Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate Carnivals net income for tax purpose for 2020 For the year ending December 31, 2020, Carnival Limited determined that net income, calculated in accordance

Calculate Carnivals net income for tax purpose for 2020

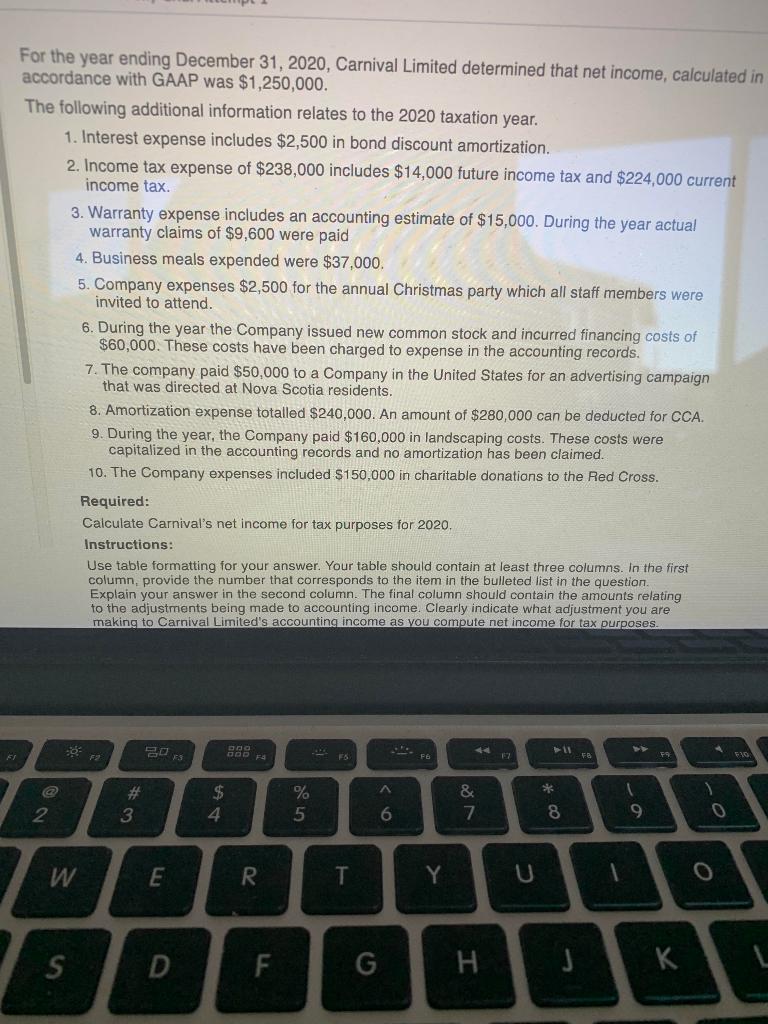

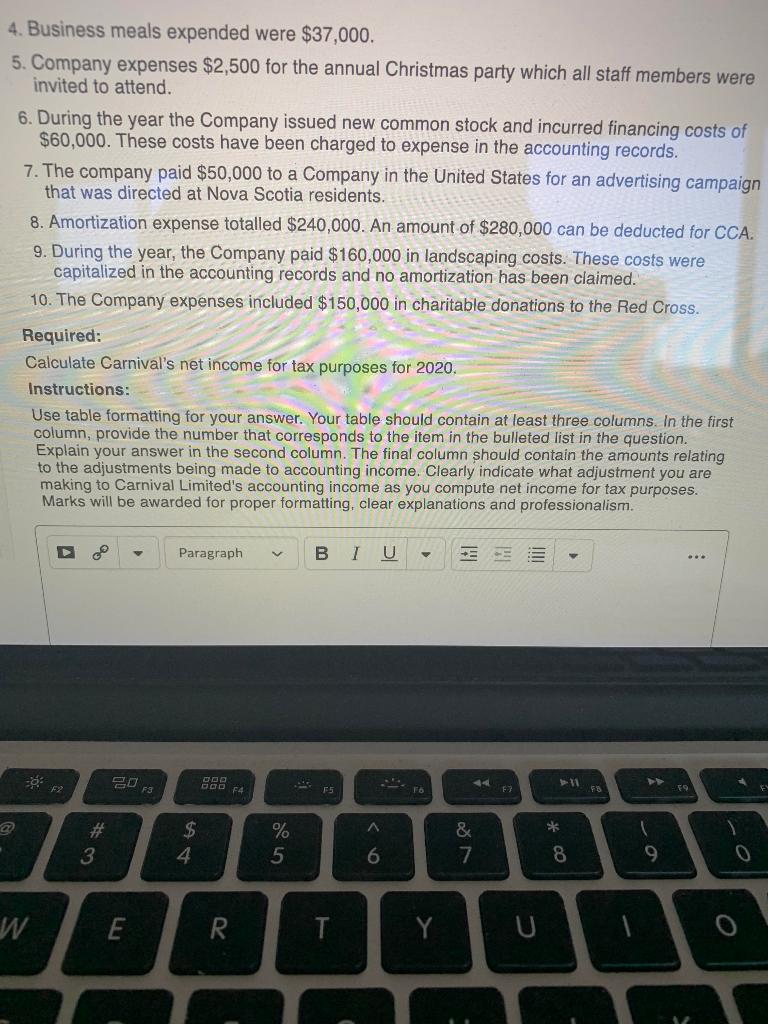

For the year ending December 31, 2020, Carnival Limited determined that net income, calculated in accordance with GAAP was $1,250,000. The following additional information relates to the 2020 taxation year. 1. Interest expense includes $2,500 in bond discount amortization. 2. Income tax expense of $238,000 includes $14,000 future income tax and $224,000 current income tax. 3. Warranty expense includes an accounting estimate of $15,000. During the year actual warranty claims of $9,600 were paid 4. Business meals expended were $37,000. 5. Company expenses $2,500 for the annual Christmas party which all staff members were invited to attend. 6. During the year the Company issued new common stock and incurred financing costs of $60,000. These costs have been charged to expense in the accounting records. 7. The company paid $50,000 to a Company in the United States for an advertising campaign that was directed at Nova Scotia residents. 8. Amortization expense totalled $240,000. An amount of $280,000 can be deducted for CCA. 9. During the year, the Company paid $160,000 in landscaping costs. These costs were capitalized in the accounting records and no amortization has been claimed. 10. The Company expenses included $150,000 in charitable donations to the Red Cross. Required: Calculate Carnival's net income for tax purposes for 2020. Instructions: Use table formatting for your answer. Your table should contain at least three columns. In the first column, provide the number that corresponds to the item in the bulleted list in the question Explain your answer in the second column. The final column should contain the amounts relating to the adjustments being made to accounting income. Clearly indicate what adjustment you are making to Carnival Limited's accounting income as you compute net income for tax purposes. 11 ES A #3 $ 4 % 5 & 7 * 2 6 8 9 0 W E R T Y U o S D F H J 4. Business meals expended were $37,000. 5. Company expenses $2,500 for the annual Christmas party which all staff members were invited to attend. 6. During the year the Company issued new common stock and incurred financing costs of $60,000. These costs have been charged to expense in the accounting records. 7. The company paid $50,000 to a Company in the United States for an advertising campaign that was directed at Nova Scotia residents. 8. Amortization expense totalled $240,000. An amount of $280,000 can be deducted for CCA. 9. During the year, the Company paid $160,000 in landscaping costs. These costs were capitalized in the accounting records and no amortization has been claimed. 10. The Company expenses included $150,000 in charitable donations to the Red Cross. Required: Calculate Carnival's net income for tax purposes for 2020. Instructions: Use table formatting for your answer. Your table should contain at least three columns. In the first column, provide the number that corresponds to the item in the bulleted list in the question. Explain your answer in the second column. The final column should contain the amounts relating to the adjustments being made to accounting income. Clearly indicate what adjustment you are making to Carnival Limited's accounting income as you compute net income for tax purposes. Marks will be awarded for proper formatting, clear explanations and professionalism. Paragraph V B 1 20 F3 11 F4 F5 FO E 59 * # 3 $ 4 % 5 & 7 6 8 9 W E R. Y For the year ending December 31, 2020, Carnival Limited determined that net income, calculated in accordance with GAAP was $1,250,000. The following additional information relates to the 2020 taxation year. 1. Interest expense includes $2,500 in bond discount amortization. 