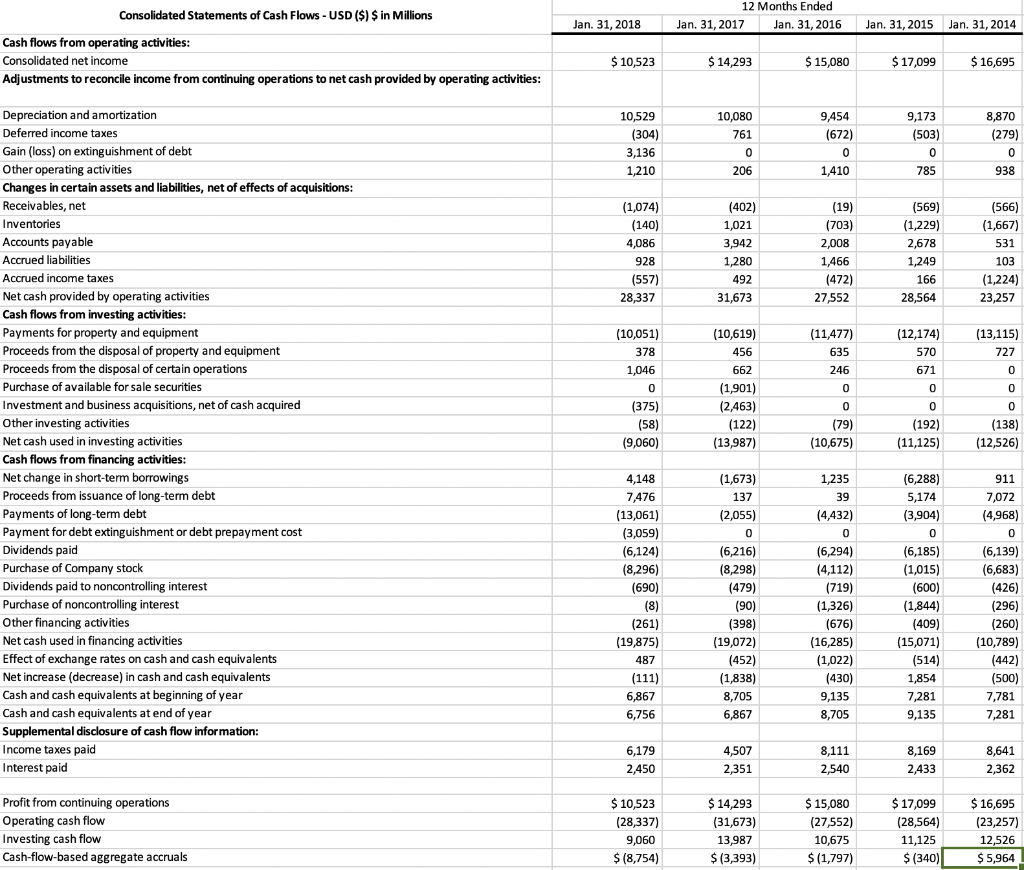

Calculate current ratios, quick ratios, days sales outstanding, days on hand of inventory, number of days payables, and cash conversion cycle. Comment on the results of the trend analysis of those efficiency ratios.

