Answered step by step

Verified Expert Solution

Question

1 Approved Answer

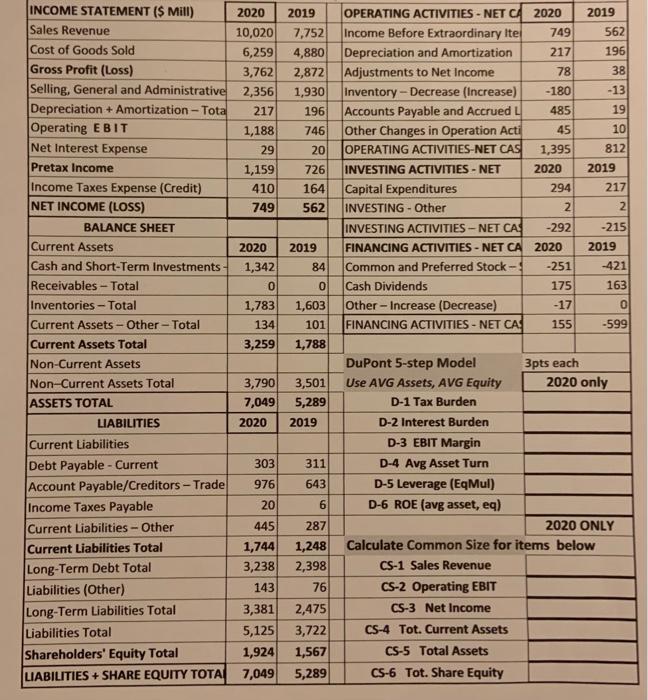

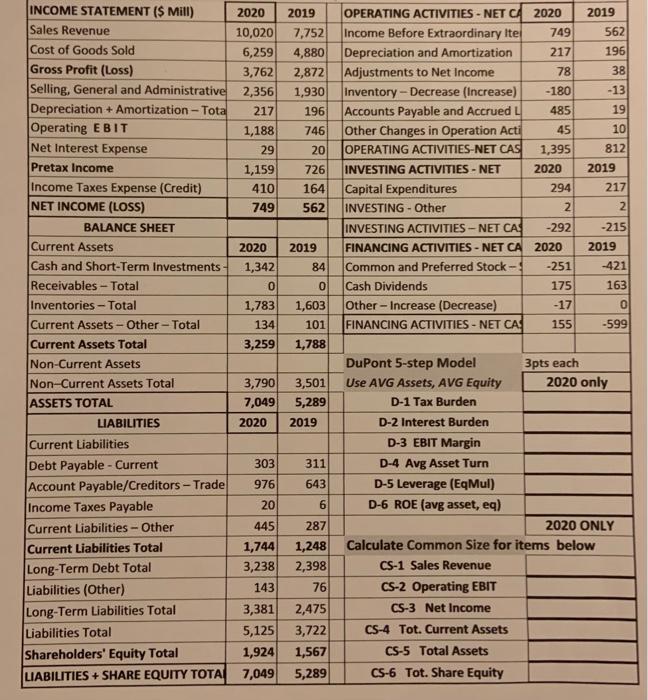

Calculate common size for items below. I don't need the DuPont 5 step model, just the bottom right. 294 INCOME STATEMENT ($ Mill) 2020 Sales

Calculate common size for items below. I don't need the DuPont 5 step model, just the bottom right.

294 INCOME STATEMENT ($ Mill) 2020 Sales Revenue 10,020 Cost of Goods Sold 6,259 Gross Profit (Loss) 3,762 Selling, General and Administrative 2,356 Depreciation + Amortization - Tota 217 Operating EBIT 1,188 Net Interest Expense 29 Pretax Income 1,159 Income Taxes Expense (Credit) 410 NET INCOME (LOSS) 749 BALANCE SHEET Current Assets 2020 Cash and Short-Term Investments 1,342 Receivables - Total 0 Inventories-Total 1,783 Current Assets - Other - Total 134 Current Assets Total 3,259 Non-Current Assets Non-Current Assets Total 3,790 ASSETS TOTAL 7,049 LIABILITIES 2020 Current Liabilities Debt Payable - Current 303 Account Payable/Creditors - Trade 976 Income Taxes Payable 20 Current Liabilities -Other 445 Current Liabilities Total 1,744 Long-Term Debt Total 3,238 Liabilities (Other) 143 Long-Term Liabilities Total 3,381 Liabilities Total 5,125 Shareholders' Equity Total 1,924 LIABILITIES + SHARE EQUITY TOTA 7,049 2019 OPERATING ACTIVITIES - NET CA 2020 2019 7,752 Income Before Extraordinary Ite 749 562 4,880 Depreciation and Amortization 217 196 2,872 Adjustments to Net Income 78 38 1,930 Inventory -Decrease (Increase) -180 -13 196 Accounts Payable and Accrued 4 485 19 746 Other Changes in Operation Acti 45 10 20 OPERATING ACTIVITIES-NET CAS 1,395 812 726 INVESTING ACTIVITIES - NET 2020 2019 164 Capital Expenditures 217 562 INVESTING - Other 2 2 INVESTING ACTIVITIES - NET CAS -292 -215 2019 FINANCING ACTIVITIES - NET CA 2020 2019 84 Common and Preferred Stock- -251 -421 0 Cash Dividends 175 163 1,603 Other - Increase (Decrease) -17 0 101 FINANCING ACTIVITIES - NET CAS 155 -599 1,788 DuPont 5-step Model 3pts each 3,501 Use AVG Assets, AVG Equity 2020 only 5,289 D-1 Tax Burden 2019 D-2 Interest Burden D-3 EBIT Margin 311 D-4 Avg Asset Turn 643 D-5 Leverage (EqMul) 6 D-6 ROE (avg asset, eq) 287 2020 ONLY 1,248 Calculate Common Size for items below 2,398 CS-1 Sales Revenue 76 CS-2 Operating EBIT 2,475 CS-3 Net Income 3,722 CS-4 Tot. Current Assets 1,567 CS-5 Total Assets 5,289 CS-6 Tot. Share Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started