CALCULATE CASH BUDGET, BREAK EVEN POINT AND MARGIN OF SAFETY

CALCULATE CASH BUDGET, BREAK EVEN POINT AND MARGIN OF SAFETY

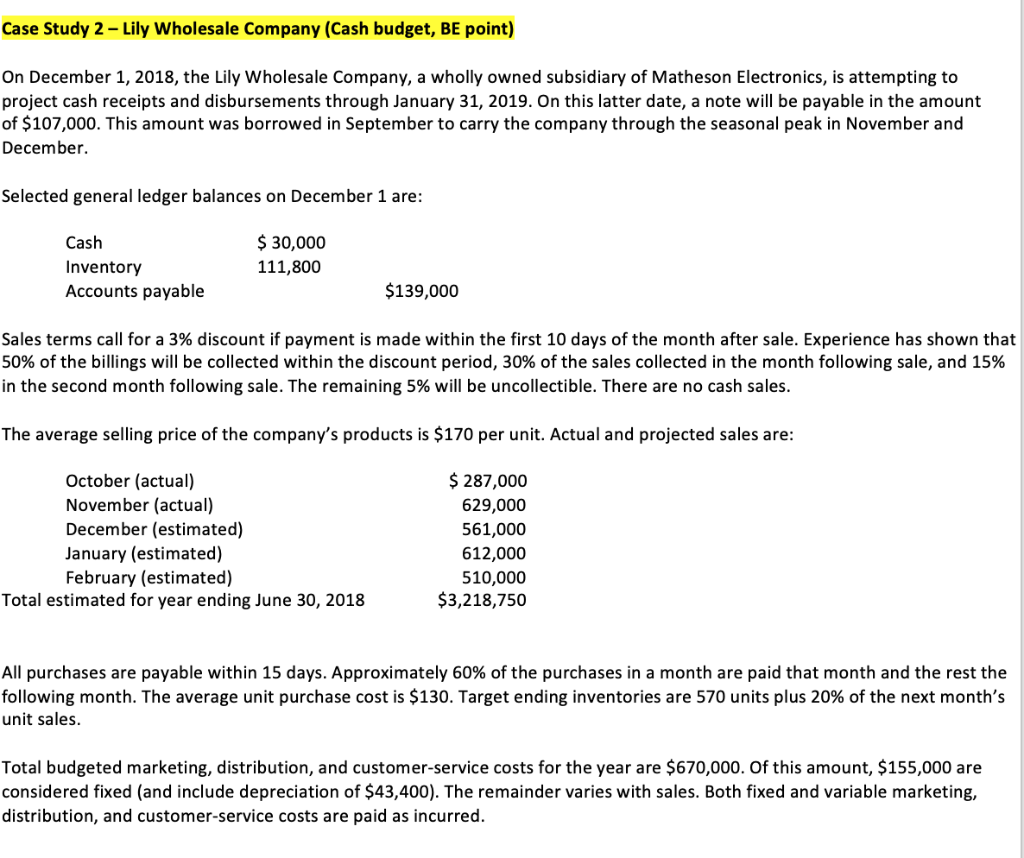

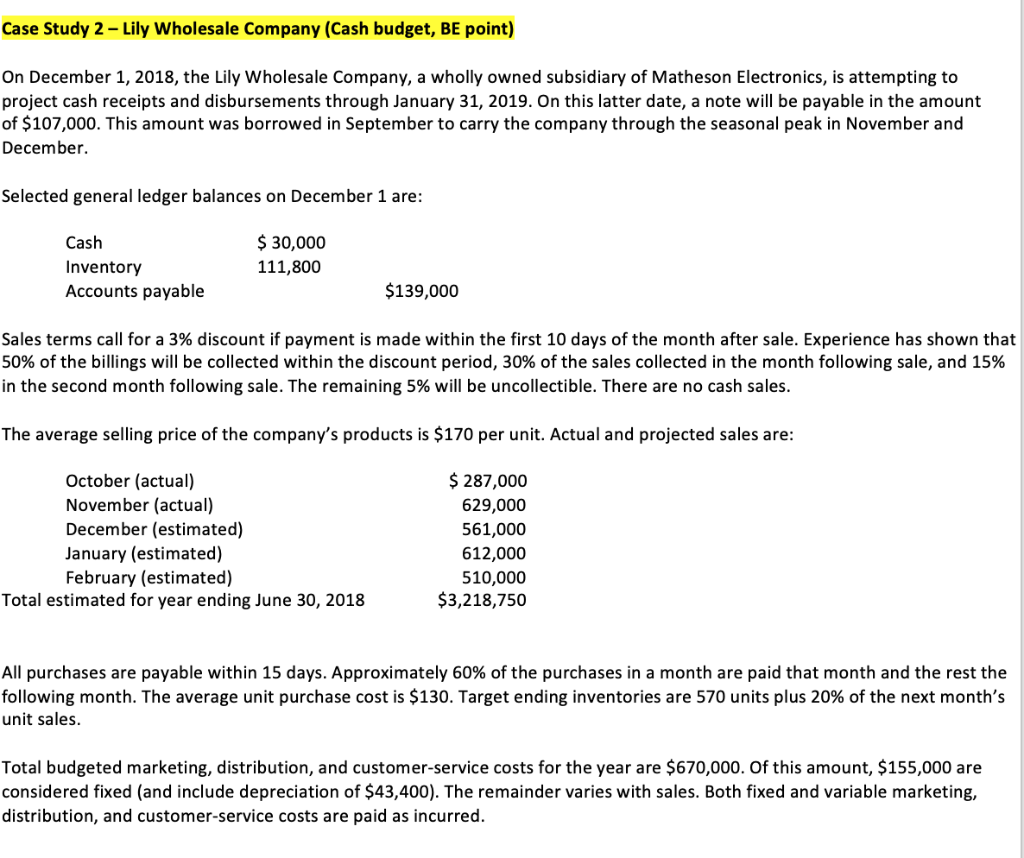

Case Study 2-Lily Wholesale Company (Cash budget, BE point) On December 1, 2018, the Lily Wholesale Company, a wholly owned subsidiary of Matheson Electronics, is attempting to project cash receipts and disbursements through January 31, 2019. On this latter date, a note will be payable in the amount of $107,000. This amount was borrowed in September to carry the company through the seasonal peak in November and December. Selected general ledger balances on December 1 are Cash Inventory Accounts payable 30,000 111,800 $139,000 Sales terms call for a 3% discount if payment is made within the first 10 days of the month after sale. Experience has shown that 50% of the billings will be collected within the discount period, 30% of the sales collected in the month following sale, and 15% in the second month following sale. The remaining 5% will be uncollectible. There are no cash sales The average selling price of the company's products is $170 per unit. Actual and projected sales are October (actual) November (actual) December (estimated) January (estimated) February (estimated) $ 287,000 629,000 561,000 612,000 510,000 $3,218,750 Total estimated for year ending June 30, 2018 All purchases are payable within 15 days. Approximately 60% of the purchases in a month are paid that month and the rest the following month. The average unit purchase cost is $130. Target ending inventories are 570 units plus 20% of the next month's unit sales. Total budgeted marketing, distribution, and customer-service costs for the year are $670,000. Of this amount, $155,000 are considered fixed (and include depreciation of $43,400). The remainder varies with sales. Both fixed and variable marketing, distribution, and