Question

Calculate consolidated goodwill at the date of acquisition under the proportionate consolidation method. (Omit $ sign in your response.) Consolidated goodwill $ ?(b) Prepare a

Calculate consolidated goodwill at the date of acquisition under the proportionate consolidation method. (Omit $ sign in your response.) Consolidated goodwill $

?(b) Prepare a consolidated statement of financial position at the date of acquisition under each of the following: (i) Identifiable net assets method (ii) Fair value enterprise method?

(c) Calculate the current ratio and debt-to-equity ratio for P Company under the identifiable net assets (INA) method and the fair value enterprise (FVE) method. (Round "Current ratio" answers to 2 decimal places and "Debt to equity ratio" answers to 4 decimal places.)

Current ratio?

Debt to equity ratio ?

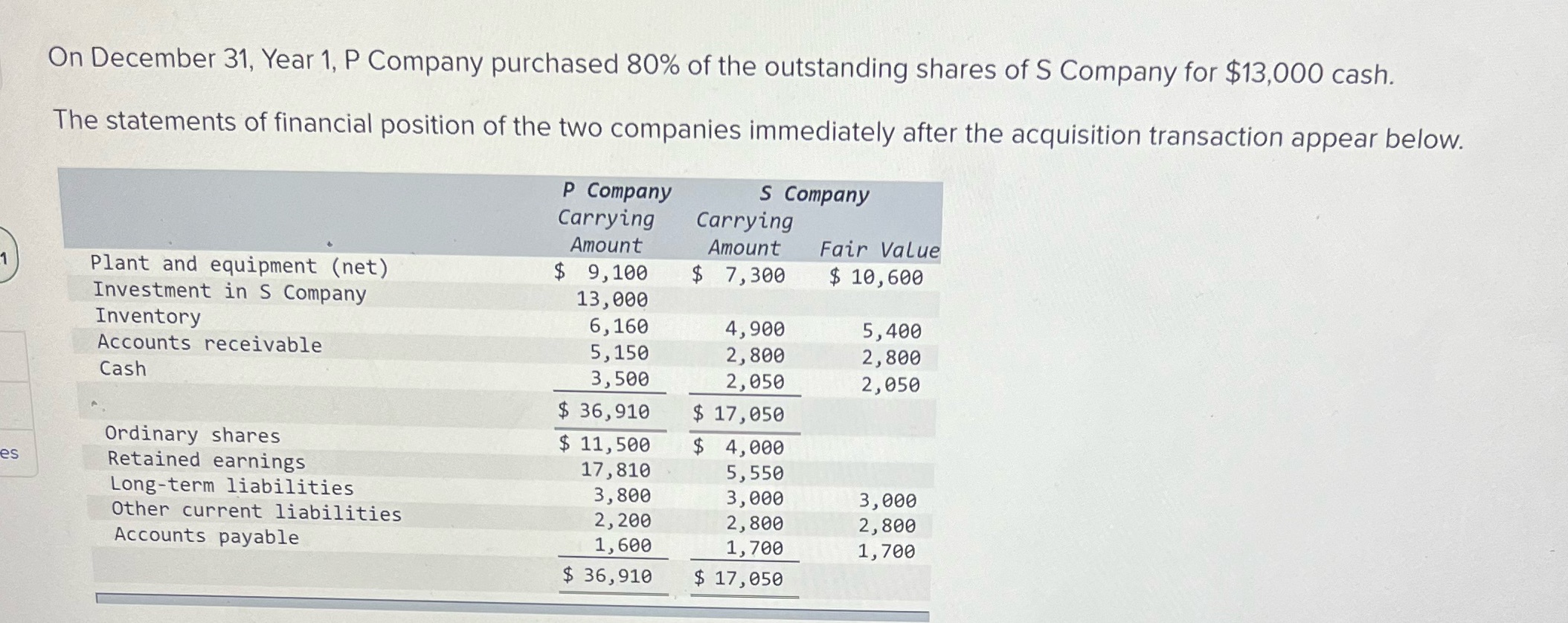

On December 31, Year 1, P Company purchased 80% of the outstanding shares of S Company for $13,000 cash. The statements of financial position of the two companies immediately after the acquisition transaction appear below. 1 Plant and equipment (net) Investment in S Company P Company Carrying Amount $ 9,100 S Company Carrying Amount $ 7,300 Fair Value $ 10,600 13,000 Inventory Accounts receivable Cash 6,160 4,900 5,400 5,150 2,800 2,800 3,500 2,050 2,050 $ 36,910 $ 17,050 Ordinary shares $ 11,500 $ 4,000 es Retained earnings 17,810 5,550 Long-term liabilities 3,800 3,000 3,000 Other current liabilities 2,200 2,800 2,800 Accounts payable 1,600 1,700 1,700 $ 36,910 $ 17,050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Consolidated Goodwill under Proportionate Consolidation Method Consolidated Goodwill Cost of Acqui...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started