2. Income tax expense of $238,000 includes $14,000 future income tax and $224,000 current income tax. 3. Warranty expense includes an accounting estimate of $15,000. During the year actual warranty claims of $9,600 were paid 4. Business meals expended were $37,000. 5. Company expenses $2,500 for the annual Christmas party which all staff members were invited to attend. 6. During the year the Company issued new common stock and incurred financing costs of $60,000. These costs have been charged to expense in the accounting records. 7. The company paid $50,000 to a Company in the United States for an advertising campaign that was directed at Nova Scotia residents. 8. Amortization expense totalled $240,000. An amount of $280,000 can be deducted for CCA. 9. During the year, the Company paid $160,000 in landscaping costs. These costs were capitalized in the accounting records and no amortization has been claimed. 10. The Company expenses included $150,000 in charitable donations to the Red Cross. Required: Calculate Carnival's net income for tax purposes for 2020. Instructions: Use table formatting for your answer. Your table should contain at least three columns. In the first column, provide the number that corresponds to the item in the bulleted list in the question Explain your answer in the second column. The final column should contain the amounts relating to the adjustments being made to accounting income. Clearly indicate what adjustment you are making to Carnival Limited's accounting income as you compute net income for tax purposes. 11 ES A #3 $ 4 % 5 & 7 * 2 6 8 9 0 W E R T Y U o S D F H J 4. Business meals expended were $37,000. 5. Company expenses $2,500 for the annual Christmas party which all staff members were invited to attend. 6. During the year the Company issued new common stock and incurred financing costs of $60,000. These costs have been charged to expense in the accounting records. 7. The company paid $50,000 to a Company in the United States for an advertising campaign that was directed at Nova Scotia residents. 8. Amortization expense totalled $240,000. An amount of $280,000 can be deducted for CCA. 9. During the year, the Company paid $160,000 in landscaping costs. These costs were capitalized in the accounting records and no amortization has been claimed. 10. The Company expenses included $150,000 in charitable donations to the Red Cross. Required: Calculate Carnival's net income for tax purposes for 2020. Instructions: Use table formatting for your answer. Your table should contain at least three columns. In the first column, provide the number that corresponds to the item in the bulleted list in the question. Explain your answer in the second column. The final column should contain the amounts relating to the adjustments being made to accounting income. Clearly indicate what adjustment you are making to Carnival Limited's accounting income as you compute net income for tax purposes. Marks will be awarded for proper formatting, clear explanations and professionalism. Paragraph V B 1 20 F3 11 F4 F5 FO E 59 * # 3 $ 4 % 5 & 7 6 8 9 W E R. YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started