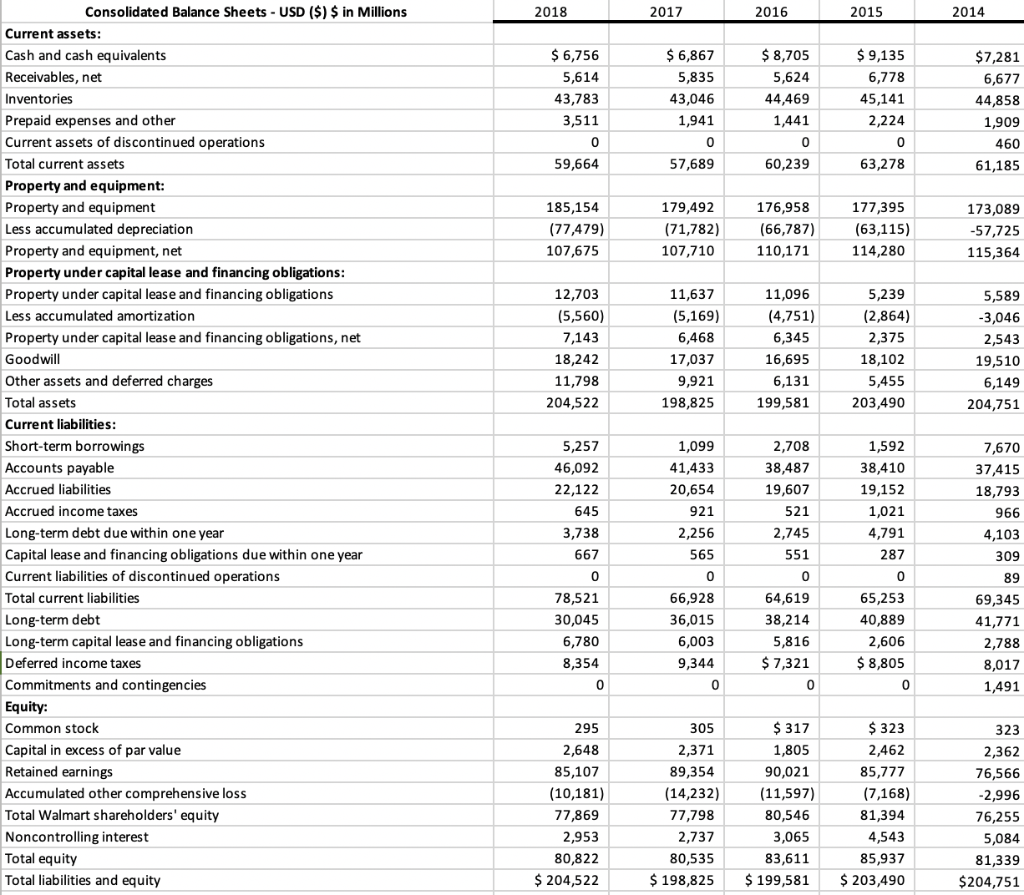

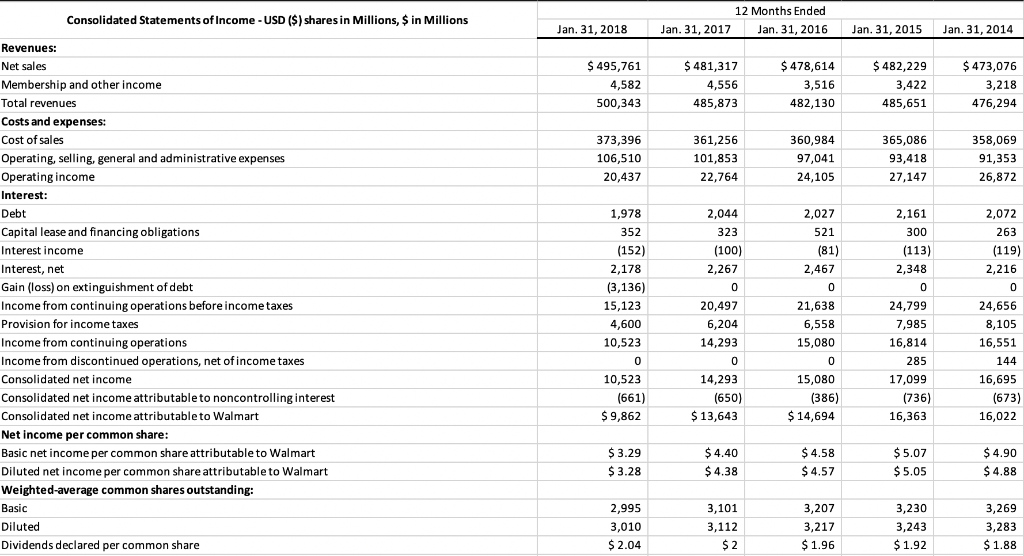

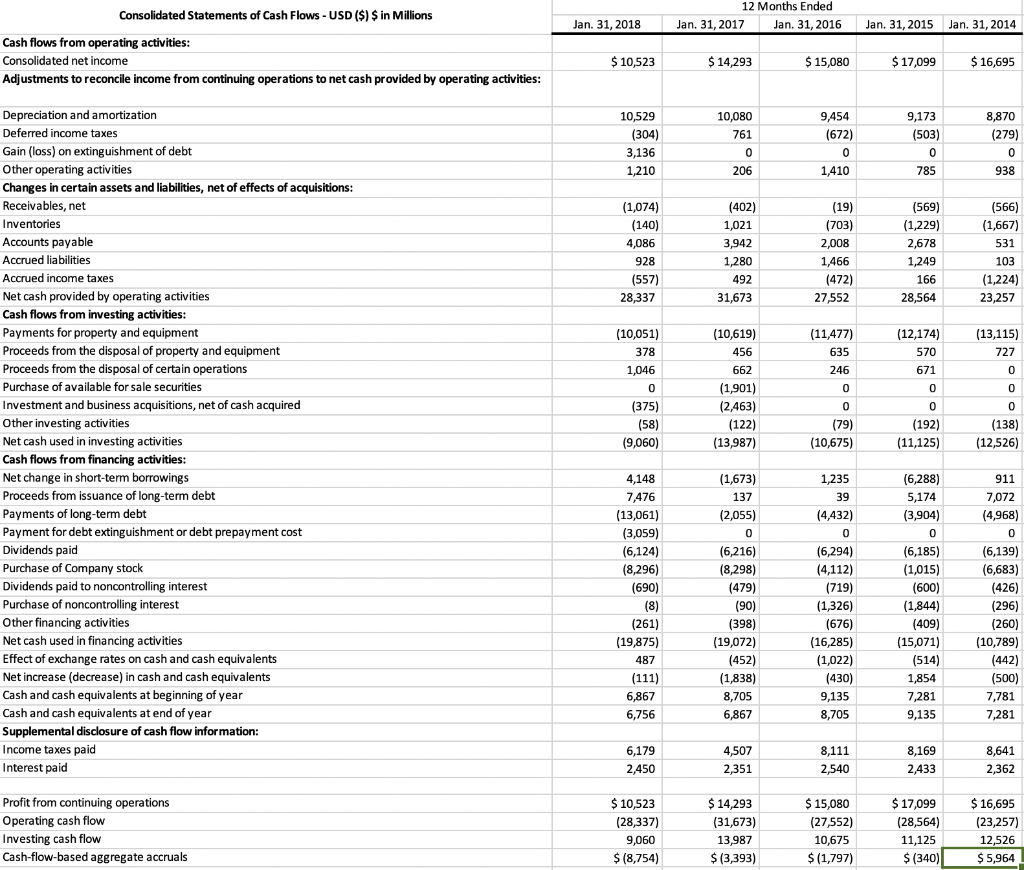

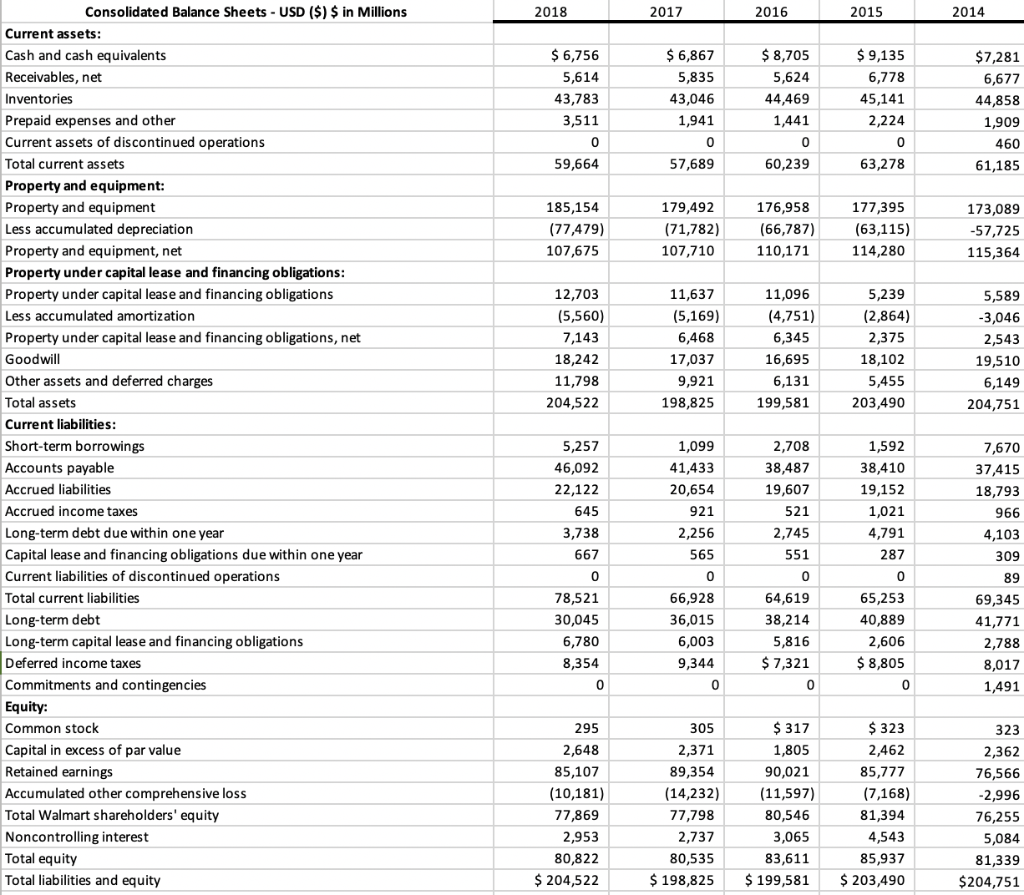

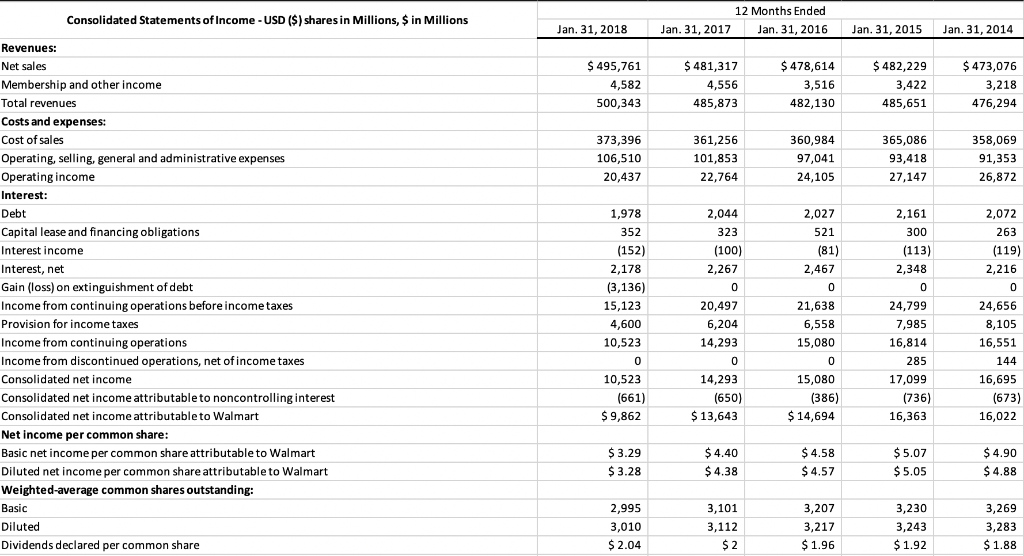

Consolidated Balance Sheets-USD ($) $ in Millions 2018 2017 2016 2014 Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Current assets of discontinued operations Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations Property under capital lease and financing obligations Less accumulated amortization Property under capital lease and financing obligations, net Goodwil Other assets and deferred charges 6,756 5,614 43,783 3,511 0 59,664 $ 8,705 $9,135 6,778 5,835 43,046 6,677 1,909 61,185 44,469 0 0 57,689 179,492 107,710 60,239 185,154 176,958 (71,782)(66,787)(63,115) 110,171 177,395 173,089 57,725 115,364 107,675 114,280 12,703 (5,560) 7,143 11,637 5169) 6,468 11,096 4,751) 5,239 (2,864) 18,102 5,455 5,589 11,798 204,522 9,921 198,825 16,695 6,131 199,581 6,149 204,751 203,490 Current liabilities Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Current liabilities of discontinued operations Total current liabilities Long-term debt 5,257 46,092 22,122 2,708 38,487 19,607 1,099 38,410 19,152 37,415 18,793 20,654 3,738 4,791 4,103 309 0 78,521 0,045 6,780 0 66,928 36,015 0 65,253 40,889 2,606 8,805 64,619 38,214 41,771 2,788 ng-term capital lease and financing obligations Deferred income taxes Commitments and contingencies 0 1491 Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive loss Total Walmart shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 295 305 1,805 90,021 (11,597) 2,462 85,777 (7,168) 85,107 (14,232) 77,798 77,869 3,065 83,611 80,535 198,825 199,581 $ 203,490 81,339 $204,751 $ 204,522 12 Months Ended Consolidated Statements of Income -USD ($) shares in Millions, $ in Millions Jan. 31, 2018 Jan. 31, 2017Jan. 31, 2016 Jan. 31, 2015 Jan. 31, 2014 Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Gain (loss) on extinguishment of debt Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart Net income per common share Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart Weighted-average common shares outstanding: Basic Diluted Dividends declared per common share $ 495,761 4,582 500,343 S481,3117 4,556 485,873 $478,614 3,516 482,130 482,229 473,076 3,218 476,294 3,422 485,651 373,396 106,510 20,437 361,256 101,853 22,764 360,984 97,041 24,105 365,086 93,418 27,147 358,069 91,353 26,872 1,978 352 2,044 2,027 2,161 2,072 2,267 0 20,497 6,204 14,293 2,348 0 24,799 2,178 15,123 4,600 10,523 0 10,523 2,467 0 21,638 6,558 15,080 2,216 0 24,656 8,105 16,551 14,293 15,080 17,099 16,695 9,862 $13,643 $14,694 16,022 3,230 2,995 3,010 3,207 3,217 3,283