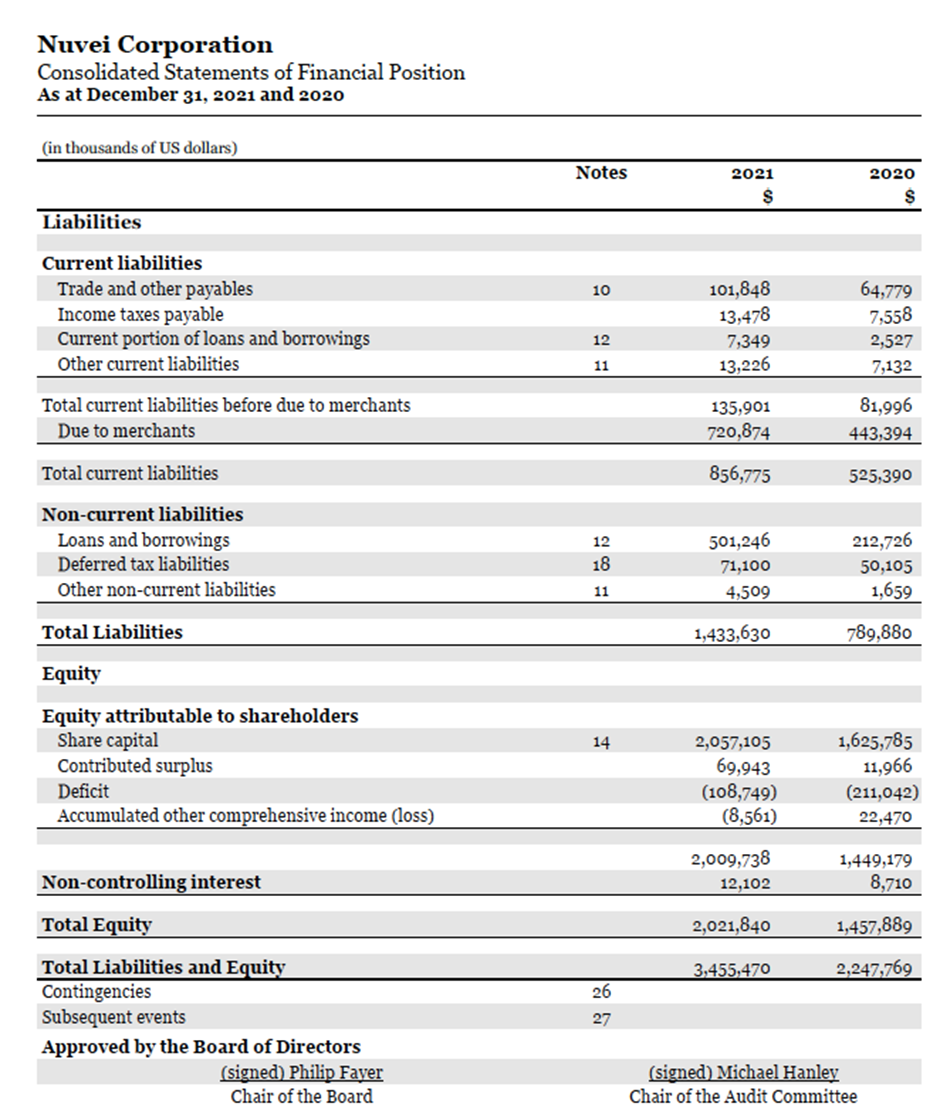

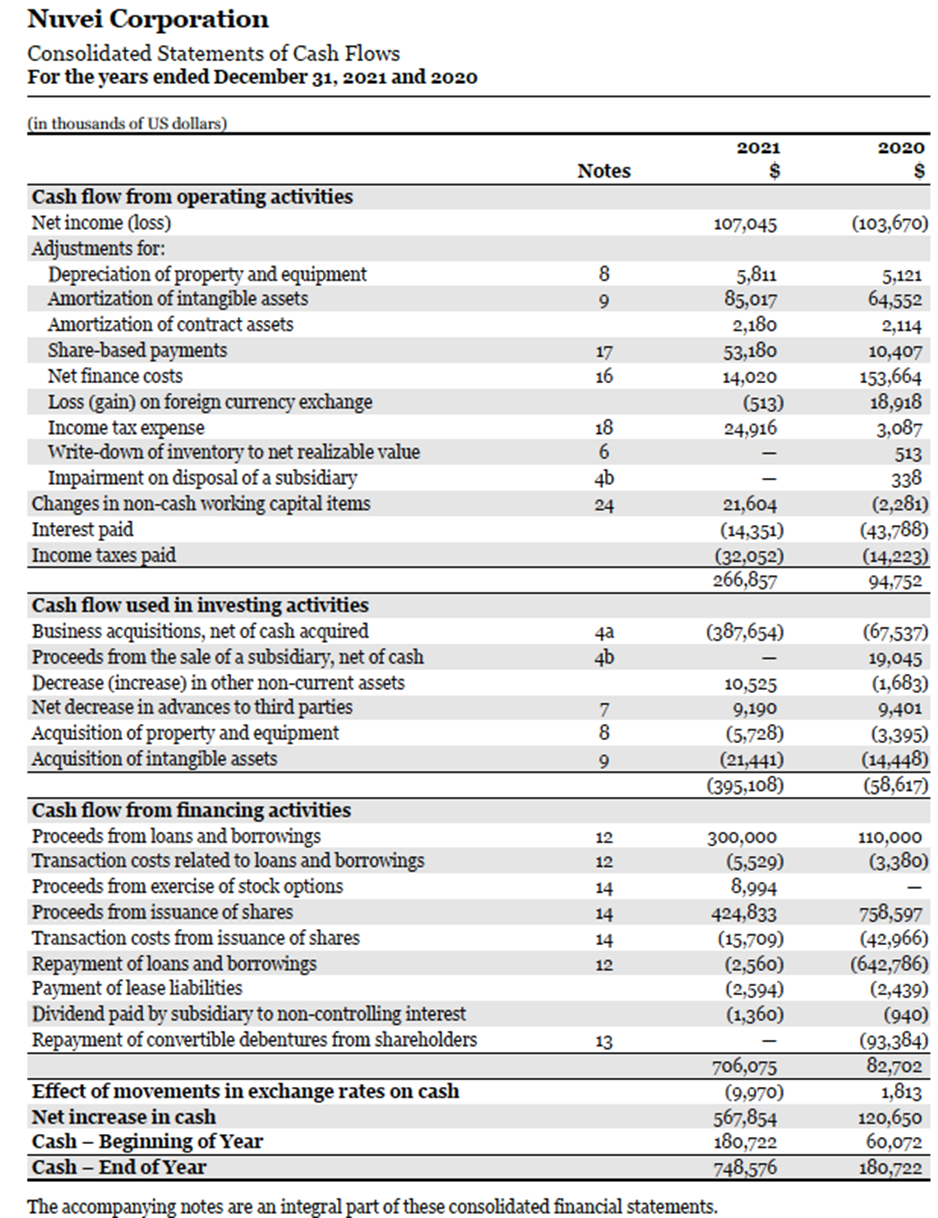

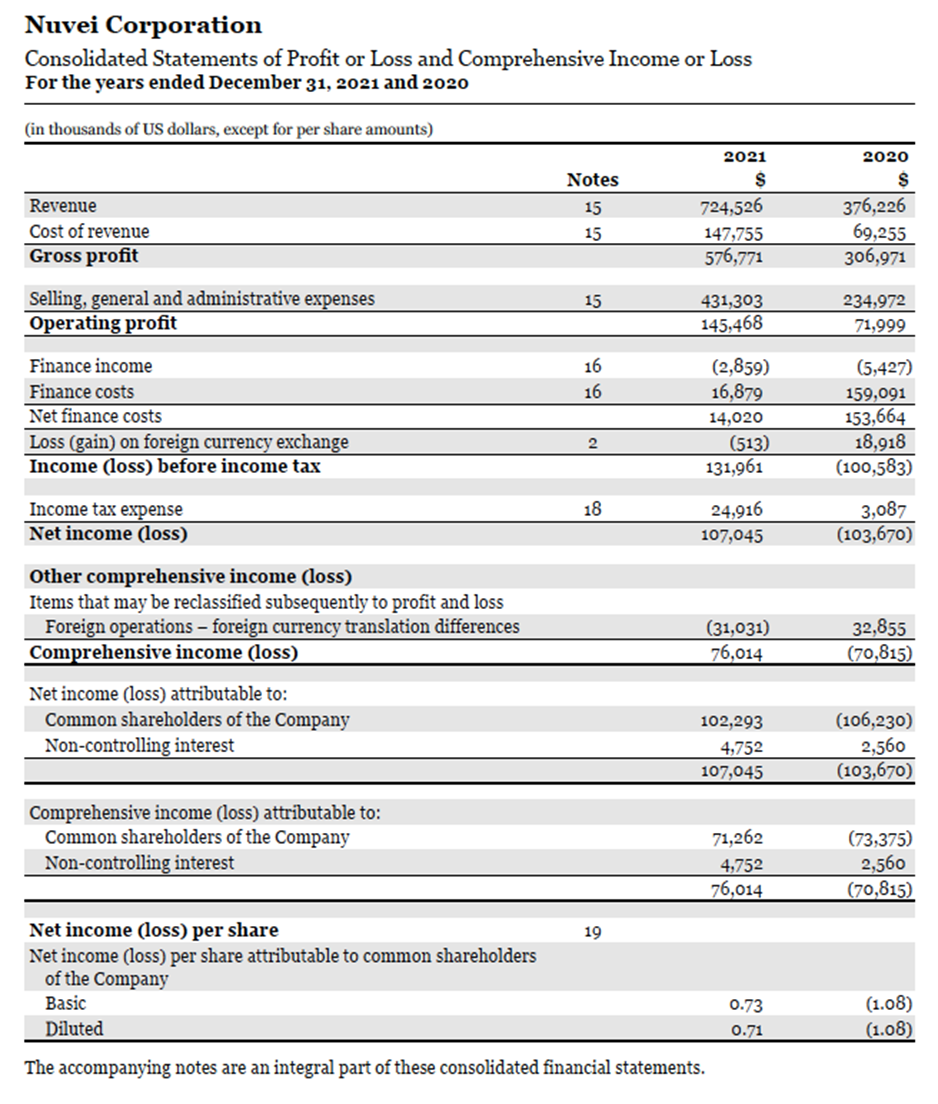

- Calculate and interpret ratios that used to analyze liquidity, solvency, and profitability (minimum two ratios for each category). Incorporate "trend" analysis where necessary. Show calculations in the Appendix.

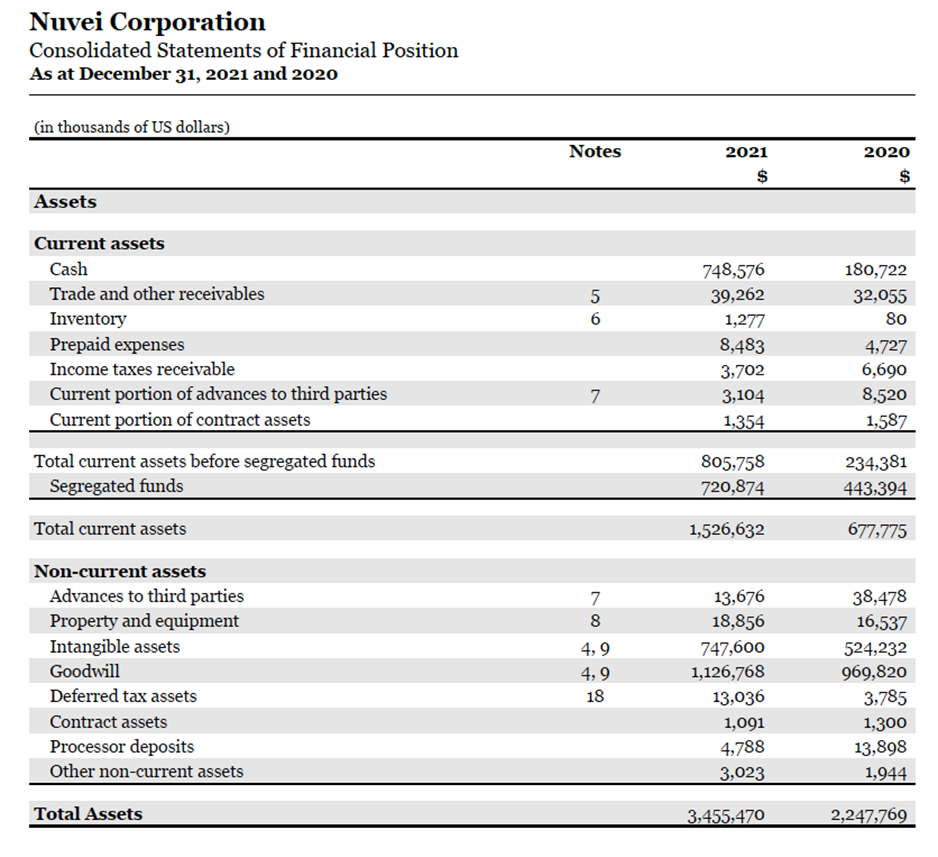

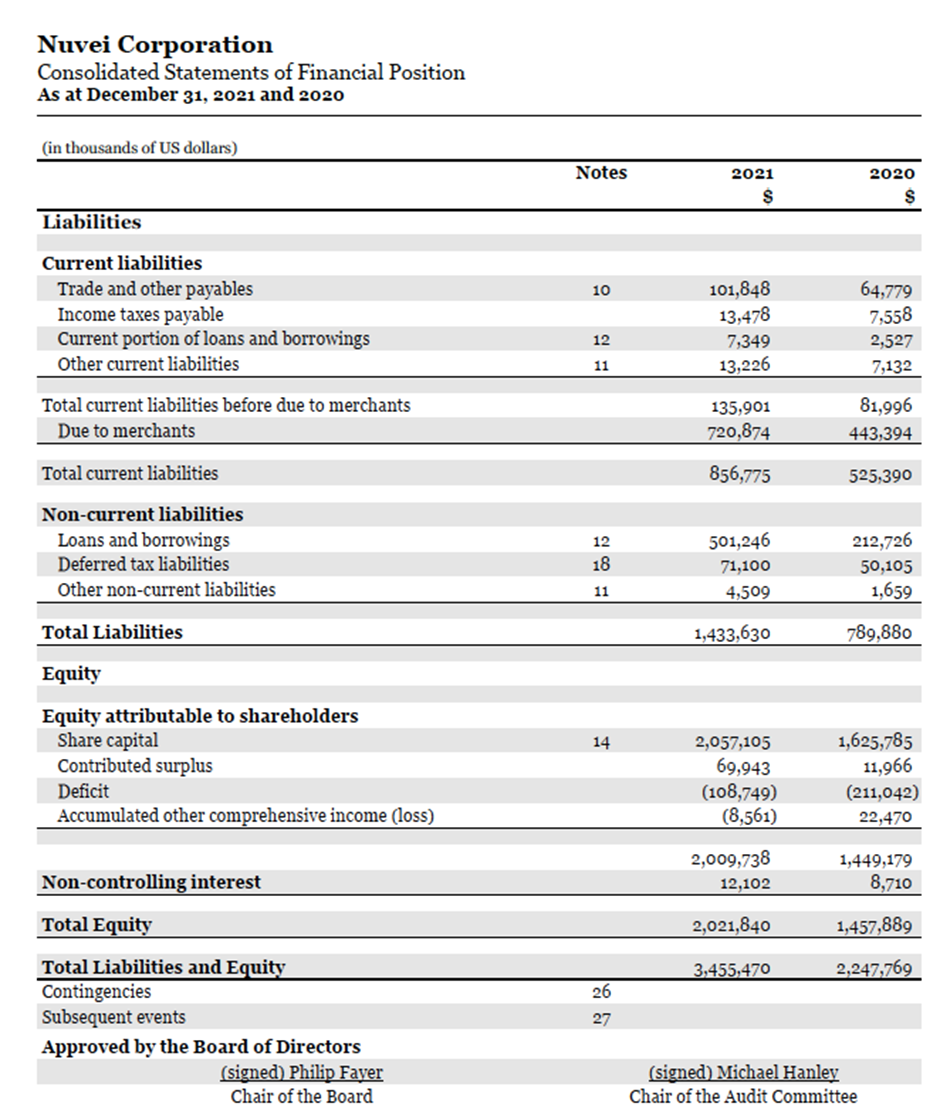

- Quick ratio/ current ratio/ Debt-to-Equity (D/E)/

- Debt to assets = Total debt / Total assets

- Profitability ratios

- Trend analysis for Year 2020 and 2021, ratios comparison with interpretations.

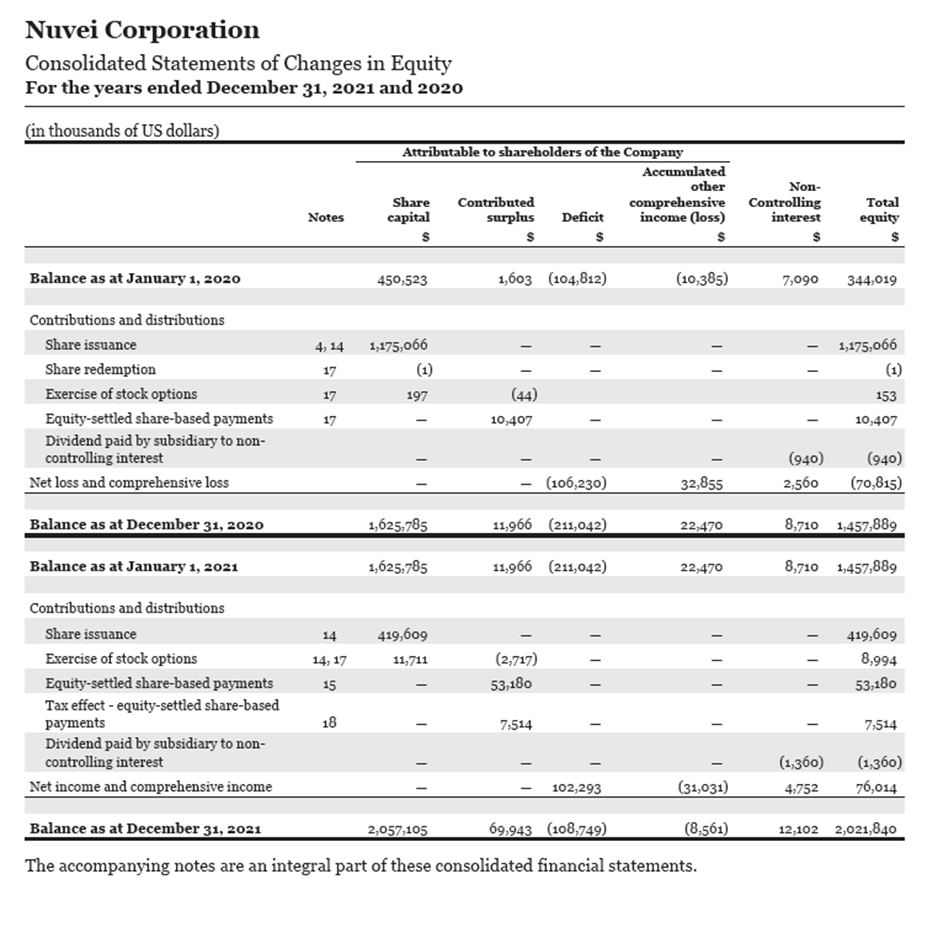

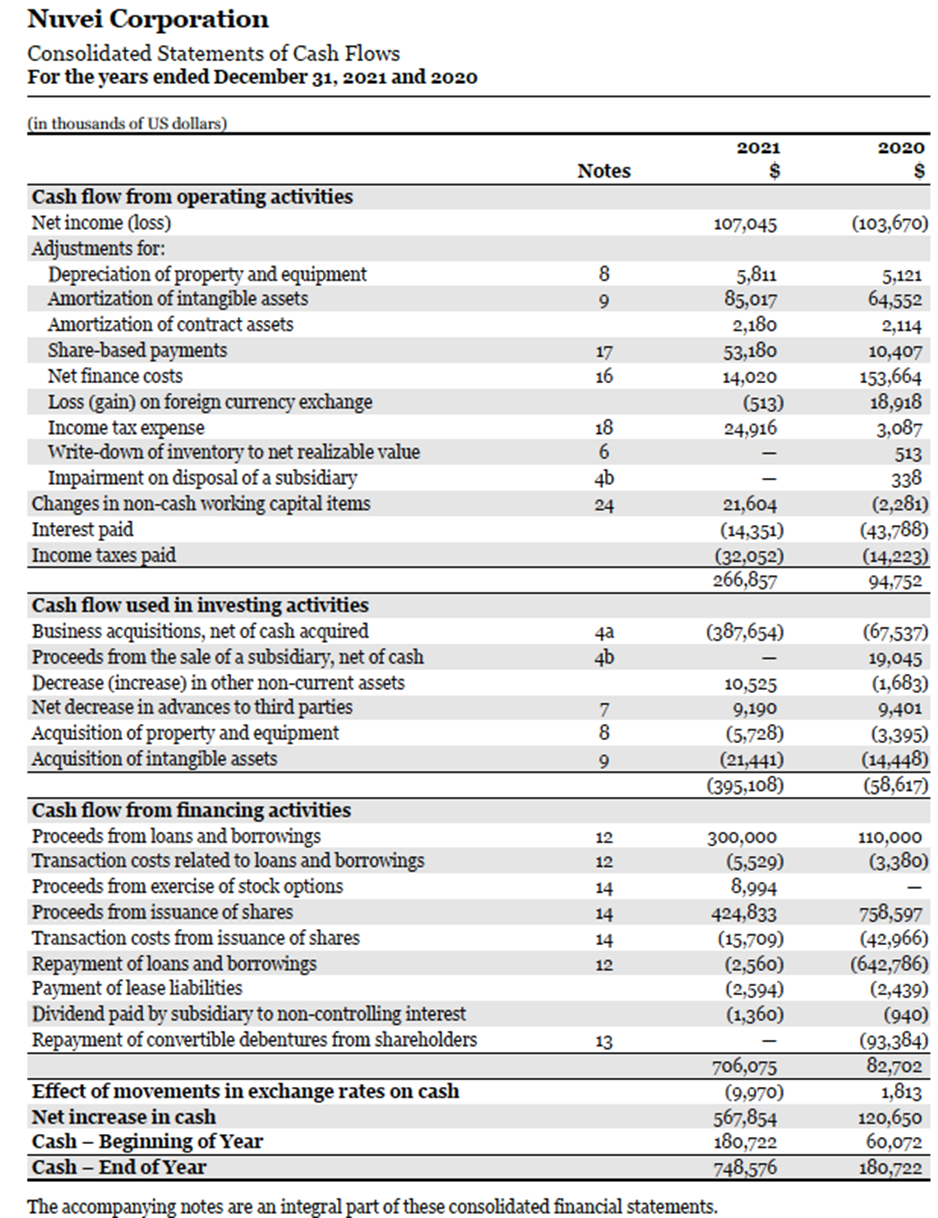

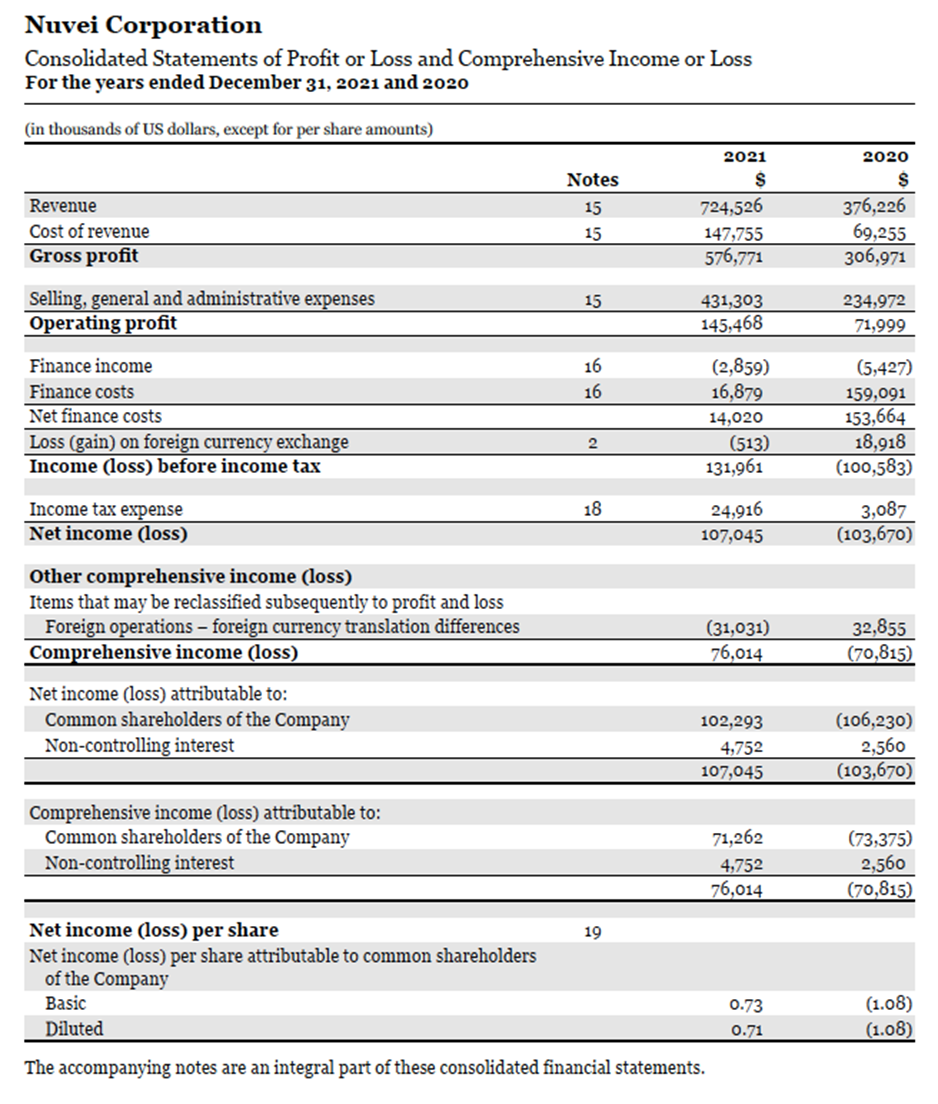

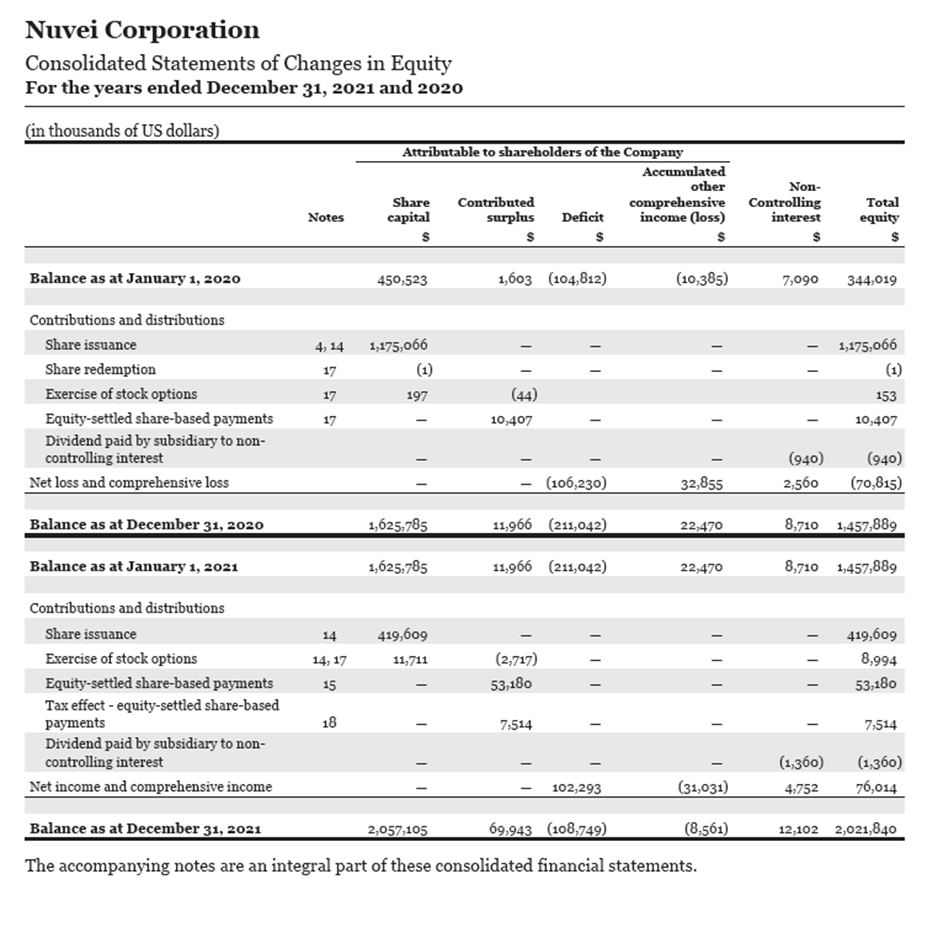

