Answered step by step

Verified Expert Solution

Question

1 Approved Answer

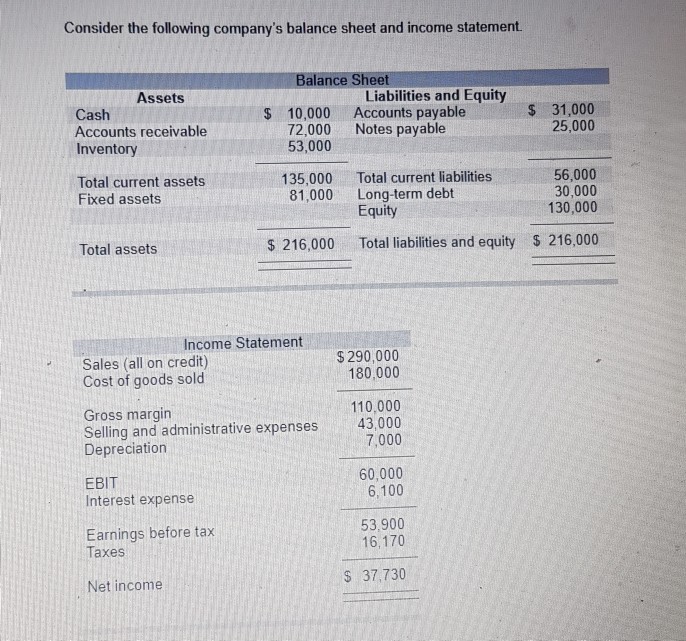

Calculate Cash-Flow Debt ratio Consider the following company's balance sheet and income statement Balance Sheet Assets Liabilities and Equity Cash Accounts receivable Inventory $ 10,000

Calculate Cash-Flow Debt ratio

Consider the following company's balance sheet and income statement Balance Sheet Assets Liabilities and Equity Cash Accounts receivable Inventory $ 10,000 Accounts payable 72,000 Notes payable S 31,000 25,000 53,000 Total current assets Fixed assets 135,000 Total current liabilities 81,000 Long-term debt Equity 56,000 30,000 130,000 Total assets $ 216,000 Total liabilities and equity S 216,000 ncome Statement Sales (all on credit) Cost of goods sold $290,000 180,000 110,000 43,000 Gross margin Selling and administrative expenses Depreciation 7,000 60,000 EBIT Interest expense 6,100 53,900 Earnings before tax Taxes 16,170 Net income S 37,730Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started