customer-service costs are paid as incurred Case Study 2-Lily Wholesale Company (Cash budget, BE point) On December 1, 2018, the Lily Wholesale Company, a wholly owned subsidiary of Matheson Electronics, is attempting to project cash receipts and disbursements through January 31, 2019. On this latter date, a note will be payable in the amount of $107,000. This amount was borrowed in September to carry the company through the seasonal peak in November and December. Selected general ledger balances on December 1 are Cash Inventory Accounts payable 30,000 111,800 $139,000 Sales terms call for a 3% discount if payment is made within the first 10 days of the month after sale. Experience has shown that 50% of the billings will be collected within the discount period, 30% of the sales collected in the month following sale, and 15% in the second month following sale. The remaining 5% will be uncollectible. There are no cash sales The average selling price of the company's products is $170 per unit. Actual and projected sales are October (actual) November (actual) December (estimated) January (estimated) February (estimated) $ 287,000 629,000 561,000 612,000 510,000 $3,218,750 Total estimated for year ending June 30, 2018 All purchases are payable within 15 days. Approximately 60% of the purchases in a month are paid that month and the rest the following month. The average unit purchase cost is $130. Target ending inventories are 570 units plus 20% of the next month's unit sales. Total budgeted marketing, distribution, and customer-service costs for the year are $670,000. Of this amount, $155,000 are considered fixed (and include depreciation of $43,400). The remainder varies with sales. Both fixed and variable marketing, distribution, and customer-service costs are paid as incurred

CALCULATE CASH BUDGET, BREAK EVEN POINT AND MARGIN OF SAFETY

CALCULATE CASH BUDGET, BREAK EVEN POINT AND MARGIN OF SAFETY