Question

Calculate depreciation using Straight-line method , diminishing-balance method using double the straight-line rate & Units of production method Exercise 9-3 (Part Level Submission) Nissong Ltd.

Calculate depreciation using Straight-line method, diminishing-balance method using double the straight-line rate & Units of production method

Exercise 9-3 (Part Level Submission)

Nissong Ltd. purchased a new extraction device on April 4, 2012, at a cost of $187,200. The company estimated that the extraction device would have a residual value of $17,760. The extraction device is expected to be used for 9,520 working hours during its four-year life. Actual extraction device usage was 540 hours in 2012; 2,570 hours in 2013; 2,810 hours in 2014; 2,450 hours in 2015; and 1,150 hours in 2016. Nissong has a December 31 year end.

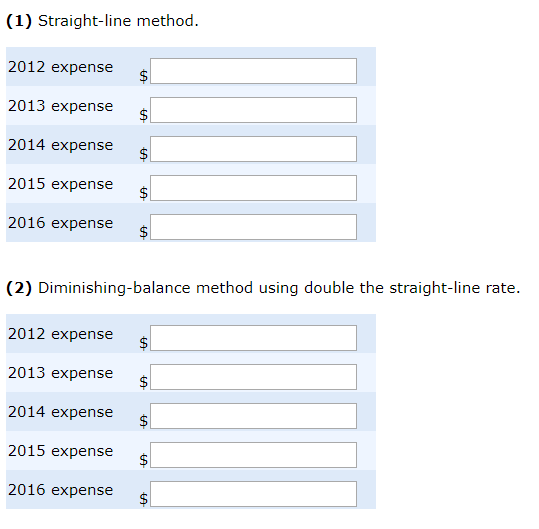

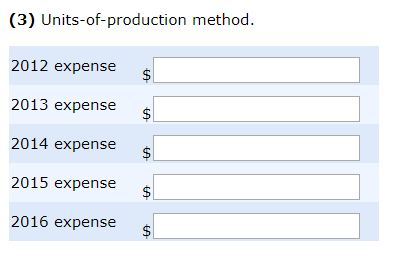

Calculate depreciation for the extraction device under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started