Answered step by step

Verified Expert Solution

Question

1 Approved Answer

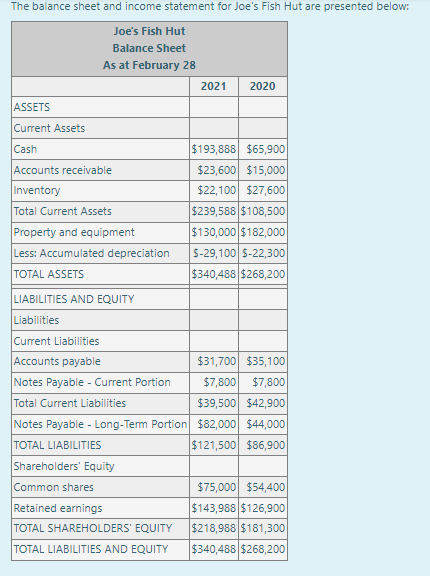

Calculate Current ratio, Quick ratio and working capital for 2021 The balance sheet and income statement for Joe's Fish Hut are presented below: Joe's Fish

Calculate Current ratio, Quick ratio and working capital for 2021

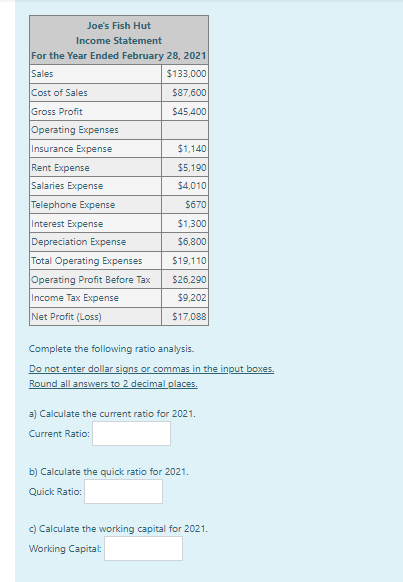

The balance sheet and income statement for Joe's Fish Hut are presented below: Joe's Fish Hut Balance Sheet As at February 28 2021 2020 ASSETS Current Assets Cash Accounts receivable Inventory Total Current Assets $193,888 $65,900 $23,600 $15,000 $22,100 $27,600 $239,588 $108,500 $130,000 $182,000 5-29,100 $-22,300 $340,488 $268,200 Property and equipment Less: Accumulated depreciation TOTAL ASSETS LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts payable $31,700 $35,100 Notes Payable - Current Portion $7,800 $7,800 Total Current Liabilities $39,500 $42,900 Notes Payable - Long-Term Portion $82,000 $44,000 TOTAL LIABILITIES $121,500 $86,900 Shareholders' Equity Common shares $75,000 $54,400 Retained earnings $143,988 $126,900 TOTAL SHAREHOLDERS' EQUITY $218,988 $181,300 TOTAL LIABILITIES AND EQUITY $340,488 $268,200 Joe's Fish Hut Income Statement For the Year Ended February 28, 2021 Sales $133,000 Cost of Sales $87,600 Gross Profit $45,400 Operating Expenses Insurance Expense $1,140 Rent Expense $5,190 Salaries Expense $4,010 Telephone Expense $670 Interest Expense $1,300 Depreciation Expense $6,800 Total Operating Expenses $19,110 Operating Profit Before Tax $26,290 Income Tax Expense $9,202 Net Profit (Loss) $17,088 Complete the following ratio analysis. Do not enter dollar signs or commas in the input boxes. Round all answers to 2 decimal places. a) Calculate the current ratio for 2021. Current Ratio: b) Calculate the quick ratio for 2021, Quick Ratio: c) Calculate the working capital for 2021. Working CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started