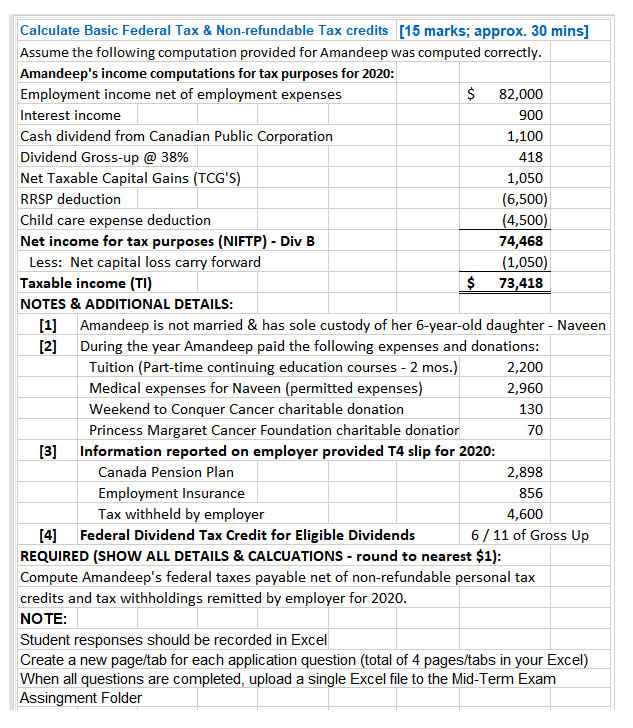

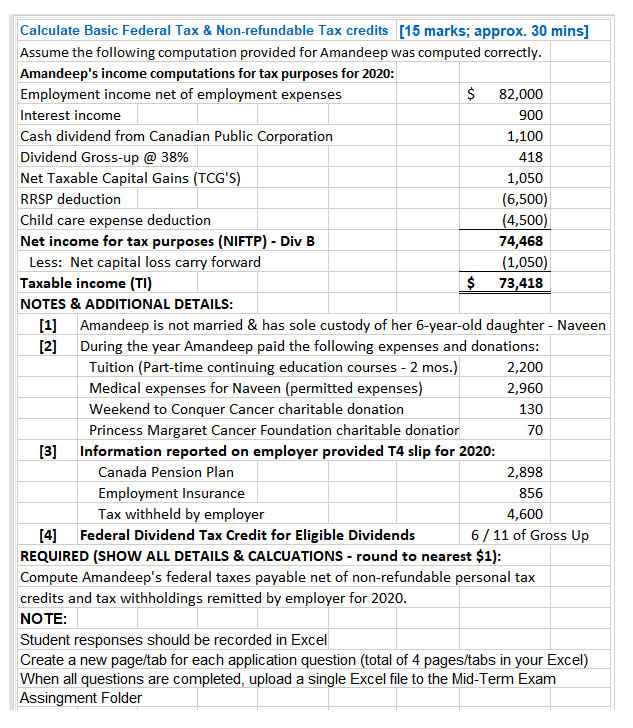

Calculate Basic Federal Tax & Non-refundable Tax credits [15 marks; approx. 30 mins] Assume the following computation provided for Amandeep was computed correctly. Amandeep's income computations for tax purposes for 2020: Employment income net of employment expenses $ 82,000 Interest income 900 Cash dividend from Canadian Public Corporation 1,100 Dividend Gross-up @ 38% 418 Net Taxable Capital Gains (TCG'S) 1,050 RRSP deduction (6,500) Child care expense deduction (4,500) Net income for tax purposes (NIFTP) - Div B 74,468 Less: Net capital loss carry forward (1,050) Taxable income (TI) $ 73,418 NOTES & ADDITIONAL DETAILS: [1] Amandeep is not married & has sole custody of her 6-year-old daughter - Naveen [2] During the year Amandeep paid the following expenses and donations: Tuition (Part-time continuing education courses - 2 mos.) 2,200 Medical expenses for Naveen (permitted expenses) 2,960 Weekend to Conquer Cancer charitable donation 130 Princess Margaret Cancer Foundation charitable donation 70 Information reported on employer provided T4 slip for 2020: Canada Pension Plan 2,898 Employment Insurance 856 Tax withheld by employer 4,600 [4] Federal Dividend Tax Credit for Eligible Dividends 6 / 11 of Gross Up REQUIRED (SHOW ALL DETAILS & CALCUATIONS - round to nearest $1): Compute Amandeep's federal taxes payable net of non-refundable personal tax credits and tax withholdings remitted by employer for 2020. NOTE: Student responses should be recorded in Excel Create a new page/tab for each application question (total of 4 pages/tabs in your Excel) When all questions are completed, upload a single Excel file to the Mid-Term Exam Assingment Folder [3] Calculate Basic Federal Tax & Non-refundable Tax credits [15 marks; approx. 30 mins] Assume the following computation provided for Amandeep was computed correctly. Amandeep's income computations for tax purposes for 2020: Employment income net of employment expenses $ 82,000 Interest income 900 Cash dividend from Canadian Public Corporation 1,100 Dividend Gross-up @ 38% 418 Net Taxable Capital Gains (TCG'S) 1,050 RRSP deduction (6,500) Child care expense deduction (4,500) Net income for tax purposes (NIFTP) - Div B 74,468 Less: Net capital loss carry forward (1,050) Taxable income (TI) $ 73,418 NOTES & ADDITIONAL DETAILS: [1] Amandeep is not married & has sole custody of her 6-year-old daughter - Naveen [2] During the year Amandeep paid the following expenses and donations: Tuition (Part-time continuing education courses - 2 mos.) 2,200 Medical expenses for Naveen (permitted expenses) 2,960 Weekend to Conquer Cancer charitable donation 130 Princess Margaret Cancer Foundation charitable donation 70 Information reported on employer provided T4 slip for 2020: Canada Pension Plan 2,898 Employment Insurance 856 Tax withheld by employer 4,600 [4] Federal Dividend Tax Credit for Eligible Dividends 6 / 11 of Gross Up REQUIRED (SHOW ALL DETAILS & CALCUATIONS - round to nearest $1): Compute Amandeep's federal taxes payable net of non-refundable personal tax credits and tax withholdings remitted by employer for 2020. NOTE: Student responses should be recorded in Excel Create a new page/tab for each application question (total of 4 pages/tabs in your Excel) When all questions are completed, upload a single Excel file to the Mid-Term Exam Assingment Folder [3]