Nuvei Corporation Nuvei Corporation Nuvei Corporation Consolidated Statements of Cash Flows For the years ended December 31, 2021 and 2020 \begin{tabular}{|c|c|c|c|} \hline & & 2021 & 2020 \\ \hline & Notes & $ & \\ \hline \multicolumn{4}{|l|}{ Cash flow from operating activities } \\ \hline Net income (loss) & & 107,045 & (103,670) \\ \hline \multicolumn{4}{|l|}{ Adjustments for: } \\ \hline Depreciation of property and equipment & 8 & 5,811 & 5,121 \\ \hline Amortization of intangible assets & 9 & 85,017 & 64,552 \\ \hline Amortization of contract assets & & 2,180 & 2,114 \\ \hline Share-based payments & 17 & 53,180 & 10,407 \\ \hline Net finance costs & 16 & 14,020 & 153,664 \\ \hline Loss (gain) on foreign currency exchange & & (513) & 18,918 \\ \hline Income tax expense & 18 & 24,916 & 3,087 \\ \hline Write-down of inventory to net realizable value & 6 & - & 513 \\ \hline Impairment on disposal of a subsidiary & 4b & - & 338 \\ \hline Changes in non-cash working capital items & 24 & 21,604 & (2,281) \\ \hline Interest paid & & (14,351) & (43,788) \\ \hline \multirow[t]{2}{*}{ Income taxes paid } & & (32,052) & (14,223) \\ \hline & & 266,857 & 94,752 \\ \hline \multicolumn{4}{|l|}{ Cash flow used in investing activities } \\ \hline Business acquisitions, net of cash acquired & 4a & (387,654) & (67,537) \\ \hline Proceeds from the sale of a subsidiary, net of cash & 4b & - & 19,045 \\ \hline Decrease (increase) in other non-current assets & & 10,525 & (1,683) \\ \hline Net decrease in advances to third parties & 7 & 9,190 & 9,401 \\ \hline Acquisition of property and equipment & 8 & (5,728) & (3,395) \\ \hline \multirow[t]{2}{*}{ Acquisition of intangible assets } & 9 & (21,441) & (14,448) \\ \hline & & (395,108) & (58,617) \\ \hline \multicolumn{4}{|l|}{ Cash flow from financing activities } \\ \hline Proceeds from loans and borrorings & 12 & 300,000 & 110,000 \\ \hline Transaction costs related to loans and borrowings & 12 & (5,529) & (3,380) \\ \hline Proceeds from exercise of stock options & 14 & 8,994 & - \\ \hline Proceeds from issuance of shares & 14 & 424,833 & 758,597 \\ \hline Transaction costs from issuance of shares & 14 & (15,709) & (42,966) \\ \hline Repayment of loans and borrowings & 12 & (2,560) & (642,786) \\ \hline Payment of lease liabilities & & (2,594) & (2,439) \\ \hline Dividend paid by subsidiary to non-controlling interest & & (1,360) & (940) \\ \hline \multirow[t]{2}{*}{ Repayment of convertible debentures from shareholders } & 13 & - & (93,384) \\ \hline & & 706,075 & 82,702 \\ \hline Effect of movements in exchange rates on cash & & (9,970) & 1,813 \\ \hline Net increase in cash & & 567,854 & 120,650 \\ \hline Cash - Beginning of Year & & 180,722 & 60,072 \\ \hline Cash - End of Year & & 748,576 & 180,722 \\ \hline \end{tabular} The accompanying notes are an integral part of these consolidated financial statements. Nuvei Corporation Consolidated Statements of Profit or Loss and Comprehensive Income or Loss Nuvei Corporation Consolidated Statements of Changes in Equity For the years ended December 31, 2021 and 2020 Nuvei Corporation Nuvei Corporation Nuvei Corporation Consolidated Statements of Cash Flows For the years ended December 31, 2021 and 2020 \begin{tabular}{|c|c|c|c|} \hline & & 2021 & 2020 \\ \hline & Notes & $ & \\ \hline \multicolumn{4}{|l|}{ Cash flow from operating activities } \\ \hline Net income (loss) & & 107,045 & (103,670) \\ \hline \multicolumn{4}{|l|}{ Adjustments for: } \\ \hline Depreciation of property and equipment & 8 & 5,811 & 5,121 \\ \hline Amortization