Answered step by step

Verified Expert Solution

Question

1 Approved Answer

calculate below image Abby Ltd is a manufacturing company located in Nilai, Negeri Sembilan. The records of Abby Limited include the following balances as at

calculate below image

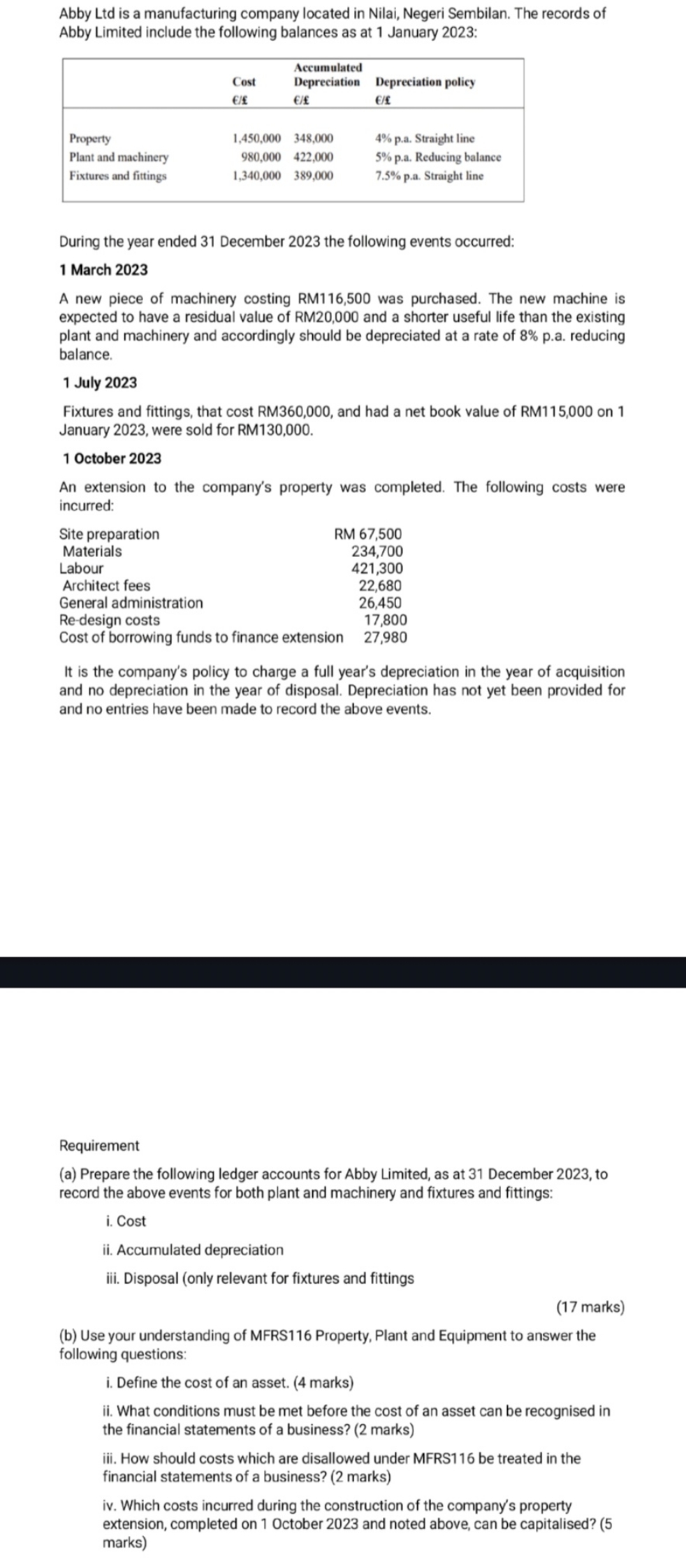

Abby Ltd is a manufacturing company located in Nilai, Negeri Sembilan. The records of Abby Limited include the following balances as at 1 January 2023: Cost Accumulated Depreciation / / Depreciation policy E/E Property 1,450,000 348,000 4% p.a. Straight line Plant and machinery 980,000 422,000 Fixtures and fittings 1,340,000 389,000 5% p.a. Reducing balance 7.5% p.a. Straight line During the year ended 31 December 2023 the following events occurred: 1 March 2023 A new piece of machinery costing RM116,500 was purchased. The new machine is expected to have a residual value of RM20,000 and a shorter useful life than the existing plant and machinery and accordingly should be depreciated at a rate of 8% p.a. reducing balance. 1 July 2023 Fixtures and fittings, that cost RM360,000, and had a net book value of RM115,000 on 1 January 2023, were sold for RM130,000. 1 October 2023 An extension to the company's property was completed. The following costs were incurred: Site preparation Materials Labour Architect fees General administration Re-design costs RM 67,500 234,700 421,300 22,680 26,450 17,800 Cost of borrowing funds to finance extension 27,980 It is the company's policy to charge a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. Depreciation has not yet been provided for and no entries have been made to record the above events. Requirement (a) Prepare the following ledger accounts for Abby Limited, as at 31 December 2023, to record the above events for both plant and machinery and fixtures and fittings: i. Cost ii. Accumulated depreciation iii. Disposal (only relevant for fixtures and fittings (17 marks) (b) Use your understanding of MFRS116 Property, Plant and Equipment to answer the following questions: i. Define the cost of an asset. (4 marks) ii. What conditions must be met before the cost of an asset can be recognised in the financial statements of a business? (2 marks) iii. How should costs which are disallowed under MFRS116 be treated in the financial statements of a business? (2 marks) iv. Which costs incurred during the construction of the company's property extension, completed on 1 October 2023 and noted above, can be capitalised? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started