of intangible assets & 9 & 85,017 & 64,552 \\ \hline Amortization of contract assets & & 2,180 & 2,114 \\ \hline Share-based payments & 17 & 53,180 & 10,407 \\ \hline Net finance costs & 16 & 14,020 & 153,664 \\ \hline Loss (gain) on foreign currency exchange & & (513) & 18,918 \\ \hline Income tax expense & 18 & 24,916 & 3,087 \\ \hline Write-down of inventory to net realizable value & 6 & - & 513 \\ \hline Impairment on disposal of a subsidiary & 4b & - & 338 \\ \hline Changes in non-cash working capital items & 24 & 21,604 & (2,281) \\ \hline Interest paid & & (14,351) & (43,788) \\ \hline \multirow[t]{2}{*}{ Income taxes paid } & & (32,052) & (14,223) \\ \hline & & 266,857 & 94,752 \\ \hline \multicolumn{4}{|l|}{ Cash flow used in investing activities } \\ \hline Business acquisitions, net of cash acquired & 4a & (387,654) & (67,537) \\ \hline Proceeds from the sale of a subsidiary, net of cash & 4b & - & 19,045 \\ \hline Decrease (increase) in other non-current assets & & 10,525 & (1,683) \\ \hline Net decrease in advances to third parties & 7 & 9,190 & 9,401 \\ \hline Acquisition of property and equipment & 8 & (5,728) & (3,395) \\ \hline \multirow[t]{2}{*}{ Acquisition of intangible assets } & 9 & (21,441) & (14,448) \\ \hline & & (395,108) & (58,617) \\ \hline \multicolumn{4}{|l|}{ Cash flow from financing activities } \\ \hline Proceeds from loans and borrorings & 12 & 300,000 & 110,000 \\ \hline Transaction costs related to loans and borrowings & 12 & (5,529) & (3,380) \\ \hline Proceeds from exercise of stock options & 14 & 8,994 & - \\ \hline Proceeds from issuance of shares & 14 & 424,833 & 758,597 \\ \hline Transaction costs from issuance of shares & 14 & (15,709) & (42,966) \\ \hline Repayment of loans and borrowings & 12 & (2,560) & (642,786) \\ \hline Payment of lease liabilities & & (2,594) & (2,439) \\ \hline Dividend paid by subsidiary to non-controlling interest & & (1,360) & (940) \\ \hline \multirow[t]{2}{*}{ Repayment of convertible debentures from shareholders } & 13 & - & (93,384) \\ \hline & & 706,075 & 82,702 \\ \hline Effect of movements in exchange rates on cash & & (9,970) & 1,813 \\ \hline Net increase in cash & & 567,854 & 120,650 \\ \hline Cash - Beginning of Year & & 180,722 & 60,072 \\ \hline Cash - End of Year & & 748,576 & 180,722 \\ \hline \end{tabular} The accompanying notes are an integral part of these consolidated financial statements. Nuvei Corporation Consolidated Statements of Profit or Loss and Comprehensive Income or Loss Nuvei Corporation Consolidated Statements of Changes in Equity For the years ended December 31, 2021 and 2020